SCHEDULE in 113 Income Adjustment Vermont Department of Taxes 2020

What is the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes

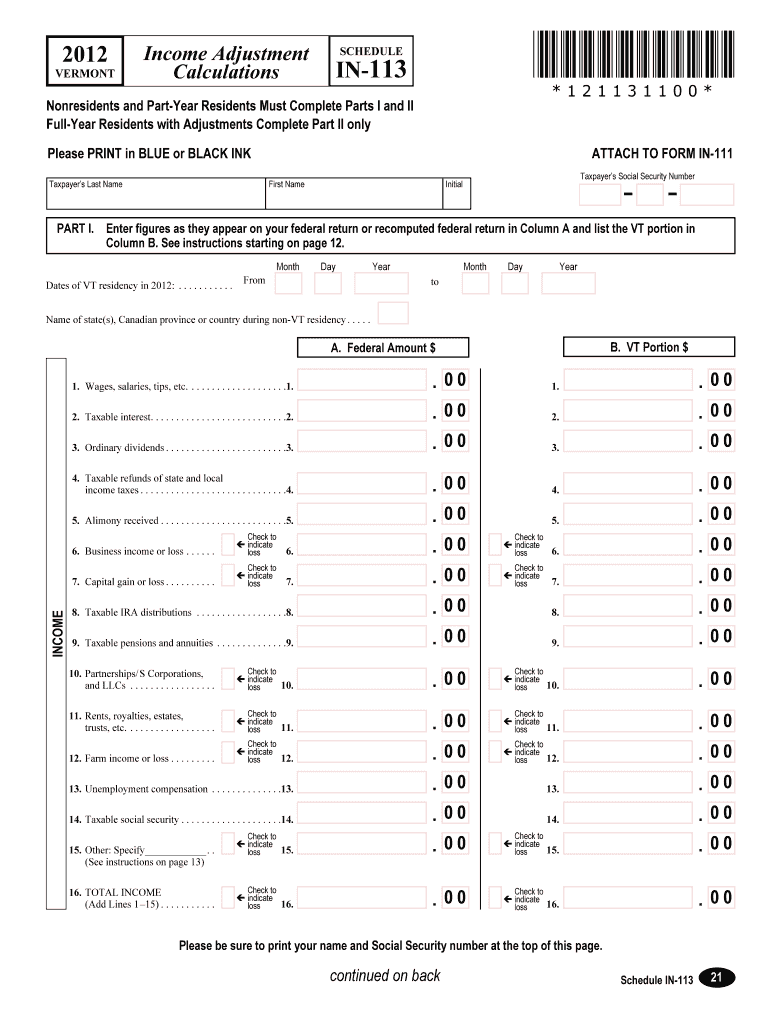

The SCHEDULE IN 113 Income Adjustment form is a tax document used by residents of Vermont to report and adjust their income for tax purposes. This form is specifically designed to help taxpayers calculate any necessary adjustments to their income that may affect their overall tax liability. It includes various sections that guide users through the process of reporting income from different sources, including wages, self-employment income, and other taxable earnings. Understanding this form is essential for ensuring accurate tax filings and compliance with state tax regulations.

Steps to complete the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes

Completing the SCHEDULE IN 113 Income Adjustment form involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, follow these steps:

- Begin by filling out your personal information at the top of the form, including your name, address, and Social Security number.

- Report your total income from all sources in the designated sections, ensuring that you include all applicable income types.

- Make any necessary adjustments to your income as required by Vermont tax laws, such as deductions or credits.

- Double-check all calculations and ensure that all entries are accurate before finalizing the form.

- Sign and date the form to certify that the information provided is correct.

How to use the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes

The SCHEDULE IN 113 Income Adjustment form is used primarily for adjusting reported income on your Vermont tax return. To effectively use this form, follow these guidelines:

- Identify the specific income items that require adjustment based on your financial situation.

- Carefully complete each section of the form, ensuring that all adjustments align with Vermont tax regulations.

- Utilize the form to clarify any discrepancies in your reported income, which may arise from various sources.

- Consult with a tax professional if you have questions about specific adjustments or how they may impact your overall tax liability.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the SCHEDULE IN 113 Income Adjustment form. Typically, the form should be submitted along with your Vermont tax return by the state’s tax filing deadline, which is usually April fifteenth. If you are unable to meet this deadline, you may request an extension, but it is important to file the form as soon as possible to avoid potential penalties.

Legal use of the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes

The legal use of the SCHEDULE IN 113 Income Adjustment form is governed by Vermont tax laws. This form must be completed accurately to ensure compliance with state regulations. Failure to provide correct information can lead to penalties or audits. It is important to retain copies of submitted forms and any supporting documentation for your records, as these may be required for future reference or in case of an audit.

Required Documents

To complete the SCHEDULE IN 113 Income Adjustment form, you will need several documents to support your reported income and adjustments. These typically include:

- W-2 forms from employers showing your annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as interest or dividends.

- Documentation for any deductions or credits that you plan to claim.

Quick guide on how to complete schedule in 113 income adjustment vermont department of taxes

Complete SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes hassle-free

- Find SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, either by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule in 113 income adjustment vermont department of taxes

Create this form in 5 minutes!

How to create an eSignature for the schedule in 113 income adjustment vermont department of taxes

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes?

The SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes is a form used by residents to adjust their reported income for tax purposes. It allows taxpayers to claim various deductions or modifications to their income, ensuring they comply with Vermont tax laws.

-

How can airSlate SignNow help with the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes?

airSlate SignNow simplifies the process of submitting your SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes by allowing users to eSign documents securely. This ensures that your adjustments are filed quickly and efficiently, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for my SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes?

Yes, airSlate SignNow offers affordable pricing plans tailored to meet the needs of individuals and businesses. You can choose a plan that best fits your requirements for handling documents, including the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes.

-

What features does airSlate SignNow offer for managing the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes?

airSlate SignNow provides features such as document templates, secure eSignatures, and cloud storage to manage your SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes effectively. These features help streamline your workflow and ensure compliance with the Vermont Department of Taxes.

-

Can I integrate airSlate SignNow with other software to assist with the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes?

Absolutely! airSlate SignNow integrates seamlessly with various applications, helping you manage your SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes alongside your existing workflows. This integration keeps your documentation organized and accessible.

-

What are the benefits of using airSlate SignNow for tax-related documents like the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes?

Using airSlate SignNow for tax documents, including the SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes, offers numerous benefits. You get accurate, fast filing and improved compliance, along with a user-friendly experience that can save you time and reduce stress.

-

Is airSlate SignNow secure for submitting my SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes?

Yes, airSlate SignNow prioritizes security, employing advanced encryption to protect your sensitive information. When submitting your SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes, your data remains confidential and secure throughout the process.

Get more for SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes

- Instructions for form 2290 rev july instructions for form 2290 heavy highway vehicle use tax return

- Root planing informed consent periodontal scaling and

- Peacehealth financial assistance application form

- Private passenger auto insurance application form

- Nw1 form fill out amp sign online

- 130u formfill out and use this pdf

- Scope of work contract template form

- Screenwriter contract template form

Find out other SCHEDULE IN 113 Income Adjustment Vermont Department Of Taxes

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document