Arizona Form 650a

What is the Arizona Form 650a

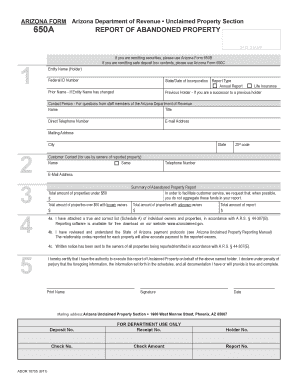

The Arizona Form 650a is a specific tax form used by individuals and businesses in Arizona to report certain financial information to the state. This form is essential for ensuring compliance with state tax regulations and is typically associated with income tax filings. Understanding its purpose is crucial for accurate reporting and avoiding potential penalties.

How to use the Arizona Form 650a

Using the Arizona Form 650a involves several steps to ensure that all required information is accurately reported. Start by gathering necessary financial documents, such as income statements and expense records. Carefully fill out the form, ensuring that all sections are completed. After filling out the form, review it for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the Arizona Form 650a

Completing the Arizona Form 650a requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the Arizona Department of Revenue.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your income and any deductions you are eligible for.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Arizona Form 650a

The Arizona Form 650a is legally binding when filled out and submitted in accordance with state regulations. To ensure its legal validity, it is important to comply with all applicable laws regarding eSignature and document submission. This includes using a secure platform that provides a verifiable electronic signature, which can enhance the form's enforceability in legal contexts.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 650a vary depending on the specific tax year and the type of taxpayer. Generally, individual taxpayers must submit their forms by April 15 of the following year. It is crucial to stay informed about any changes to deadlines, as late submissions can result in penalties and interest on unpaid taxes.

Who Issues the Form

The Arizona Form 650a is issued by the Arizona Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. For any updates or changes to the form, it is advisable to regularly check the department's official communications or website.

Penalties for Non-Compliance

Failure to file the Arizona Form 650a by the deadline can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action for non-compliance. Understanding these penalties emphasizes the importance of timely and accurate submissions to avoid financial repercussions.

Quick guide on how to complete arizona form 650a

Finalize Arizona Form 650a effortlessly on any gadget

Digital document management has become favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can find the required template and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents swiftly without delays. Handle Arizona Form 650a on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and eSign Arizona Form 650a seamlessly

- Find Arizona Form 650a and click Obtain Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Finish button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Disregard lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device of your choice. Edit and eSign Arizona Form 650a and ensure outstanding communication at any point of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 650a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona Form 650A?

Arizona Form 650A is a personal income tax return form used for reporting income and calculating tax liabilities in the state of Arizona. It’s primarily designed for individuals and can include various deductions and credits that apply to Arizona tax laws. Using airSlate SignNow, you can easily eSign and submit your Arizona Form 650A for a hassle-free tax filing experience.

-

How can airSlate SignNow help with filling out Arizona Form 650A?

airSlate SignNow provides a user-friendly interface that simplifies the process of filling out Arizona Form 650A. Users can easily input their data and save their progress, ensuring that they don’t miss any critical information. Furthermore, our document templates can help streamline the completion process, making tax filing easier and more efficient.

-

Is there a cost associated with using airSlate SignNow for Arizona Form 650A?

Yes, there is a subscription fee associated with using airSlate SignNow, which varies based on the selected plan and features. However, considering the time and resources saved by using a digital solution, many users find it to be a cost-effective option for managing documents like the Arizona Form 650A. We also offer a free trial period for you to evaluate our services.

-

Can I integrate airSlate SignNow with my existing accounting software for Arizona Form 650A?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting and tax preparation software. These integrations enable you to directly import and export data related to your Arizona Form 650A, making your workflow smoother and more efficient. Check our integrations page for a list of compatible applications.

-

What are the benefits of using airSlate SignNow for Arizona Form 650A?

Using airSlate SignNow for Arizona Form 650A offers numerous benefits, including efficient document management, secure eSigning, and reduced turnaround time. Our platform also ensures compliance with state regulations, reducing errors and enhancing the reliability of your tax submissions. Plus, you can access your documents anytime and anywhere, providing added convenience.

-

Is airSlate SignNow secure for handling Arizona Form 650A?

Yes, airSlate SignNow prioritizes security and takes various measures to protect your sensitive data. We implement advanced encryption and secure authentication protocols to ensure your Arizona Form 650A and other documents are safe from unauthorized access. Trust us to keep your information confidential and secure throughout the signing process.

-

How do I eSign Arizona Form 650A using airSlate SignNow?

eSigning Arizona Form 650A with airSlate SignNow is straightforward. Once you've completed the form, simply click on the 'Sign' button and follow the prompts to add your electronic signature. Our platform offers multiple signing options, allowing you to choose the method that suits you best, ensuring a smooth signing experience.

Get more for Arizona Form 650a

- Start the sql server import and docsmicrosoftcom form

- Cg4700pdf coast guard phs ampamp noaa retired pay account worksheet and survivor benefit plan election form

- Cbp 5129 form

- Form 944 x rev february 2021 adjusted employers annual federal tax return or claim for refund

- I 864 affidavit of support faqs united states department form

- I 95 form

- Inz 1226 student visa declaration form

- Certificate of financial resources form office of global

Find out other Arizona Form 650a

- Send eSignature Word iPad

- How To Send eSignature Word

- How To Send eSignature Document

- Send eSignature Document Simple

- Send eSignature PPT Myself

- Fax eSignature PDF Now

- Fax eSignature PPT Online

- Fax eSignature Form Android

- Invite eSignature PDF Safe

- Invite eSignature Presentation Online

- Invite eSignature Presentation Free

- How To Invite eSignature Presentation

- How Do I Invite eSignature Presentation

- Invite eSignature Presentation Android

- Invite eSignature Presentation iOS

- How Can I Invite eSignature Presentation

- Invite eSignature Presentation iPad

- Complete eSignature Form Simple

- Request eSignature Word Easy

- Request eSignature Document Myself