Form 50 123

What is the Form 50 123

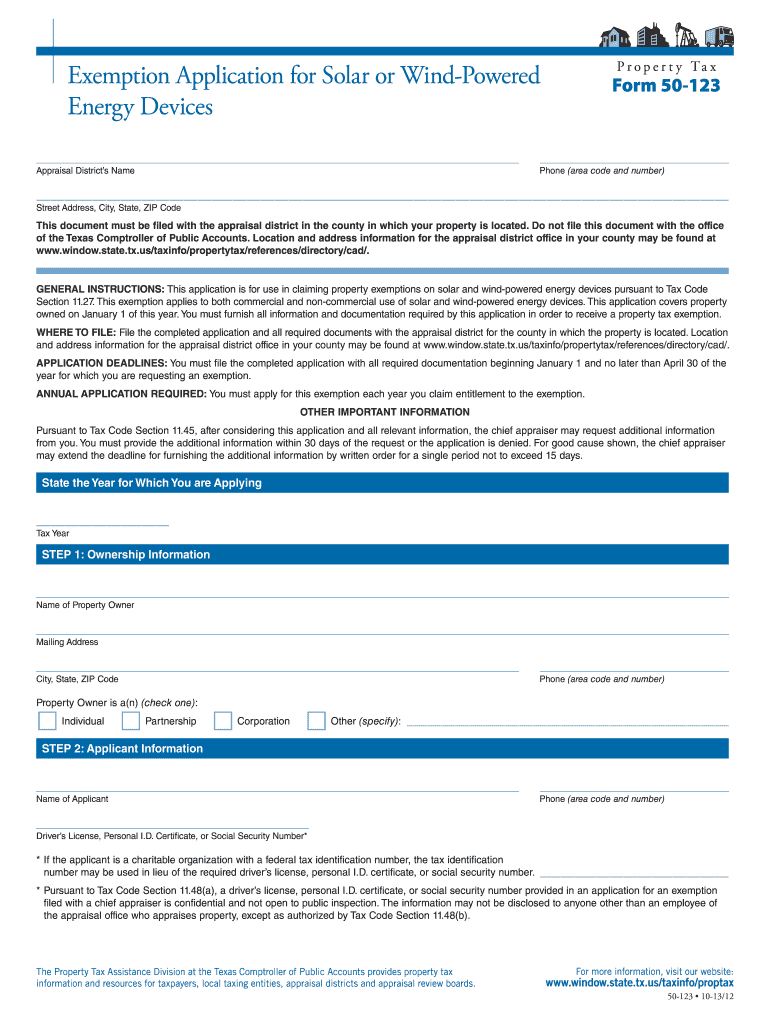

The Form 50 123 is a specific document used in Texas, primarily related to property tax exemptions. This form allows property owners to apply for various exemptions, which can significantly reduce their property tax burden. Understanding the purpose and implications of this form is essential for homeowners seeking financial relief through tax benefits.

How to use the Form 50 123

Using the Form 50 123 involves several steps to ensure it is completed accurately and submitted correctly. First, gather all necessary information, such as property details and personal identification. Next, fill out the form with precise data, ensuring that all sections are completed. After completing the form, review it for accuracy before submission. This careful approach helps prevent delays in processing your exemption request.

Steps to complete the Form 50 123

Completing the Form 50 123 requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the appropriate Texas tax authority.

- Provide your name, address, and contact information in the designated fields.

- Detail the property information, including the property ID and type of exemption being requested.

- Include any supporting documentation that may be required, such as proof of residence or eligibility.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Form 50 123

The legal use of the Form 50 123 is governed by Texas property tax laws. When properly completed and submitted, this form serves as a formal request for tax exemptions. It is essential to ensure compliance with all legal requirements to avoid issues such as denial of the exemption or potential penalties. Understanding the legal framework surrounding this form helps ensure that property owners can take full advantage of available tax benefits.

Who Issues the Form

The Form 50 123 is issued by the Texas Comptroller of Public Accounts. This state agency oversees property tax exemptions and provides the necessary forms for property owners. By obtaining the form directly from the Comptroller’s office, individuals can ensure they are using the most current version and following the correct procedures for submission.

Form Submission Methods

Submitting the Form 50 123 can be done through various methods to accommodate different preferences. Property owners may choose to submit the form online, via mail, or in person at their local appraisal district office. Each method has its own advantages, such as immediate processing for online submissions or the ability to ask questions directly when submitting in person.

Quick guide on how to complete form 50 123

Effortlessly Prepare Form 50 123 on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any holdups. Manage Form 50 123 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Form 50 123 with ease

- Locate Form 50 123 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form: via email, SMS, invitation link, or download it to your computer.

Eliminate issues related to lost or missing files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form 50 123 to ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 50 123

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 50 123?

The form 50 123 is a specific document used for various purposes, including submissions and approvals in a business context. With airSlate SignNow, you can easily create, send, and eSign the form 50 123, streamlining your document processes efficiently.

-

How does airSlate SignNow help with the form 50 123?

airSlate SignNow provides an intuitive platform that allows users to prepare and sign the form 50 123 quickly. The platform's features including templates and automated workflows simplify the completion of this form, reducing the time needed for document management.

-

What pricing options are available for using airSlate SignNow with form 50 123?

airSlate SignNow offers several pricing tiers designed to fit businesses of all sizes. Whether you're a small business needing basic functions for the form 50 123 or a large enterprise requiring advanced features, there is a plan that suits your needs.

-

Can I integrate airSlate SignNow with other software for form 50 123?

Yes, airSlate SignNow supports integration with various third-party applications, making it easier to manage the form 50 123 alongside your existing tools. Popular integrations include CRM systems, project management apps, and cloud storage services, boosting your workflow efficiency.

-

What are the key features for managing form 50 123 in airSlate SignNow?

Key features for managing form 50 123 in airSlate SignNow include customizable templates, secure eSigning, and real-time tracking of document progress. These features ensure that your forms are not only easy to fill out but also secure and easily monitored throughout the signing process.

-

What benefits does airSlate SignNow offer for the form 50 123?

Using airSlate SignNow for the form 50 123 provides numerous benefits such as increased efficiency in document processing, reduced paper usage, and enhanced security for sensitive data. This cost-effective solution allows you to focus on your business rather than paperwork.

-

Is airSlate SignNow user-friendly for completing the form 50 123?

Absolutely! airSlate SignNow is designed with user experience in mind, ensuring that the process of completing the form 50 123 is straightforward and accessible, even for those who are not tech-savvy. Its intuitive interface makes eSigning and document management hassle-free.

Get more for Form 50 123

- Nnhscat adoption questionnairedocx form

- Missouri medicaid logisticare lodging assistance form

- Nv energy standing order request northern nevada nv energy standing order request northern nevada form

- Property ownermanager standing order request nv energy form

- Photosynthesis making energy form

- Sarah williams edspalmetto counseling associates form

- Deferred payment agreement template form

- Wisconsin dnr form 2450 140

Find out other Form 50 123

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed