Texas Franchise Tax 2022

What is the Texas Franchise Tax

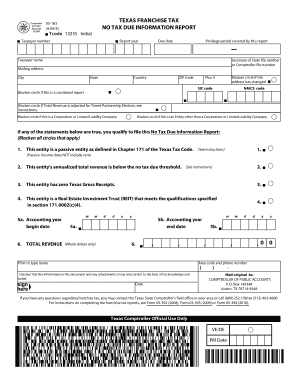

The Texas Franchise Tax is a tax imposed on businesses operating in Texas, primarily based on their revenue. This tax applies to various business entities, including corporations and limited liability companies (LLCs). It is essential for businesses to understand their obligations under this tax to ensure compliance and avoid penalties. The tax is calculated on a sliding scale, with rates varying depending on the amount of revenue generated by the business.

Steps to complete the Texas Franchise Tax

Completing the Texas Franchise Tax form involves several key steps to ensure accuracy and compliance. First, businesses must gather necessary financial information, including revenue figures from the previous year. Next, they should determine their eligibility for any deductions or exemptions that may apply. Once all information is compiled, businesses can fill out the Texas 05 164 form, ensuring all fields are completed accurately. After reviewing the form for any errors, it can be submitted electronically or via mail.

Key elements of the Texas Franchise Tax

Understanding the key elements of the Texas Franchise Tax is crucial for businesses. These elements include the tax rate, which is determined by the revenue tier, and the reporting requirements that dictate how often businesses must file. Additionally, businesses should be aware of any deductions available, such as those for cost of goods sold or compensation paid to employees. Familiarity with these components helps businesses effectively manage their tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Texas Franchise Tax are critical for compliance. Generally, the annual report and tax payment are due on May 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is important for businesses to mark their calendars and prepare their documentation ahead of time to avoid late fees or penalties.

Required Documents

To complete the Texas Franchise Tax form, businesses must prepare several required documents. These typically include financial statements, revenue reports, and any supporting documentation for deductions claimed. Having these documents organized and readily available can streamline the filing process and help ensure that all information submitted is accurate and complete.

Penalties for Non-Compliance

Non-compliance with the Texas Franchise Tax can lead to significant penalties. Businesses that fail to file their tax returns on time may incur late fees, and continued non-compliance can result in additional fines or legal action. It is essential for businesses to stay informed about their filing requirements and deadlines to avoid these consequences.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Texas Franchise Tax form. The preferred method is online submission, which provides immediate confirmation of receipt and can expedite processing. Alternatively, businesses can choose to mail their completed forms or submit them in person at designated state offices. Each method has its own considerations, such as processing times and confirmation of submission, which businesses should take into account when deciding how to file.

Quick guide on how to complete texas franchise tax

Complete Texas Franchise Tax effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Texas Franchise Tax on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

How to alter and electronically sign Texas Franchise Tax with ease

- Obtain Texas Franchise Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and electronically sign Texas Franchise Tax to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas franchise tax

Create this form in 5 minutes!

How to create an eSignature for the texas franchise tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are texas 05 164 instructions?

The texas 05 164 instructions provide detailed guidelines on completing a specific form used in Texas legal and administrative contexts. Understanding these instructions is crucial for ensuring compliance with state requirements. By following the texas 05 164 instructions carefully, users can avoid common pitfalls and ensure their documents are processed efficiently.

-

How does airSlate SignNow help with texas 05 164 instructions?

airSlate SignNow offers a user-friendly platform that simplifies the process of filling out and eSigning documents, including those requiring texas 05 164 instructions. Our solution ensures that you can easily upload, edit, and sign documents while adhering to the necessary guidelines. This streamlines your workflow and helps avoid errors when submitting essential forms.

-

Is airSlate SignNow cost-effective for businesses needing texas 05 164 instructions?

Yes, airSlate SignNow is a cost-effective solution for businesses that often deal with documents requiring texas 05 164 instructions. Our pricing structure is designed to be accessible for teams of all sizes, ensuring you can manage your document workflows without breaking the bank. By investing in our services, you can save both time and money on document management.

-

What features does airSlate SignNow offer to assist with texas 05 164 instructions?

airSlate SignNow provides several features designed to support users with texas 05 164 instructions, including templates, document automation, and real-time collaboration. These features allow you to quickly create and modify documents in compliance with Texas state requirements. Additionally, our platform enables easy tracking of document progress, ensuring all necessary steps are completed.

-

Are there integrations available with airSlate SignNow for texas 05 164 instructions?

airSlate SignNow seamlessly integrates with various applications and platforms to enhance your workflow, especially for documents requiring texas 05 164 instructions. Whether you use CRM systems, cloud storage, or other business tools, our integrations facilitate a smooth experience. This connectivity ensures that you can access all necessary features while following the texas 05 164 instructions effectively.

-

Can airSlate SignNow improve compliance when following texas 05 164 instructions?

Absolutely, airSlate SignNow signNowly improves compliance with texas 05 164 instructions through its built-in compliance features. By utilizing our platform, you can ensure that all signatures and document edits are legally binding and securely stored. This minimizes the risk of non-compliance and helps you meet all necessary legal standards in Texas.

-

What benefits do users experience with airSlate SignNow in relation to texas 05 164 instructions?

Users of airSlate SignNow experience numerous benefits when handling documents tied to texas 05 164 instructions, including time savings, enhanced accuracy, and smoother workflows. Our platform allows you to focus on your business operations rather than on administrative tasks. As a result, businesses can enhance productivity while ensuring compliance with Texas regulations.

Get more for Texas Franchise Tax

- C sides of paper filesncgov form

- Sls 450 sales amp use tax for periods beginning 112020 and after sls 450 sales amp use tax for periods beginning 112020 and form

- Line instructions for form d 400 individual income ncgov

- Partnership tax forms and instructions ncdor

- C corporation tax return cd 405 instructions ncgov form

- Schedule of county sales and use taxes for claims ncgov form

- Submit originals only form

- Addresses and telephone numbers can be found online at httpswww form

Find out other Texas Franchise Tax

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document