Ohio Department of Taxation 2022

What is the Ohio Department of Taxation

The Ohio Department of Taxation is the state agency responsible for administering and enforcing tax laws in Ohio. This includes the collection of various taxes, such as income tax, sales tax, and property tax. The department also oversees tax policy development, ensuring compliance with state and federal regulations. Understanding the role of this agency is crucial for taxpayers who need to navigate their obligations effectively.

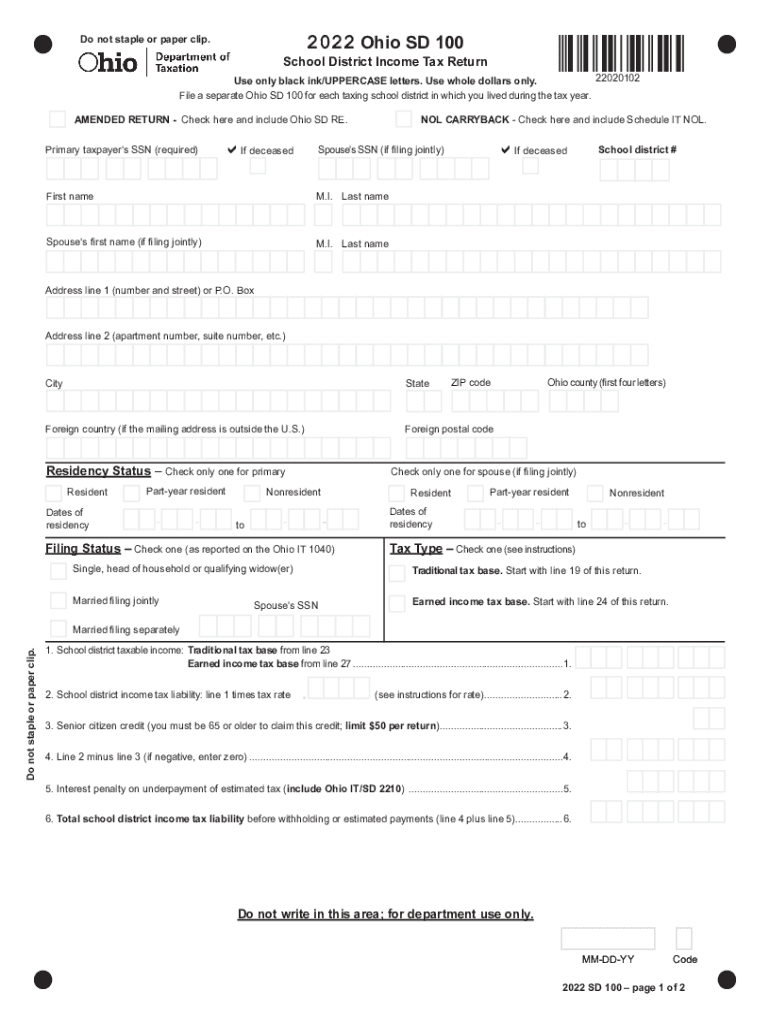

Steps to Complete the Ohio Department of Taxation Form

Completing the Ohio SD 100X form requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including income statements and previous tax returns.

- Ensure you understand the specific requirements for the amended school district tax return.

- Fill out the form accurately, providing all required information.

- Review the completed form for errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference.

Required Documents

When filing the Ohio SD 100X form, certain documents are essential to ensure a smooth process. These include:

- Previous year’s tax returns for reference.

- W-2 forms or 1099 forms that report your income.

- Any documentation supporting deductions or credits claimed.

- Proof of residency in the school district for which you are filing.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for compliance. The Ohio SD 100X form typically has specific deadlines aligned with the state’s tax calendar. Generally, amended returns must be filed within three years from the original due date of the return. It is essential to check for any updates or changes to these dates annually.

Penalties for Non-Compliance

Failing to comply with the requirements of the Ohio Department of Taxation can result in penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid taxes, calculated from the due date until payment is made.

- Potential legal action for severe non-compliance cases.

Digital vs. Paper Version

When it comes to submitting the Ohio SD 100X form, taxpayers have the option of filing digitally or using a paper version. Digital submissions are often faster and can provide immediate confirmation of receipt. Conversely, paper submissions may take longer to process and require careful tracking to ensure they are received on time. Choosing the right method depends on personal preference and the specific circumstances of the taxpayer.

Quick guide on how to complete 2022 ohio department of taxation

Complete Ohio Department Of Taxation effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage Ohio Department Of Taxation on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The simplest method to modify and eSign Ohio Department Of Taxation with ease

- Locate Ohio Department Of Taxation and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Verify the information and click the Done button to store your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Ohio Department Of Taxation while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 ohio department of taxation

Create this form in 5 minutes!

How to create an eSignature for the 2022 ohio department of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ohio SD 100X and how does it relate to airSlate SignNow?

Ohio SD 100X is a digital documentation solution that integrates seamlessly with airSlate SignNow, elevating the efficiency of document management. It allows businesses in Ohio to eSign documents quickly, enhancing their workflow. With this solution, you can streamline your processes without hassle.

-

What are the pricing options for Ohio SD 100X users of airSlate SignNow?

airSlate SignNow offers flexible pricing plans suitable for Ohio SD 100X users to meet varying business needs. You can choose from monthly or annual subscriptions, providing cost-effective options. Pricing plans often include features tailored specifically for businesses in Ohio.

-

What features of airSlate SignNow benefit Ohio SD 100X users?

airSlate SignNow is designed with features that cater specifically to Ohio SD 100X users, such as customizable templates and mobile compatibility. These features simplify document signing and management, ensuring that businesses can operate smoothly. The user-friendly interface also makes it easy to adopt.

-

How can airSlate SignNow enhance productivity for Ohio SD 100X users?

By utilizing airSlate SignNow, Ohio SD 100X users can signNowly boost their productivity through streamlined workflows. Documents can be signed and processed faster, reducing turnaround times. This efficiency allows teams to focus on core business tasks instead of getting bogged down in paperwork.

-

What security measures does airSlate SignNow implement for Ohio SD 100X?

airSlate SignNow prioritizes security for Ohio SD 100X users with industry-standard encryption and secure data storage. Every signed document is protected to ensure compliance and confidentiality. This peace of mind is essential for businesses handling sensitive information.

-

Can Ohio SD 100X integrate with other tools using airSlate SignNow?

Yes, airSlate SignNow offers robust integrations that benefit Ohio SD 100X users by connecting with popular software tools. This adaptability allows seamless data transfer and management across various platforms. These integrations streamline workflows, making it easier for teams to collaborate.

-

What are the benefits of using airSlate SignNow for Ohio SD 100X businesses?

Using airSlate SignNow provides numerous benefits for Ohio SD 100X businesses, including reduced operational costs and faster document turnaround. Businesses can easily manage their documentation processes without complicated setups. By centralizing document management, teams can collaborate more effectively.

Get more for Ohio Department Of Taxation

- Employment agreement of form

- Letter notifying social security administration of identity theft of minor form

- Letter to other entities notifying them of identity theft of minor form

- Sales agency agreement form

- Identity theft checklist for minors form

- License to operate a kiosk booth rentals or renters for vending farmers markets or flea markets form

- Sample letter new application form

- Letter request credit application form

Find out other Ohio Department Of Taxation

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple