About Form 941 SS, Employer's Quarterly Federal Tax IRS Gov 2014

What is the About Form 941 SS, Employer's Quarterly Federal Tax IRS gov

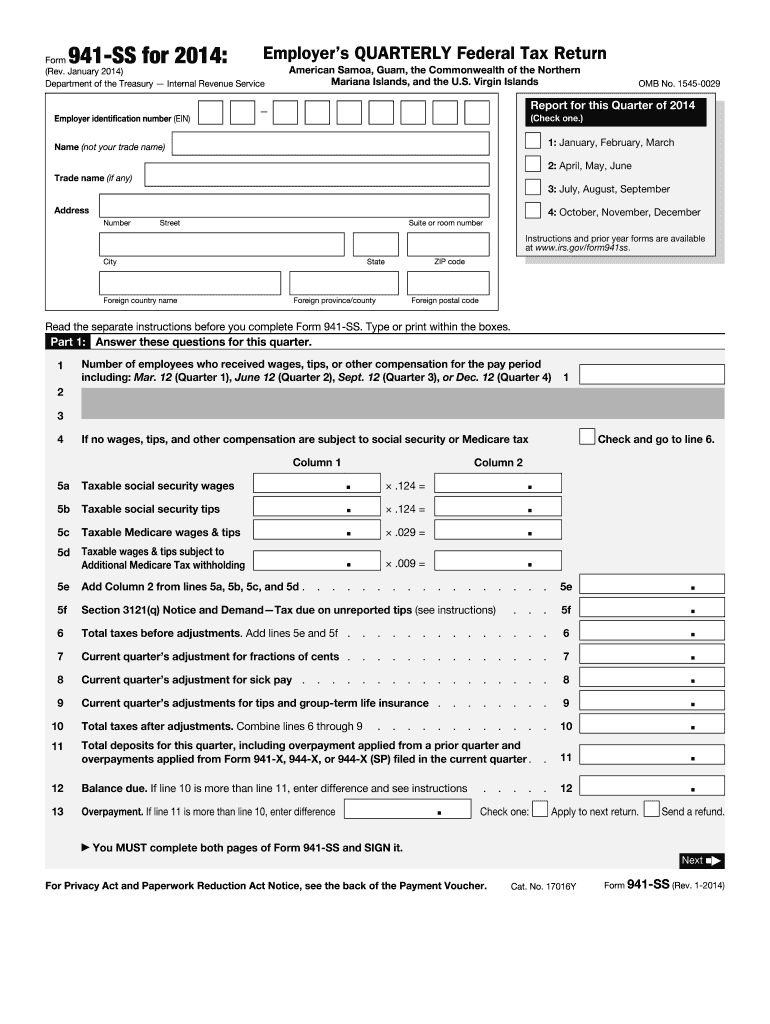

The About Form 941 SS, Employer's Quarterly Federal Tax, is a tax form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is specifically designed for employers who pay wages to employees in U.S. territories. It serves as a crucial document for the Internal Revenue Service (IRS) to track employer tax liabilities and ensure compliance with federal tax regulations. Employers must accurately complete and submit this form quarterly to avoid penalties and maintain good standing with the IRS.

Steps to complete the About Form 941 SS, Employer's Quarterly Federal Tax IRS gov

Completing the About Form 941 SS involves several key steps:

- Gather necessary information: Collect details about your business, including your Employer Identification Number (EIN), the number of employees, and total wages paid during the quarter.

- Calculate taxes: Determine the total amount of federal income tax withheld, Social Security tax, and Medicare tax based on your payroll records.

- Fill out the form: Accurately enter the gathered information into the appropriate sections of the form, ensuring all figures are correct.

- Review for accuracy: Double-check all entries for errors or omissions to avoid issues with the IRS.

- Submit the form: File the completed form either electronically or by mail, depending on your preference and the IRS guidelines.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the About Form 941 SS. The form is due on the last day of the month following the end of each quarter. The deadlines are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Legal use of the About Form 941 SS, Employer's Quarterly Federal Tax IRS gov

The About Form 941 SS is legally binding and must be filled out accurately to reflect the employer's tax obligations. Filing this form is a requirement under federal law, and failure to comply can result in penalties and interest charges. Employers must ensure that all information reported is truthful and complete to avoid legal repercussions. Additionally, using a reliable electronic signature solution can enhance the legitimacy of the submission, ensuring compliance with eSignature regulations.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the About Form 941 SS. The methods include:

- Online: Employers can file electronically using the IRS e-file system, which is efficient and allows for quicker processing.

- Mail: The form can be mailed to the appropriate IRS address, depending on the employer's location and whether they are enclosing a payment.

- In-Person: While not common, employers may also choose to deliver the form in person at designated IRS offices.

Key elements of the About Form 941 SS, Employer's Quarterly Federal Tax IRS gov

The About Form 941 SS contains several key elements that employers must complete:

- Employer Identification Number (EIN): A unique identifier assigned to the business.

- Number of employees: Total count of employees paid during the quarter.

- Wages paid: Total wages subject to federal income tax withholding.

- Tax calculations: Detailed calculations of withheld federal income tax, Social Security tax, and Medicare tax.

- Signature: The form must be signed by an authorized representative of the business, confirming the accuracy of the information provided.

Quick guide on how to complete about form 941 ss employers quarterly federal tax irsgov

Effortlessly Prepare About Form 941 SS, Employer's Quarterly Federal Tax IRS gov on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to efficiently create, edit, and eSign your documents without delays. Manage About Form 941 SS, Employer's Quarterly Federal Tax IRS gov on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign About Form 941 SS, Employer's Quarterly Federal Tax IRS gov Easily

- Locate About Form 941 SS, Employer's Quarterly Federal Tax IRS gov and click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign About Form 941 SS, Employer's Quarterly Federal Tax IRS gov and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 941 ss employers quarterly federal tax irsgov

Create this form in 5 minutes!

How to create an eSignature for the about form 941 ss employers quarterly federal tax irsgov

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 941 SS, and why is it important for employers?

Form 941 SS is a quarterly tax return that employers must file to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Understanding 'About Form 941 SS, Employer's Quarterly Federal Tax IRS gov.' is crucial for maintaining compliance with federal tax regulations and avoiding penalties.

-

How do I file Form 941 SS using airSlate SignNow?

Filing Form 941 SS with airSlate SignNow is straightforward. The platform provides an easy-to-use interface that allows you to complete and eSign documents quickly. After filling out the form, you can submit it directly to the IRS, ensuring you meet all deadlines for 'About Form 941 SS, Employer's Quarterly Federal Tax IRS gov.' compliance.

-

What features does airSlate SignNow offer for managing Form 941 SS?

airSlate SignNow offers various features tailored for managing Form 941 SS, including customizable templates, secure eSignature capabilities, and automated reminders for filing deadlines. These features enhance productivity, making it easier for businesses to stay compliant with 'About Form 941 SS, Employer's Quarterly Federal Tax IRS gov.' processes.

-

Are there any costs associated with using airSlate SignNow for Form 941 SS?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes access to features that simplify the filing of 'About Form 941 SS, Employer's Quarterly Federal Tax IRS gov.' and other important documents while providing a cost-effective solution.

-

Can I integrate airSlate SignNow with other accounting software for filing Form 941 SS?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, enabling users to streamline the filing process for 'About Form 941 SS, Employer's Quarterly Federal Tax IRS gov.' Based on your existing software, you can manage workflows efficiently and keep your tax records organized.

-

What benefits does airSlate SignNow provide for filing taxes?

Using airSlate SignNow to file taxes, including Form 941 SS, provides benefits such as reduced paperwork, faster processing times, and improved accuracy. These efficiencies allow businesses to focus on core operations while remaining compliant with 'About Form 941 SS, Employer's Quarterly Federal Tax IRS gov.' requirements.

-

Is airSlate SignNow secure for filing Form 941 SS?

Yes, airSlate SignNow prioritizes security, implementing advanced encryption methods and compliance standards to safeguard sensitive information. Employers can confidently file 'About Form 941 SS, Employer's Quarterly Federal Tax IRS gov.' with the assurance that their data is protected.

Get more for About Form 941 SS, Employer's Quarterly Federal Tax IRS gov

- Commercial lease assignment from tenant to new tenant hawaii form

- Tenant consent to background and reference check hawaii form

- Residential lease or rental agreement for month to month hawaii form

- Residential rental lease agreement hawaii form

- Hawaii tenant 497304520 form

- Warning of default on commercial lease hawaii form

- Warning of default on residential lease hawaii form

- Landlord tenant closing statement to reconcile security deposit hawaii form

Find out other About Form 941 SS, Employer's Quarterly Federal Tax IRS gov

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now