PA 8453 EX 10 21 PA Department of Revenue 2022-2026

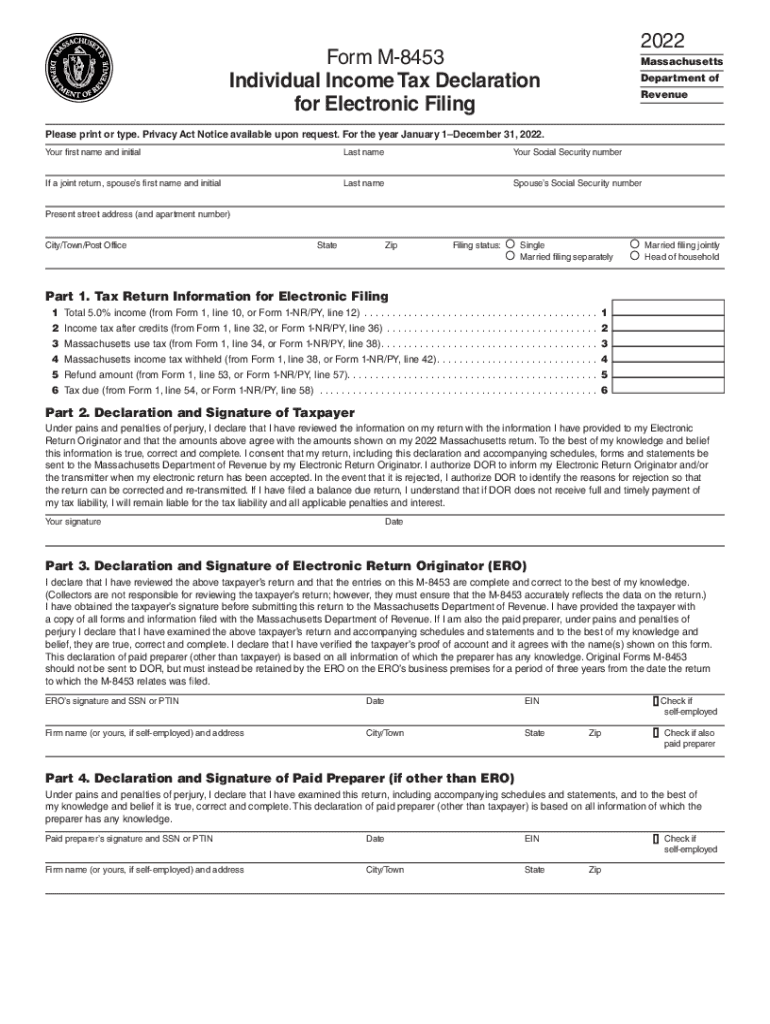

What is the PA 8453?

The PA 8453 is a form used by taxpayers in Pennsylvania to authorize the electronic filing of their state tax returns. This form serves as a declaration that the taxpayer has reviewed the return and agrees to its submission via electronic means. It is essential for ensuring compliance with state regulations regarding electronic tax filings.

Steps to Complete the PA 8453

Completing the PA 8453 involves several straightforward steps:

- Gather necessary information, including your Social Security number, tax return details, and any relevant documentation.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy to avoid any delays or issues with your filing.

- Sign the form electronically, which may require a secure method of authentication.

- Submit the completed form along with your electronic tax return to the appropriate state department.

Legal Use of the PA 8453

The PA 8453 is legally binding when completed and submitted according to state guidelines. It must be signed by the taxpayer or their authorized representative. This form confirms that the taxpayer consents to the electronic submission of their tax return, making it a crucial component of the electronic filing process.

Form Submission Methods

The PA 8453 can be submitted electronically along with your tax return. It is important to follow the specific guidelines provided by the Pennsylvania Department of Revenue for electronic submissions. The form may also be printed and submitted via mail if electronic filing is not an option.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines related to the PA 8453. Typically, the deadline for filing state tax returns in Pennsylvania aligns with the federal tax filing deadline, which is usually April fifteenth. It is advisable to check for any updates or changes to these dates each tax year.

Required Documents

To complete the PA 8453, taxpayers will need to have several documents on hand, including:

- Personal identification, such as a Social Security card or driver's license.

- Income statements, including W-2s and 1099s.

- Any relevant deductions or credits documentation.

IRS Guidelines

While the PA 8453 is a state-specific form, it is essential to comply with IRS guidelines for electronic filing. Taxpayers should ensure that their federal tax return is also filed correctly and in accordance with IRS regulations to avoid any complications.

Quick guide on how to complete pa 8453 ex 10 21 pa department of revenue

Prepare PA 8453 EX 10 21 PA Department Of Revenue effortlessly on any device

Web-based document management has become popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage PA 8453 EX 10 21 PA Department Of Revenue on any device using the airSlate SignNow Android or iOS apps and enhance any document-focused process today.

The easiest way to modify and electronically sign PA 8453 EX 10 21 PA Department Of Revenue effortlessly

- Locate PA 8453 EX 10 21 PA Department Of Revenue and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign functionality, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device you prefer. Edit and eSign PA 8453 EX 10 21 PA Department Of Revenue and guarantee effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa 8453 ex 10 21 pa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the pa 8453 ex 10 21 pa department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form PA 8453 used for?

The form PA 8453 is utilized for electronic submission of tax returns in Pennsylvania. It serves as a declaration of the taxpayer's identity and authorizes the e-filing of their tax return. This essential form helps ensure compliance with state requirements while simplifying the filing process.

-

How can I complete the form PA 8453 using airSlate SignNow?

With airSlate SignNow, you can easily fill out the form PA 8453 electronically. Our platform provides user-friendly tools to input your information, review, and sign the document securely. This streamlines your e-filing process, eliminating the hassle of paper forms.

-

Is airSlate SignNow a cost-effective solution for processing the form PA 8453?

Yes, airSlate SignNow offers a cost-effective solution for managing the form PA 8453 and other documents. Our competitive pricing plans provide businesses with the tools they need without exceeding their budgets. You can access all features and sign documents efficiently at an affordable rate.

-

What features does airSlate SignNow offer for managing the form PA 8453?

airSlate SignNow includes features like customizable templates, secure e-signature functionality, and document tracking for the form PA 8453. Additionally, our intuitive interface ensures that users can create, edit, and manage their documents with ease. This enhances the overall document management experience.

-

Can I integrate airSlate SignNow with other tools for the form PA 8453?

Absolutely! airSlate SignNow provides seamless integration with various tools and applications, enhancing your workflow with the form PA 8453. You can connect with CRM systems, cloud storage services, and more to streamline your document processing and improve efficiency.

-

What are the benefits of using airSlate SignNow for the form PA 8453?

Using airSlate SignNow for the form PA 8453 offers numerous benefits, including quicker processing times, enhanced security, and reduced paper usage. It simplifies the e-filing process, allowing users to sign and send documents from anywhere, improving overall productivity and compliance.

-

Is it secure to sign the form PA 8453 using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption methods and secure authentication processes to protect your information when signing the form PA 8453. You can trust that your documents are safe and compliant with legal regulations.

Get more for PA 8453 EX 10 21 PA Department Of Revenue

Find out other PA 8453 EX 10 21 PA Department Of Revenue

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed