Ausfuhr Und Abnehmerbescheinigung 2004

What is the Ausfuhr Und Abnehmerbescheinigung

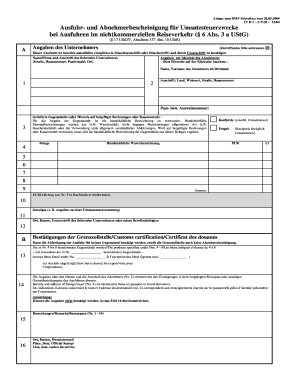

The Ausfuhr und Abnehmerbescheinigung is a crucial document used in international trade, particularly for tax purposes. It serves as a proof of export and is essential for businesses that sell goods outside the United States. This form is primarily used to confirm that the goods have been exported and to facilitate the exemption from sales tax in the exporting country. Understanding this document is vital for companies engaged in cross-border transactions, as it helps ensure compliance with tax regulations.

How to Use the Ausfuhr Und Abnehmerbescheinigung

Using the Ausfuhr und Abnehmerbescheinigung involves several steps. First, businesses must accurately fill out the form, providing details about the goods being exported and the recipient's information. Once completed, the document must be submitted to the relevant tax authorities to claim any applicable tax exemptions. It is important to keep a copy of the form for record-keeping and potential audits. Proper use of this document can help businesses avoid unnecessary tax liabilities.

Steps to Complete the Ausfuhr Und Abnehmerbescheinigung

Completing the Ausfuhr und Abnehmerbescheinigung requires careful attention to detail. Follow these steps:

- Gather necessary information, including details about the goods and the recipient.

- Fill out the form accurately, ensuring all fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority, either electronically or by mail.

- Retain a copy for your records and future reference.

Legal Use of the Ausfuhr Und Abnehmerbescheinigung

The legal use of the Ausfuhr und Abnehmerbescheinigung is governed by tax laws that vary by state. This document must be filled out correctly to be considered valid. It is essential for businesses to understand the legal implications of using this form, as improper use can lead to penalties or tax liabilities. Compliance with local regulations ensures that the document serves its intended purpose without legal complications.

Key Elements of the Ausfuhr Und Abnehmerbescheinigung

Several key elements must be included in the Ausfuhr und Abnehmerbescheinigung to ensure its validity:

- Exporter Information: Name, address, and tax identification number of the exporting business.

- Recipient Information: Name and address of the recipient receiving the goods.

- Description of Goods: Detailed description of the items being exported.

- Value of Goods: The monetary value of the exported items.

- Signature: The signature of the authorized representative of the exporting business.

Examples of Using the Ausfuhr Und Abnehmerbescheinigung

Examples of using the Ausfuhr und Abnehmerbescheinigung include scenarios where a U.S. company exports machinery to a buyer in Canada. In this case, the company would complete the form to document the export and claim a sales tax exemption. Another example is a business exporting textiles to Europe, where the form helps in complying with both U.S. and European tax regulations. These examples illustrate the importance of the document in facilitating international trade.

Quick guide on how to complete ausfuhr und abnehmerbescheinigung

Complete Ausfuhr Und Abnehmerbescheinigung effortlessly on every device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without delays. Manage Ausfuhr Und Abnehmerbescheinigung on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The easiest way to modify and eSign Ausfuhr Und Abnehmerbescheinigung without effort

- Obtain Ausfuhr Und Abnehmerbescheinigung and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for such tasks.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your edits.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Ausfuhr Und Abnehmerbescheinigung and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ausfuhr und abnehmerbescheinigung

Create this form in 5 minutes!

How to create an eSignature for the ausfuhr und abnehmerbescheinigung

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Ausfuhr und Abnehmerbescheinigung?

An Ausfuhr und Abnehmerbescheinigung is a crucial document for businesses involved in exporting goods. This certificate verifies the recipient of the goods and serves as proof that the shipment meets export regulations. Understanding its importance can streamline your export processes.

-

How can airSlate SignNow help with obtaining the Ausfuhr und Abnehmerbescheinigung?

With airSlate SignNow, you can easily create and manage your Ausfuhr und Abnehmerbescheinigung digitally. The platform simplifies document generation, allowing you to quickly fill out necessary information and send it for eSignature. This reduces turnaround time and enhances your operational efficiency.

-

Is airSlate SignNow cost-effective for managing the Ausfuhr und Abnehmerbescheinigung?

Yes, airSlate SignNow offers a cost-effective solution for managing your Ausfuhr und Abnehmerbescheinigung. With various pricing plans to choose from, you can select one that fits your business needs without breaking the bank. This helps you save money while ensuring compliance with export documentation requirements.

-

What features does airSlate SignNow offer for the Ausfuhr und Abnehmerbescheinigung?

airSlate SignNow includes features such as customizable templates for the Ausfuhr und Abnehmerbescheinigung, electronic signatures, and document tracking. These features enhance the capability to streamline the signing process and maintain compliance with export regulations. This ensures your business operations are both smooth and legally sound.

-

Can I integrate airSlate SignNow with other software for managing the Ausfuhr und Abnehmerbescheinigung?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications. This allows you to connect your existing tools easily, making the management of the Ausfuhr und Abnehmerbescheinigung even more efficient and enhancing overall productivity.

-

How secure is the process of signing the Ausfuhr und Abnehmerbescheinigung with airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform incorporates advanced encryption and compliance measures to ensure that your Ausfuhr und Abnehmerbescheinigung is protected throughout the signing process. You can trust that your sensitive information is in safe hands.

-

What benefits does using airSlate SignNow provide for businesses handling Ausfuhr und Abnehmerbescheinigung?

Using airSlate SignNow benefits businesses by making document management easier, faster, and compliant with regulations. You can reduce paperwork, minimize delays, and enhance collaboration among stakeholders when handling the Ausfuhr und Abnehmerbescheinigung. This leads to improved operational efficiency.

Get more for Ausfuhr Und Abnehmerbescheinigung

Find out other Ausfuhr Und Abnehmerbescheinigung

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT