Genworth Annuity Withdrawal Form 2008

What is the Genworth Annuity Withdrawal Form

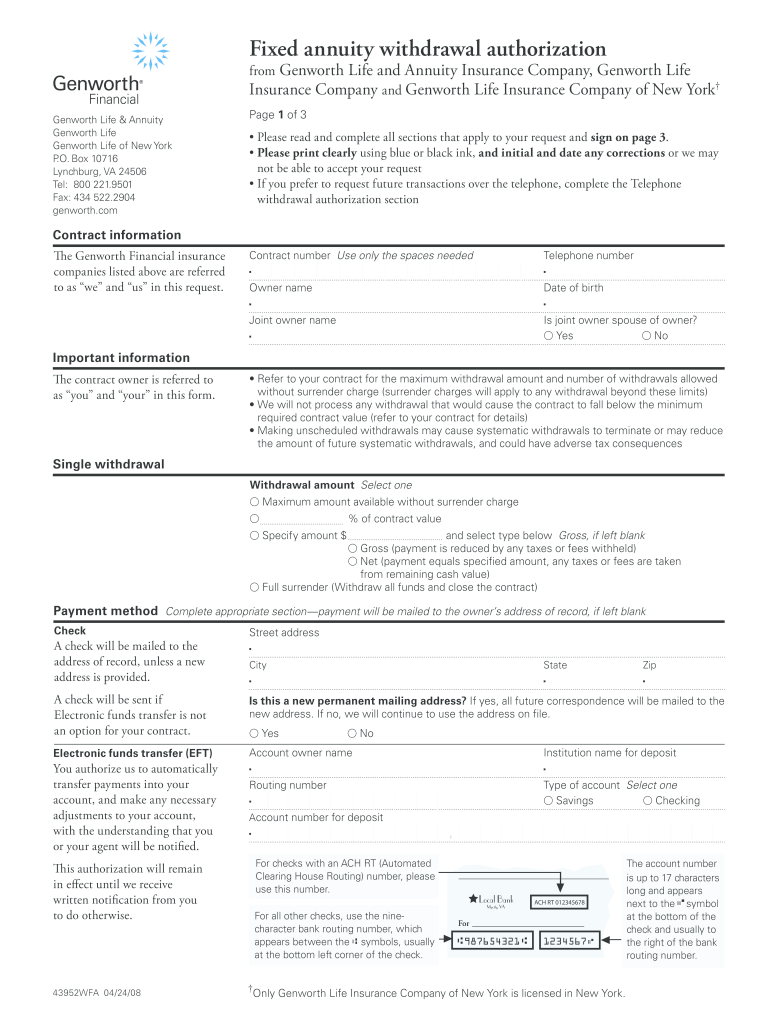

The Genworth Annuity Withdrawal Form is a crucial document for individuals seeking to access funds from their Genworth annuity. This form serves as a formal request to withdraw a specified amount from the annuity account. It is essential for policyholders to understand the implications of their withdrawal, including potential penalties or tax consequences. Completing this form accurately ensures that the request is processed efficiently and in compliance with Genworth's policies.

How to use the Genworth Annuity Withdrawal Form

Using the Genworth Annuity Withdrawal Form involves several key steps. First, obtain the form from Genworth’s official website or customer service. Next, fill out the required fields, which typically include personal information, annuity details, and the amount to be withdrawn. It is important to review the form for accuracy before submission to avoid delays. Once completed, the form can be submitted electronically or via mail, depending on the preferred method of processing.

Steps to complete the Genworth Annuity Withdrawal Form

Completing the Genworth Annuity Withdrawal Form requires attention to detail. Follow these steps to ensure a smooth process:

- Download the form from Genworth's website or request a physical copy.

- Provide your personal information, including your name, address, and contact details.

- Enter your annuity account number and specify the amount you wish to withdraw.

- Sign and date the form to validate your request.

- Review all information for accuracy before submission.

