Ftb 3571 Form

What is the Ftb 3571

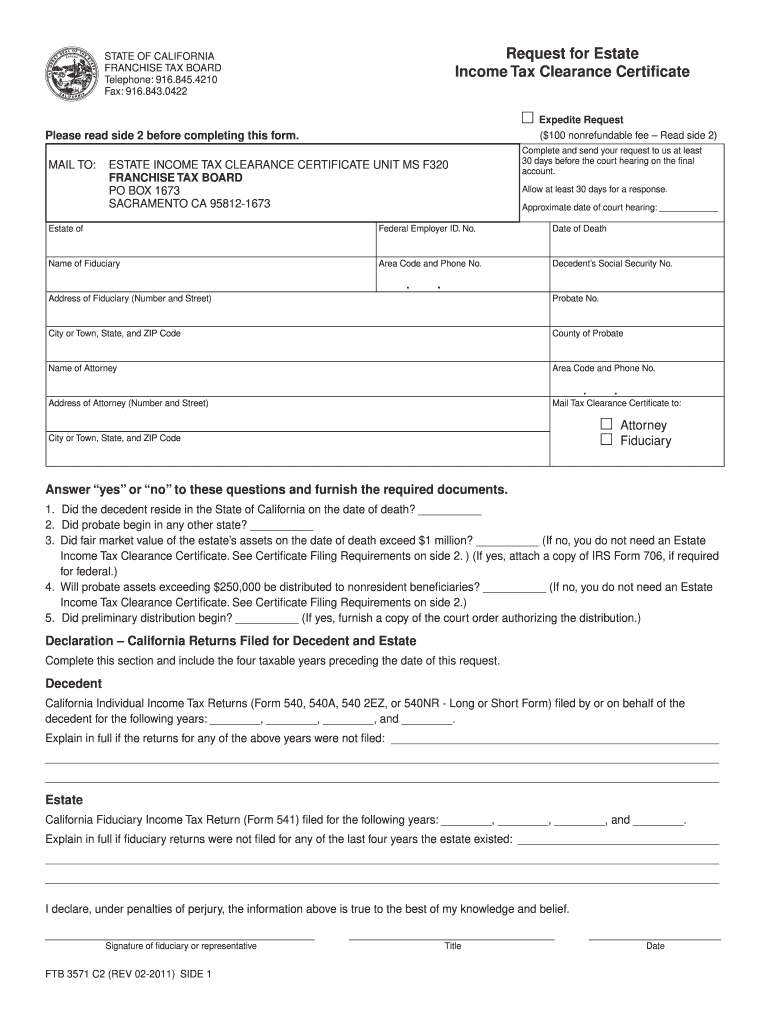

The Ftb 3571 is a form used by taxpayers in California to report specific tax-related information. It is primarily associated with the California Franchise Tax Board and is essential for individuals and businesses to ensure compliance with state tax regulations. The form collects data that may affect tax liabilities, credits, and deductions, making it a crucial component of the state's tax filing process.

How to use the Ftb 3571

Using the Ftb 3571 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submission. It is advisable to keep a copy for your records. The form can be submitted electronically or via mail, depending on your preference and the requirements set by the California Franchise Tax Board.

Steps to complete the Ftb 3571

Completing the Ftb 3571 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Ftb 3571 from the California Franchise Tax Board website.

- Read the instructions thoroughly to understand the requirements.

- Gather all relevant financial documents, including W-2s, 1099s, and any supporting documentation.

- Fill out the form accurately, ensuring all information is current and correct.

- Review the completed form for any mistakes or omissions.

- Submit the form electronically or by mail, as per your preference.

Legal use of the Ftb 3571

The legal use of the Ftb 3571 is governed by California tax laws. To ensure that the form is considered valid, it must be completed accurately and submitted within the designated deadlines. Compliance with the instructions provided by the California Franchise Tax Board is crucial. Additionally, using a reliable electronic signature solution can enhance the legal standing of the submitted form, ensuring that it meets all necessary legal requirements.

Key elements of the Ftb 3571

The Ftb 3571 includes several key elements that are essential for accurate reporting. These elements typically encompass:

- Taxpayer identification information, including name and Social Security number.

- Details regarding income sources and amounts.

- Applicable deductions and credits that may reduce tax liability.

- Signature and date fields to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Ftb 3571 are critical to avoid penalties. Generally, the form must be submitted by April 15 for individual taxpayers, aligning with the federal tax deadline. However, specific circumstances, such as extensions or special filing statuses, may alter these dates. It is important to check the California Franchise Tax Board’s official calendar for any updates or changes to deadlines.

Quick guide on how to complete ftb 3571

Effortlessly Prepare Ftb 3571 on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Ftb 3571 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Ftb 3571 with Ease

- Find Ftb 3571 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your edits.

- Choose how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries over lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Ftb 3571 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 3571

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FTB 3571 form and how does airSlate SignNow help with it?

The FTB 3571 form is an essential document for California business entities. airSlate SignNow allows you to eSign and manage this form efficiently, ensuring compliance and accuracy. With our platform, you can easily fill out the FTB 3571 and send it for signatures, streamlining your filing process.

-

How can airSlate SignNow reduce the costs associated with handling FTB 3571 documents?

By using airSlate SignNow for your FTB 3571 filings, you can signNowly cut down paper usage and printing costs. Our digital solution eliminates the need for physical storage and reduces delays in processing times, ultimately saving your business money. The cost-effective pricing plan also makes it budget-friendly for all organizations.

-

What features does airSlate SignNow offer for FTB 3571 document management?

airSlate SignNow offers various features tailored for FTB 3571 document management, including eSignature capabilities, document templates, and real-time tracking. Our user-friendly interface simplifies the process of creating, personalizing, and sending your FTB 3571 for signing. This ensures a seamless experience and quick turnaround times.

-

Is airSlate SignNow compliant with legal requirements for filing FTB 3571?

Yes, airSlate SignNow is fully compliant with the legal requirements for electronic signatures as set forth by various regulatory bodies. Using SignNow for your FTB 3571 ensures that your signatures hold up in court and meet all necessary compliance standards. You can trust our platform for secure and valid document execution.

-

Can I integrate airSlate SignNow with other software to manage FTB 3571 forms?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage your FTB 3571 forms more effectively. Whether you use CRM, accounting, or document management systems, SignNow can connect and streamline your workflows, making handling multiple platforms easier.

-

What are the benefits of using airSlate SignNow for my FTB 3571 needs?

Using airSlate SignNow for your FTB 3571 needs offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. You can track document status in real-time, ensuring all parties are informed. This boosts productivity and allows you to focus more on your core business activities.

-

Is there a free trial available for airSlate SignNow when dealing with FTB 3571?

Yes, airSlate SignNow provides a free trial that allows you to explore its features and see how it can simplify your FTB 3571 process. This trial period helps you assess the suitability of SignNow for your business needs without any financial commitment. Start your journey towards efficient document management today!

Get more for Ftb 3571

- Nd pers designation group form

- Virginia department of motor vehicles authorized motor form

- Application guide artswagov form

- 2019 2021 form il dsd tvdl 7 fill online printable

- Enhanced vehicle safety inspection penndot home form

- Abandoned vehicle affidavit of sale form for registered tow truck operators rtto to use as an affidavit of sale of an abandoned

- Itdidahogovwp contentuploadsindemnifying affidavit itd idaho transportation department form

- Request to re issue a bureau of motor vehicles division of form

Find out other Ftb 3571

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien