Form 4562

What is the Form 4562

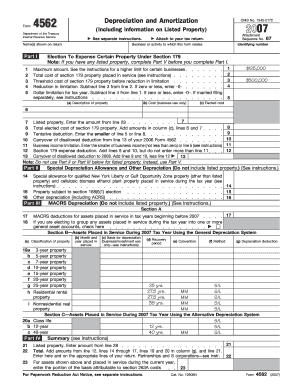

The Form 4562, also known as the Depreciation and Amortization form, is a crucial document used by businesses and individuals to report depreciation and amortization expenses on their tax returns. This form allows taxpayers to claim deductions for the wear and tear of assets over time, which can significantly reduce taxable income. Understanding the purpose and function of this form is essential for ensuring compliance with IRS regulations and maximizing potential tax benefits.

How to use the Form 4562

Using the Form 4562 involves several key steps. First, gather all necessary information regarding the assets you plan to depreciate or amortize. This includes the date the asset was placed in service, its cost, and the method of depreciation you intend to use. Next, complete the form by accurately filling out the required sections, which include Part I for the election of the Section 179 expense deduction and Part II for the computation of depreciation. Ensure that all calculations are precise to avoid potential issues with the IRS.

Steps to complete the Form 4562

Completing the Form 4562 requires careful attention to detail. Follow these steps:

- Begin with your personal or business information at the top of the form.

- In Part I, indicate if you are electing to expense certain assets under Section 179.

- In Part II, list each asset you are depreciating, including its cost, date placed in service, and applicable depreciation method.

- Fill out Parts III and IV if applicable, detailing any additional depreciation or amortization.

- Review the completed form for accuracy before submission.

Legal use of the Form 4562

The legal use of the Form 4562 is governed by IRS regulations that dictate how depreciation and amortization should be reported. To be considered valid, the form must be filled out accurately and submitted with your tax return. It is essential to keep detailed records of all assets and related expenses in case of an audit. Compliance with IRS guidelines ensures that the deductions claimed are legitimate and can withstand scrutiny.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4562 align with the overall tax return deadlines. Generally, individual taxpayers must file their returns by April fifteenth. However, if you are a business entity, the deadlines may vary depending on your entity type. It's important to note that extensions can be requested, but any taxes owed must still be paid by the original deadline to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 4562. These guidelines cover various aspects, including eligibility for depreciation, acceptable methods for calculating depreciation, and the requirements for claiming the Section 179 deduction. Familiarizing yourself with these guidelines is crucial for ensuring that your form is completed correctly and that you are taking full advantage of available tax benefits.

Required Documents

To complete the Form 4562 accurately, you will need several supporting documents. These may include:

- Purchase receipts or invoices for the assets being depreciated.

- Documentation of the date each asset was placed in service.

- Previous tax returns if you are carrying over depreciation from prior years.

- Any relevant financial statements that detail asset costs and depreciation methods.

Quick guide on how to complete form 4562

Complete Form 4562 effortlessly on any gadget

Online document management has gained popularity among enterprises and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form 4562 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Form 4562 with ease

- Find Form 4562 and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 4562 and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4562

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is formulario 4562 and why is it important?

Formulario 4562 is a tax form used to report the depreciation of assets for tax purposes. Understanding how to properly complete formulario 4562 can help businesses maximize their tax benefits and maintain compliance with IRS regulations.

-

How can airSlate SignNow assist with the completion of formulario 4562?

airSlate SignNow provides powerful tools that simplify the process of filling out formulario 4562. Our platform allows users to create, edit, and securely sign documents online, which streamlines your tax preparation efforts.

-

Is there a cost associated with using airSlate SignNow for formulario 4562?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. You can choose a plan that suits your budget while accessing all the essential features for managing formulario 4562 and other documents.

-

What features does airSlate SignNow offer for handling formulario 4562?

With airSlate SignNow, you can enjoy features such as document templates, eSignature capabilities, and automated workflows tailored for formulario 4562. These features enhance efficiency and ensure that your documents are completed accurately and on time.

-

Can I integrate airSlate SignNow with other software for formulario 4562 management?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions like CRMs, accounting software, and cloud storage services, making it easier to manage your formulario 4562 alongside other documents.

-

What are the benefits of using airSlate SignNow for formulario 4562?

Using airSlate SignNow for formulario 4562 offers multiple benefits, including increased efficiency, improved accuracy, and enhanced security for your documents. This ensures a smoother tax process and peace of mind during tax season.

-

Is it easy to use airSlate SignNow for first-time users of formulario 4562?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible even for first-time users of formulario 4562. Our intuitive interface and helpful resources guide you through the process, ensuring you complete the form correctly.

Get more for Form 4562

- Thank you for choosing dynamic pain and wellness form

- Member forms arkansas blue cross and blue shield

- Bcbs companies and licenseesblue cross blue shield form

- Group employee vision application and change form

- Arizona state trauma registry data request form

- Rabies risk assessment ampamp laboratory submission form county

- Rabies risk assessment amp laboratory submission form

- Attached are the start up forms for arizonas hiv care and services

Find out other Form 4562

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free