Legal use of the Genworth Annuity Withdrawal Form

The legal use of the Genworth Annuity Withdrawal Form is governed by various regulations regarding annuity contracts. To ensure that the withdrawal is legally binding, the form must be completed in accordance with Genworth's guidelines and relevant state laws. This includes providing accurate information and obtaining necessary signatures. Compliance with these legal requirements helps protect the rights of both the policyholder and the issuing company.

Key elements of the Genworth Annuity Withdrawal Form

When filling out the Genworth Annuity Withdrawal Form, several key elements must be included to ensure its validity:

- Personal Information: Full name, address, and contact information.

- Annuity Details: Account number and type of annuity.

- Withdrawal Amount: Specify the exact amount requested for withdrawal.

- Signature: Required to authorize the withdrawal.

- Date: The date of submission must be included.

Form Submission Methods

The Genworth Annuity Withdrawal Form can be submitted through various methods, providing flexibility for policyholders. Options typically include:

- Online Submission: Many users prefer to submit the form electronically through Genworth's secure portal.

- Mail: The completed form can also be sent via postal service to the designated address provided by Genworth.

- In-Person: For those who prefer direct interaction, submitting the form at a local Genworth office is an option.

Quick guide on how to complete genworth annuity withdrawal form

Handle Genworth Annuity Withdrawal Form effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage Genworth Annuity Withdrawal Form across any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest method to modify and eSign Genworth Annuity Withdrawal Form smoothly

- Obtain Genworth Annuity Withdrawal Form and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or incorrectly filed documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Genworth Annuity Withdrawal Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct genworth annuity withdrawal form

Create this form in 5 minutes!

How to create an eSignature for the genworth annuity withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Genworth annuity?

A Genworth annuity is a financial product designed to provide a steady income during retirement. It can be structured in various ways to meet the specific needs of the policyholder. By investing in a Genworth annuity, individuals can secure their financial future with predictable payments.

-

What are the main benefits of a Genworth annuity?

The primary benefits of a Genworth annuity include financial security and peace of mind in retirement. These products often offer tax-deferred growth of your investment and can provide lifetime income options. Additionally, a Genworth annuity can help you avoid the risk of outliving your savings.

-

How does pricing work for a Genworth annuity?

Pricing for a Genworth annuity varies based on factors such as the type of annuity, investment amount, and chosen payout options. It's essential to evaluate different plans to find one that fits your financial goals. Speak with a financial advisor to understand how pricing will affect your long-term investment.

-

What features should I look for in a Genworth annuity?

Key features to consider in a Genworth annuity include flexibility in payout options, withdrawal provisions, and any built-in riders you may need. It's also essential to review the fees associated with the annuity, such as surrender charges and management fees. These features can signNowly influence your decision.

-

Are there different types of Genworth annuities available?

Yes, Genworth offers several types of annuities, including fixed, variable, and indexed annuities. Each type comes with its unique features and benefits, catering to different risk appetites and financial goals. Evaluating these options carefully is crucial to ensure you choose the right product for your needs.

-

How can I integrate a Genworth annuity into my financial plan?

Integrating a Genworth annuity into your financial plan involves assessing your current financial situation and long-term goals. A financial advisor can help you determine how an annuity fits within your overall retirement strategy. This approach ensures you make informed decisions based on your specific circumstances.

-

What should I consider before purchasing a Genworth annuity?

Before purchasing a Genworth annuity, consider your retirement timeline, income needs, and risk tolerance. Understand the product's fees and terms, and how they affect your investment over time. Consulting with a financial professional is advisable to ensure the product aligns with your financial objectives.

Get more for Genworth Annuity Withdrawal Form

- Spousal consent form california

- Printable real id application california form

- The 626 ofm form

- Ejt 005 order on request to opt out of mandatory expedited jury trial procedures judicial council forms courts ca

- 661 info form

- California policy worn test form

- California extension retention form

- California reunification services form

Find out other Genworth Annuity Withdrawal Form

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe