Printable Tax Exempt Form for Wisconsin

What is the printable tax exempt form for Wisconsin

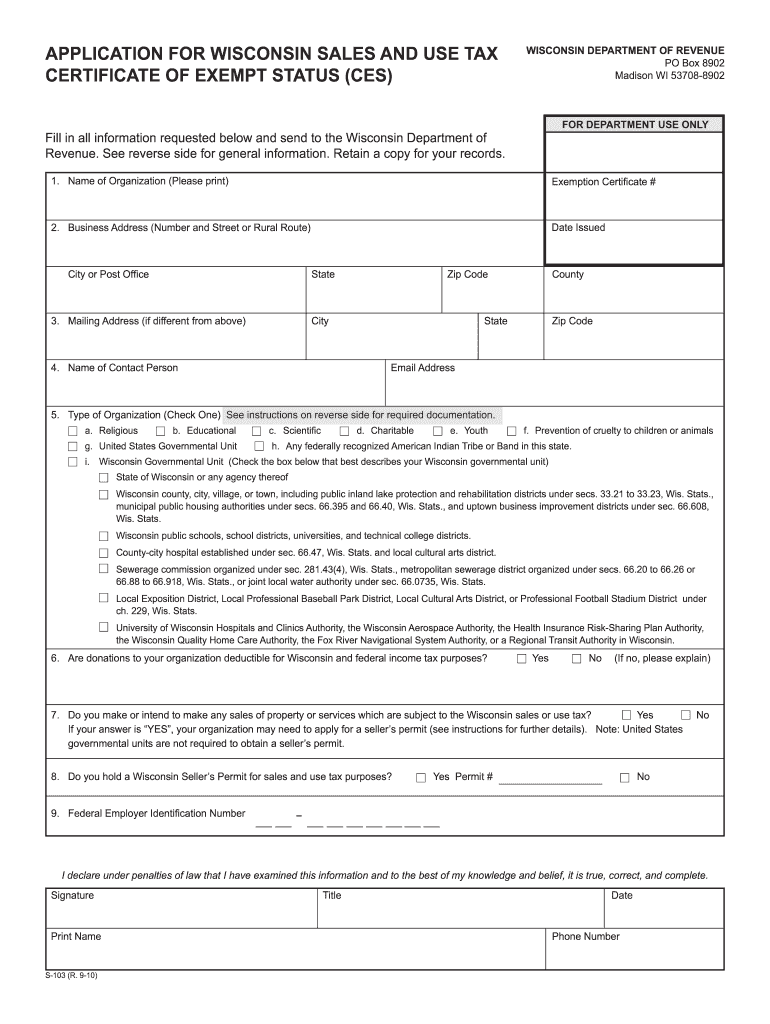

The printable tax exempt form for Wisconsin is a document that allows certain organizations and individuals to claim exemption from sales and use taxes. This form is essential for qualifying entities, such as non-profit organizations, governmental units, and certain educational institutions, to avoid paying sales tax on eligible purchases. By submitting this form, the purchaser certifies that the items being bought are intended for exempt purposes, thus ensuring compliance with Wisconsin tax regulations.

How to use the printable tax exempt form for Wisconsin

Using the printable tax exempt form for Wisconsin involves a few straightforward steps. First, ensure that you are eligible to use the form based on your organization type or purpose of purchase. Next, download and print the form. Fill in the required information, including the purchaser’s name, address, and the nature of the exemption. Finally, present the completed form to the seller at the time of purchase to avoid sales tax charges. It is important to keep a copy of the form for your records.

Steps to complete the printable tax exempt form for Wisconsin

Completing the printable tax exempt form for Wisconsin requires careful attention to detail. Follow these steps:

- Download the form from a reliable source.

- Fill in the name and address of the purchaser accurately.

- Indicate the type of exemption being claimed, such as for a non-profit organization.

- Provide a description of the items being purchased.

- Sign and date the form to validate it.

After completing the form, present it to the seller to ensure that the purchase is exempt from sales tax.

Legal use of the printable tax exempt form for Wisconsin

The legal use of the printable tax exempt form for Wisconsin is governed by state tax laws. To be considered valid, the form must be filled out completely and accurately. The purchaser must also ensure that the items purchased are indeed eligible for exemption under Wisconsin law. Misuse of the form or providing false information can lead to penalties, including fines and back taxes. Therefore, it is crucial to understand the specific requirements and to use the form in accordance with state regulations.

Key elements of the printable tax exempt form for Wisconsin

The key elements of the printable tax exempt form for Wisconsin include:

- Purchaser Information: Name and address of the organization or individual claiming the exemption.

- Exemption Type: A clear indication of the reason for tax exemption, such as non-profit status.

- Item Description: Details about the items being purchased that qualify for the exemption.

- Signature: The signature of an authorized representative of the purchasing entity, along with the date.

These elements ensure that the form is complete and valid for tax exemption purposes.

Who issues the form

The printable tax exempt form for Wisconsin is issued by the Wisconsin Department of Revenue. This governmental body is responsible for overseeing tax regulations and ensuring compliance with state tax laws. Organizations and individuals seeking to use the form must adhere to the guidelines set forth by the Department of Revenue to ensure proper use and acceptance of the form during transactions.

Quick guide on how to complete printable tax exempt form for wisconsin

Accomplish Printable Tax Exempt Form For Wisconsin effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Printable Tax Exempt Form For Wisconsin on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to alter and electronically sign Printable Tax Exempt Form For Wisconsin without hassle

- Obtain Printable Tax Exempt Form For Wisconsin and click Get Form to commence.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent parts of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or disorganized files, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice.Alter and electronically sign Printable Tax Exempt Form For Wisconsin and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable tax exempt form for wisconsin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a WI tax exempt form?

The WI tax exempt form allows eligible organizations in Wisconsin to make purchases without paying sales tax. This form is crucial for non-profits, government entities, and other qualifying groups. Using the WI tax exempt form helps save money and streamline purchasing processes.

-

How can airSlate SignNow help with the WI tax exempt form?

airSlate SignNow offers a seamless way to create, send, and eSign your WI tax exempt form securely online. Our platform simplifies the document management process, ensuring that your tax exempt forms are efficiently handled. With airSlate SignNow, you can track and store your forms in one place.

-

Is there a cost associated with using airSlate SignNow for the WI tax exempt form?

While airSlate SignNow offers various pricing plans, creating and managing your WI tax exempt form is cost-effective. We provide flexible plans to suit businesses of all sizes, ensuring you can eSign documents without breaking the bank. Explore our plans to find one that fits your needs.

-

What features does airSlate SignNow offer for managing tax exempt forms?

airSlate SignNow includes features such as templates, customizable fields, and real-time document tracking which are perfect for managing your WI tax exempt form. You can easily edit forms, track eSignature status, and access documents from anywhere. These features enhance productivity and organization.

-

Can I integrate airSlate SignNow with other applications for managing my WI tax exempt form?

Yes, airSlate SignNow can be integrated with various applications, allowing you to manage your WI tax exempt form more efficiently. Integrations with tools like Google Drive, Salesforce, and more help to create a streamlined workflow. This adaptability ensures you have access to all your necessary documents.

-

What are the benefits of using an electronic WI tax exempt form over a paper version?

Using an electronic WI tax exempt form with airSlate SignNow speeds up the entire process from creation to eSignature. It reduces errors associated with manual entries, saves time on processing, and provides an eco-friendly solution. Plus, you can access your documents anytime, anywhere.

-

Is airSlate SignNow compliant with legal standards for the WI tax exempt form?

Yes, airSlate SignNow ensures that all eSigned documents, including the WI tax exempt form, comply with legal standards. Our platform adheres to electronic signature laws, providing you with a legally binding way to manage your documents. Trust us for secure and compliant document solutions.

Get more for Printable Tax Exempt Form For Wisconsin

Find out other Printable Tax Exempt Form For Wisconsin

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed