Miller Trust Tennessee Form

What is the Miller Trust in Tennessee

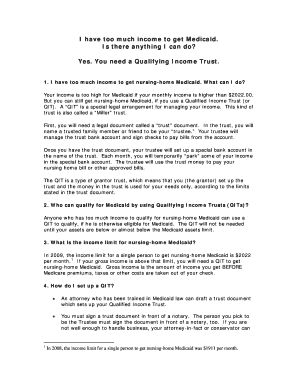

The Miller Trust, also known as a qualified income trust, is a legal instrument designed to assist individuals in qualifying for Medicaid benefits in Tennessee. This trust allows individuals whose income exceeds the Medicaid eligibility threshold to place excess income into the trust, thereby reducing their countable income for Medicaid purposes. The funds in the trust can only be used for specific expenses, such as medical care and certain living costs, ensuring that the individual can receive necessary health services while complying with Medicaid regulations.

How to Use the Miller Trust in Tennessee

Using a Miller Trust in Tennessee involves several steps. First, you must establish the trust by drafting a trust document that meets state requirements. Next, you will need to fund the trust with any excess income that exceeds Medicaid's income limits. This funding must be done regularly to maintain compliance. The trust must also have a designated trustee, who is responsible for managing the funds according to the terms of the trust. It is essential to keep detailed records of all transactions to ensure transparency and adherence to Medicaid guidelines.

Steps to Complete the Miller Trust in Tennessee

Completing a Miller Trust in Tennessee requires careful attention to detail. Here are the key steps:

- Draft the Trust Document: Create a legal document outlining the terms of the trust, including the trustee's responsibilities.

- Fund the Trust: Transfer any excess income into the trust account each month.

- Designate a Trustee: Appoint a responsible individual to manage the trust funds.

- Maintain Records: Keep detailed records of all income and expenditures related to the trust.

- Submit Necessary Documentation: Provide any required documentation to Medicaid to demonstrate compliance.

Legal Use of the Miller Trust in Tennessee

The Miller Trust must be used in accordance with Tennessee state laws and federal Medicaid regulations. This means that funds in the trust can only be used for allowable expenses, such as medical bills and long-term care costs. Misuse of the trust funds can lead to penalties, including disqualification from Medicaid benefits. It is crucial to understand the legal framework surrounding the trust to ensure that it serves its intended purpose without violating any laws.

Required Documents for the Miller Trust in Tennessee

To establish a Miller Trust in Tennessee, several documents are typically required. These may include:

- Trust Document: The legal document that outlines the terms and conditions of the trust.

- Proof of Income: Documentation showing the individual's income level to determine eligibility.

- Bank Statements: Recent statements for accounts where trust funds will be deposited.

- Medicaid Application: The completed application for Medicaid benefits, which may require the trust information.

Eligibility Criteria for the Miller Trust in Tennessee

To qualify for a Miller Trust in Tennessee, individuals must meet specific eligibility criteria. Generally, the individual must be applying for Medicaid benefits and have income that exceeds the allowable limits set by the state. Additionally, the trust must be properly established and funded to ensure compliance with Medicaid regulations. It is essential to consult with a legal professional to confirm eligibility and to navigate the complexities of the trust and Medicaid application process.

Quick guide on how to complete miller trust tennessee

Complete Miller Trust Tennessee effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage Miller Trust Tennessee on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Miller Trust Tennessee with ease

- Find Miller Trust Tennessee and click Get Form to begin.

- Use the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Miller Trust Tennessee and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the miller trust tennessee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Miller trust form?

A Miller trust form is a legal document used to help individuals in need of long-term care qualify for Medicaid benefits. It allows excess income to be deposited into the trust, ensuring eligibility while preserving resources for beneficiaries. Understanding how to properly fill out a Miller trust form is crucial for anyone considering Medicaid.

-

How can airSlate SignNow assist with completing a Miller trust form?

airSlate SignNow simplifies the process of completing a Miller trust form by offering customizable templates and a user-friendly interface. Users can easily input their information, sign documents electronically, and share them securely. This efficiency saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Miller trust form?

Yes, there is a pricing structure for using airSlate SignNow, which offers various plans based on features and user needs. However, costs are generally low compared to the savings obtained from streamlining document processes like the Miller trust form. Evaluating the plans will help you choose the right one for your requirements.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow to handle documents like the Miller trust form offers multiple benefits, such as increased efficiency and enhanced security. The ability to eSign documents quickly ensures compliance and reduces waiting times. Additionally, users can track document statuses in real-time for the utmost convenience.

-

Can I integrate airSlate SignNow with other tools for managing the Miller trust form?

Absolutely! airSlate SignNow offers integrations with various popular applications such as Google Drive, Dropbox, and more. This allows users to seamlessly manage the Miller trust form alongside other essential tools, creating a cohesive workflow that enhances productivity and collaboration.

-

Is it secure to use airSlate SignNow for the Miller trust form?

Yes, airSlate SignNow prioritizes security and compliance with industry standards, ensuring that your Miller trust form and other documents are protected. With features like encryption and secure access controls, users can trust that their sensitive information remains safe throughout the signing process.

-

What should I know before filling out a Miller trust form?

Before filling out a Miller trust form, it's important to gather all necessary financial documents and understand the specific requirements for your state. Consulting legal advice may also be beneficial to ensure compliance. Utilizing airSlate SignNow can make this process smoother and more manageable.

Get more for Miller Trust Tennessee

Find out other Miller Trust Tennessee

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation