P14 Form 2015-2026

What is the P14 Form

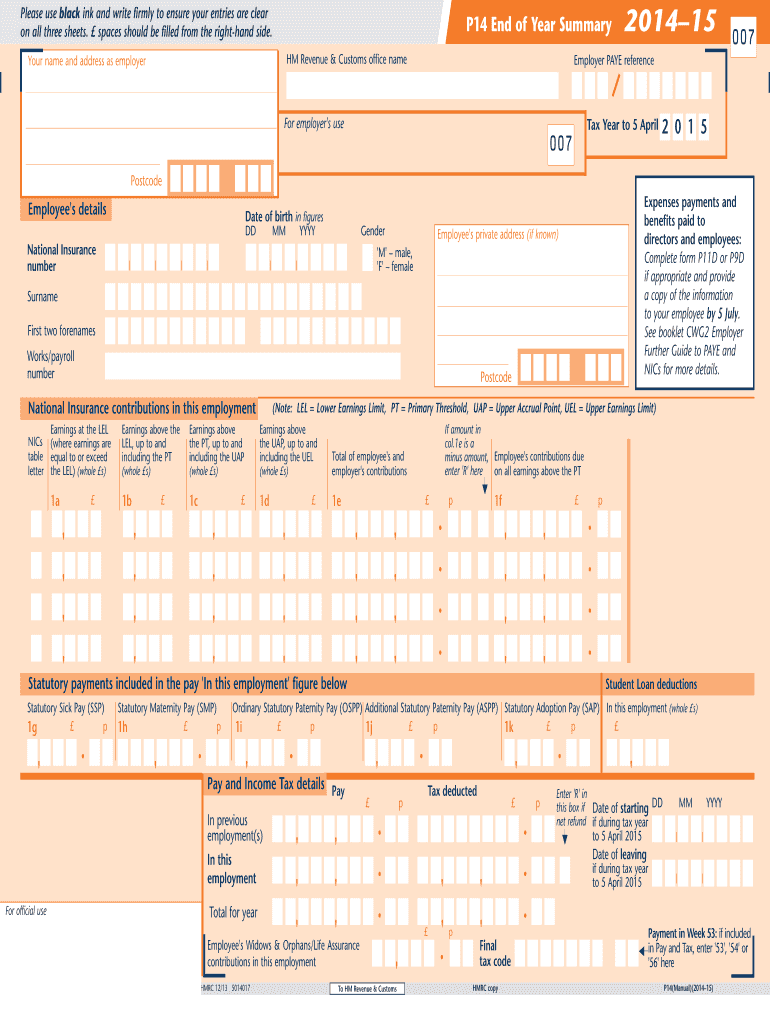

The P14 form is a summary certificate used in the United Kingdom to report an employee's earnings and tax deductions for a specific tax year. It provides essential information for both the employee and the tax authorities, ensuring accurate tax reporting and compliance. Although primarily associated with UK payroll processes, understanding its purpose can be beneficial for those involved in international business or employment practices.

How to use the P14 Form

To use the P14 form effectively, employers must complete it at the end of the tax year for each employee. The form should include total earnings, tax deducted, and National Insurance contributions. Employees can use the information provided on the P14 to verify their tax records and ensure they have been taxed correctly. It is crucial to keep a copy of the P14 for personal records, as it may be needed for future tax filings or inquiries.

Steps to complete the P14 Form

Completing the P14 form involves several key steps:

- Gather necessary employee information, including name, address, and National Insurance number.

- Calculate total earnings for the tax year, including bonuses and overtime.

- Determine the total tax deducted and National Insurance contributions.

- Fill out the P14 form accurately, ensuring all fields are completed.

- Distribute copies to employees and retain a copy for your records.

Legal use of the P14 Form

The P14 form must be used in compliance with UK tax laws. Employers are legally required to provide accurate information regarding employee earnings and tax deductions. Failure to complete and submit the P14 form correctly can lead to penalties and legal issues for both the employer and the employee. It is essential to ensure that the form is filled out with precision to avoid any complications with tax authorities.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the P14 form is crucial for compliance. Typically, the P14 must be submitted to HM Revenue and Customs (HMRC) by the end of the tax year, which runs from April sixth to April fifth of the following year. Employers should ensure that they meet this deadline to avoid potential fines or penalties associated with late submissions.

Who Issues the Form

The P14 form is issued by employers as part of their payroll reporting obligations. It is the employer's responsibility to generate this form for each employee at the end of the tax year. While there is no specific government body that issues the P14, it is a requirement for employers to provide this documentation to their employees and submit the information to HMRC.

