W4 Forms for Employees

What is the W-4 Form for Employees?

The W-4 form, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employers about their tax withholding preferences. This form helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck. By accurately completing the W-4, employees can manage their tax obligations effectively, ensuring they do not overpay or underpay taxes throughout the year.

How to Use the W-4 Form for Employees

Using the W-4 form involves a few straightforward steps. First, employees need to obtain the form from their employer or download it from the IRS website. Next, they should fill out personal information, including their name, address, and Social Security number. The form also requires employees to indicate their filing status and any additional adjustments for dependents or other tax credits. Once completed, the form should be submitted to the employer, who will then use the information to adjust the withholding amount accordingly.

Steps to Complete the W-4 Form for Employees

Completing the W-4 form requires careful attention to detail. Here are the essential steps:

- Download or request the W-4 form from your employer.

- Fill in your personal information, including your name and Social Security number.

- Select your filing status, such as single, married, or head of household.

- Claim any dependents or additional tax credits as applicable.

- Review your entries for accuracy.

- Submit the completed form to your employer.

Key Elements of the W-4 Form for Employees

The W-4 form contains several key elements that are vital for accurate tax withholding. These include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Dependents: Information on qualifying children or other dependents.

- Additional Withholding: Option to request extra withholding if desired.

IRS Guidelines for the W-4 Form

The IRS provides specific guidelines for completing the W-4 form to ensure proper tax withholding. Employees are encouraged to review these guidelines annually or whenever they experience significant life changes, such as marriage, divorce, or the birth of a child. The IRS also offers a withholding calculator on its website, which can help employees determine the appropriate withholding amount based on their individual circumstances.

Filing Deadlines for the W-4 Form

There are no strict deadlines for submitting the W-4 form; however, it is advisable to submit it as soon as employment begins or when there are changes in personal circumstances. Employers are required to implement the withholding changes as soon as possible after receiving the updated W-4. Employees should regularly review their withholding status, especially before the start of a new tax year, to ensure compliance with IRS regulations.

Quick guide on how to complete w4 forms for employees

Complete W4 Forms For Employees seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It represents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents promptly without any holdups. Handle W4 Forms For Employees on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The most efficient way to edit and electronically sign W4 Forms For Employees effortlessly

- Obtain W4 Forms For Employees and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget the hassles of lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and electronically sign W4 Forms For Employees and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w4 forms for employees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

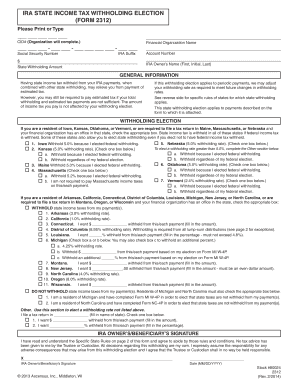

What is a generic IRA withholding form?

A generic IRA withholding form is a document used by individuals to specify how much tax should be withheld from distributions made from their Individual Retirement Accounts (IRAs). This form assists in ensuring that the right amount of tax is deducted, helping to avoid any tax liabilities during tax season.

-

How can I obtain a generic IRA withholding form through airSlate SignNow?

To obtain a generic IRA withholding form using airSlate SignNow, simply visit our templates section and search for 'generic IRA withholding form.' You can easily customize and send the form for eSignature directly from the platform, streamlining your document management process.

-

Is there a cost associated with using airSlate SignNow for generic IRA withholding forms?

AirSlate SignNow offers competitive pricing plans tailored to different business needs, which include the ability to create and manage generic IRA withholding forms. We provide flexible subscription options, ensuring that you can access our features cost-effectively.

-

What features does airSlate SignNow offer for managing generic IRA withholding forms?

AirSlate SignNow provides features such as document templates, electronic signatures, and secure cloud storage for your generic IRA withholding forms. Additionally, our platform facilitates easy sending, tracking, and management of documents, making compliance seamless.

-

How does using airSlate SignNow benefit my business when dealing with generic IRA withholding forms?

Using airSlate SignNow for generic IRA withholding forms enhances efficiency by automating the signing process and reducing paperwork. This results in faster turnaround times and improved accuracy, ultimately saving your business time and reducing potential errors.

-

Can I integrate airSlate SignNow with other tools for processing generic IRA withholding forms?

Yes, airSlate SignNow integrates seamlessly with various applications and tools such as CRM systems, email platforms, and cloud storage solutions. This integration allows for a more cohesive workflow when managing your generic IRA withholding forms and other business documents.

-

What is the process for signing a generic IRA withholding form through airSlate SignNow?

The process for signing a generic IRA withholding form through airSlate SignNow is simple and user-friendly. You upload your form, specify the signers, and send it out for signatures. Signers can then easily access the document online, sign it, and return it, all within a secure environment.

Get more for W4 Forms For Employees

- Individualclaiming economic disadvantage mustsubmit form

- How to replace your driver license commercial driver form

- Fillable online form oisss 160 request for data

- Academic review board policies and petition forms

- Confidential statement for financing studies amp sponsorship form

- Pdf course or event request form uc davis health

- Cobra insurancehealth benefits after job loss form

- Dept of labor podcast home page alaska department of form

Find out other W4 Forms For Employees

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free