Quick guide on how to complete 2012 13 p14 end of year summary 2015 2019 form

A concise guide on how to create your P14 Form

Finding the correct template can be difficult when you have to submit official international documents. Even if you possess the necessary form, it might be cumbersome to quickly fill it out according to all the specifications if you rely on paper copies rather than managing everything digitally. airSlate SignNow is the web-based eSignature tool that assists you in navigating all of this. It enables you to acquire your P14 Form and swiftly complete and sign it on the spot without having to reprint documents whenever you make a mistake.

Here are the actions you must take to create your P14 Form with airSlate SignNow:

- Click the Get Form button to upload your file to our editor immediately.

- Start at the first blank space, enter your information, and continue with the Next tool.

- Complete the empty fields using the Cross and Check features from the toolbar above.

- Choose the Highlight or Line options to emphasize the most important details.

- Select Image to upload one if your P14 Form requires it.

- Utilize the right-side panel to add additional fields for yourself or others to complete if necessary.

- Review your inputs and approve the document by clicking Date, Initials, and Sign.

- Draw, input, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing the document by clicking the Done button and selecting your file-sharing preferences.

Once your P14 Form is ready, you can distribute it however you wish - send it to your recipients via email, SMS, fax, or even print directly from the editor. You can also securely keep all your finished documents in your account, organized in folders according to your preferences. Don’t squander time on manual form filling; utilize airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

I forgot to fill the final registration form of AIIMS 2019 for UG course. What should I do?

Dear Applicant, It’s your good luck!!!AIIMS has reopened the facility of generation of code and final registration for students who have completed their basic registration. Students are advised to complete registration process for AIIMS MBBS 2019 before due date.AIIMS MBBS Reopening - 19th March 2019AIIMS MBBS Generation of Code & Final Registration last date - 25th March 2019Complete AIIMS Registration 2019 here - AIIMS LoginThanks!

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

-

How do I prepare for NEET 2019 after my Boards exam ending on 18th March (for me)? I am studying in Aakash and getting a rank of about 4000 and below out of 13,000 students. What do I do after boards to get above 500 marks in NEET 2019?

Hi;I am a study abroad specialist and have helped many students to take admission in MBBS course of top medical universiries in various countries like Ukraine , Russia , China , Nepal , Philippines , USA , Kyrgyzstan and liast goes on.As NEET is mandatory now for studying MBBS abroad as well so competition has increased a lot for NEET and achieving a good rank is the only option to get into India Govt college.However in abroad even if you are just NEET qualified you can get into top medical university and cost of education is as cheap as 4 lacs per year!Now as competition has increased and if you are targetting 500+ in NEET 2019 i would say target 600+ if you want to get admission in India top government universities.As you have mentioned that yoi are getting rank of 4000 in 13000 students , In actual NEET 2019 there will be 13 Lacs students so 500 is not enough.After you board exam what all is required is just your practice and Revision because this is not the time to study its the time for revision.Practice as much of MCQ as possible, Give Mock tests , Solve Numericals and revise the concepts.If you have some pending topics do study them. After board exams your self study will be the key to high score.Do self study for atleast 10 hours a day and just practice over and over and solve as much as possible numbericals and MCQ .Wish you Luck!Once you all clear your NEET and in case you do not get admission in government college i can help you get admission in MBBS in top government universities abroad that too in cheap fees as 4 Lacs per year.For more details my numbers are available in my profile , you can call or whatsapp me!

-

The United Nations came out with new sustainable development goals for the year 2030. One of the goals includes ending poverty in all of its forms, everywhere. What is being done to signNow those goals? How can I get involved?

To find out what is being done to signNow the goals, check this website United Nations Partnerships for SDGs platform , at the moment it lists 2148 partnerships commitments and initiatives. Initiatives can be selected by country, goal (17) or target (169).You could get involved by contacting one the initiatives.If you run a business, or can influence its strategy, it is worthwhile to Download the SDG Compass Guide and apply the five steps for companies to maximize their contribution to the SDGs. Via the website you can find information about national business networks. Other resources, for instance sectoral, can be discovered via hashtag #b4sdgs (short for business for SDGs).Alongside the Habitat III which was held in Quito during mid-October 2016, two new platforms have been created, one for implementing the New Urban Agenda - Quito Implementation Plan Platform - and one for Localizing the SDGs:Quito Implementation Plan Platform, with registration link via About The Quito Implementation Plan - Habitat IIILocalizing the SDGs which doesn’t have much traction yet,For grass-roots initiatives , it may be interesting to take a look at a recently launched app: SDGs in Action (available both via App Store and Google Play).If all the above doesn’t cater to your interests and time or resources available, you may consider doing something from your couch, via your preferred social media channels. It is cataloging the content shared by all those who have resources and commitments (but apparently no time nor brains to share content in a smart way).Consider that knowledge sharing and information overload is an important challenge for anyone getting involved in sustainable development, and localizing the goals - just check the “Discover Tools” section of “Localizing the SDGs”.See my post Jan Goossenaerts's answer to How long does Twitter store hashtag information? for the idea of creating an internet based “public library” for each local government unit on earth. Below a citation from the post:For the tactics, see:https://www.linkedin.com/pulse/w... (an post explaining how to collaboratively cope with information overload)

-

I am 22 years old and already about $3000 in debt (combined credit card, phone bill and car) I have a part-time job making $7.25 an hour and work about 20-25 hours a week. How can I budget to dig myself out of this debt before 2015 ends?

Year is over, but incase you still need financial advice, the formula is extremely simple: Increase the income and decrease the expenses. For your situation, I would aim at first creating a zero-cost life. Tell mom and dad you need to come stay home for about six months to help get your finances in order. Don't pay for or buy anything so that your pay checks are free cash flows. Next, increase the number of hours at work, while searching for higher paying work and higher paying careers with low entry levels. Look for certifications in something you can finish within a month and can get easily hired for. You don't want to have to compete hard early on. Lastly, arrange your debts from smallest to largest balance, and then from highest interest rate to lowest, and attack how you wish, either the smallest balance or the highest interest. Put ALL of your money towards it and aim at killing all balances within three months. That will give you three months of debt free, free cash flows to plan and execute your next move. By the end of that six months, you should have money saved, a lucrative certification completed, and a new more lucrative job in hand waiting on you. Make smart decisions from there and enjoy your new life!

Create this form in 5 minutes!

How to create an eSignature for the 2012 13 p14 end of year summary 2015 2019 form

How to make an electronic signature for your 2012 13 P14 End Of Year Summary 2015 2019 Form in the online mode

How to make an eSignature for the 2012 13 P14 End Of Year Summary 2015 2019 Form in Chrome

How to generate an eSignature for putting it on the 2012 13 P14 End Of Year Summary 2015 2019 Form in Gmail

How to make an eSignature for the 2012 13 P14 End Of Year Summary 2015 2019 Form straight from your mobile device

How to make an electronic signature for the 2012 13 P14 End Of Year Summary 2015 2019 Form on iOS devices

How to generate an eSignature for the 2012 13 P14 End Of Year Summary 2015 2019 Form on Android OS

People also ask

-

What is a P14 form, and why do I need it?

A P14 form is a tax document that summarizes an employee's earnings and tax deductions for the year. It is crucial for both employers and employees to ensure accurate tax reporting and compliance. By using airSlate SignNow, businesses can efficiently manage the distribution and signing of P14 forms.

-

How does airSlate SignNow simplify the P14 form process?

airSlate SignNow streamlines the P14 form process by allowing users to electronically send, sign, and store these documents securely. This minimizes paperwork and the chances of errors, making it easier for businesses to manage their tax documentation. It's a cost-effective solution that saves time and resources.

-

Are there any costs associated with using airSlate SignNow for P14 forms?

Yes, airSlate SignNow offers various pricing plans to cater to businesses of all sizes. Each plan includes features aimed at simplifying the management of P14 forms along with other document types. The pricing is designed to be cost-effective, ensuring that companies can handle their documentation without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing P14 forms?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions such as CRMs and accounting platforms. This integration allows businesses to manage P14 forms alongside other important business documents, enhancing workflow efficiency and data accuracy.

-

What security measures does airSlate SignNow have for P14 forms?

airSlate SignNow prioritizes the security of your documents, including P14 forms. The platform employs encryption, secure data storage, and compliance with industry standards to protect sensitive information. This ensures that your P14 forms are handled safely and securely throughout the signing process.

-

How can airSlate SignNow improve the signing experience for P14 forms?

With airSlate SignNow, the signing experience for P14 forms is quick and user-friendly. Recipients can sign documents digitally from any device, reducing delays and enhancing the overall efficiency of document handling. It eliminates the hassle of printing and scanning, making it a modern solution for document signing.

-

What features of airSlate SignNow are specifically beneficial for handling P14 forms?

Key features that benefit the handling of P14 forms include customizable templates, automatic reminders, and audit trails. These tools help ensure that P14 forms are completed accurately and on time, while also providing a record of all actions taken on the document. This feature set is crucial for maintaining compliance and tracking document flow.

Get more for P14 Form

- Printable puppy health guarantee template form

- Calculus 10th edition by ron larson and bruce edwards pdf download form

- Safaricom jobs for form four leavers 2022

- Health certificate for cardiovascular intensive sport activity cycling races events form

- Digital art commission contract form

- Toyota invoice pdf form

- Form 4

- Bitclub network refund form

Find out other P14 Form

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free