Jt 1 Form 2015

What is the Jt 1 Form

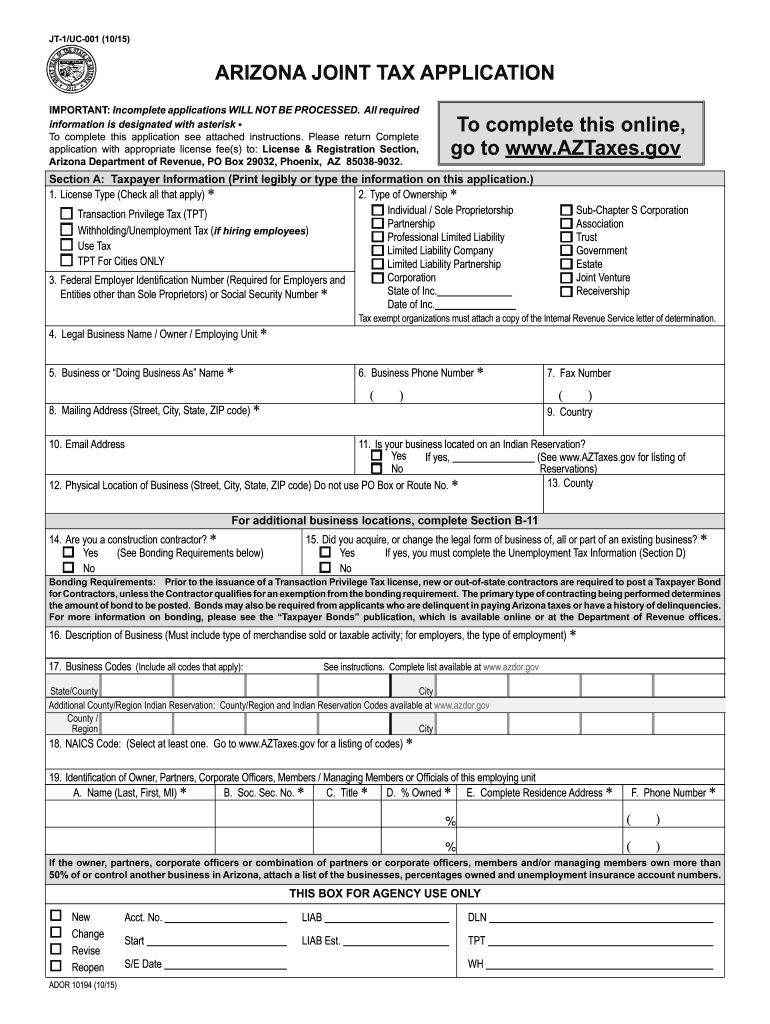

The Jt 1 Form is a specific document used primarily for tax reporting purposes in the United States. It serves as a means for individuals and businesses to report income, deductions, and other relevant financial information to the Internal Revenue Service (IRS). This form is particularly important for ensuring compliance with federal tax regulations and is designed to facilitate accurate reporting.

How to use the Jt 1 Form

Using the Jt 1 Form involves several steps to ensure that all necessary information is accurately reported. Begin by gathering all relevant financial documents, including income statements and receipts for deductions. Once you have this information, carefully fill out the form, ensuring that each section is completed according to IRS guidelines. After completing the form, review it for accuracy before submitting it to the IRS. Utilizing eSignature solutions can streamline this process, allowing for a secure and efficient submission.

Steps to complete the Jt 1 Form

Completing the Jt 1 Form requires attention to detail and adherence to specific guidelines. Follow these steps:

- Gather necessary documents, including income statements and deduction records.

- Access the Jt 1 Form online or through a tax preparation software.

- Fill out the form, ensuring all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, depending on your submission method.

- Submit the form to the IRS by the designated deadline.

Legal use of the Jt 1 Form

The Jt 1 Form must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to submission deadlines and providing accurate information. Failure to comply with these requirements can result in penalties or delays in processing. It is important to understand the legal implications of submitting this form, as it is a binding document that can affect your tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Jt 1 Form vary based on the specific tax year and the individual's circumstances. Generally, the form must be submitted by April 15 of the following year for individual taxpayers. However, extensions may be available under certain conditions. It is essential to stay informed about these deadlines to avoid penalties and ensure timely processing of your tax return.

Required Documents

To complete the Jt 1 Form accurately, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is included.

Form Submission Methods (Online / Mail / In-Person)

The Jt 1 Form can be submitted through various methods, depending on your preference and circumstances. Options include:

- Online submission through IRS-approved e-filing software.

- Mailing a paper copy to the appropriate IRS address.

- In-person submission at designated IRS offices during tax season.

Each method has its own advantages, such as speed for online submissions and personal assistance for in-person visits.

Quick guide on how to complete jt 1 2015 form

Your assistance manual on how to prepare your Jt 1 Form

If you’re unsure how to create and submit your Jt 1 Form, here are some concise instructions to simplify the tax submission process.

To get started, you simply need to register your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is an incredibly straightforward and powerful document solution that enables you to edit, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and return to amend responses as necessary. Optimize your tax administration with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow these steps to complete your Jt 1 Form in a matter of minutes:

- Create your account and begin working on PDFs swiftly.

- Utilize our catalog to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to launch your Jt 1 Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please remember that filing on paper might elevate the chances of errors and postpone refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct jt 1 2015 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the jt 1 2015 form

How to make an electronic signature for the Jt 1 2015 Form online

How to generate an eSignature for the Jt 1 2015 Form in Google Chrome

How to create an eSignature for signing the Jt 1 2015 Form in Gmail

How to create an eSignature for the Jt 1 2015 Form from your smartphone

How to create an eSignature for the Jt 1 2015 Form on iOS

How to create an eSignature for the Jt 1 2015 Form on Android

People also ask

-

What is the Jt 1 Form, and how does it work?

The Jt 1 Form is a crucial document used for reporting income in various professional settings. airSlate SignNow enables users to complete, sign, and send the Jt 1 Form effortlessly, ensuring streamlined document management and compliance. With an easy-to-use interface, you can digitally fill out and submit the Jt 1 Form quickly.

-

Is airSlate SignNow affordable for managing Jt 1 Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Jt 1 Forms and other documents. Our pricing plans are designed to accommodate businesses of all sizes, providing excellent value for comprehensive signing and document management features. You can choose a plan that best suits your needs without breaking the bank.

-

What are the key features of airSlate SignNow for Jt 1 Forms?

airSlate SignNow provides a variety of features tailored to enhance the experience of filling out Jt 1 Forms. These include templates for easy and quick document creation, automated reminders for signers, and secure storage options. Our platform ensures that your Jt 1 Forms are processed efficiently and safely.

-

How can airSlate SignNow improve my workflow when dealing with Jt 1 Forms?

Using airSlate SignNow can signNowly enhance your workflow by automating the signing process of Jt 1 Forms. With features like real-time tracking, teams can see the status of their documents instantly, reducing bottlenecks and improving overall efficiency. This streamlined approach saves time and ensures timely submissions of essential forms.

-

Does airSlate SignNow integrate with other applications for Jt 1 Form management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing for smooth management of Jt 1 Forms alongside your existing tools. These integrations facilitate enhanced productivity and ease of use, ensuring that your documents are part of a connected workflow. You can link it with CRM systems, cloud storage services, and more.

-

Is it secure to use airSlate SignNow for signing Jt 1 Forms?

Yes, security is a top priority at airSlate SignNow when it comes to handling Jt 1 Forms. Our platform employs industry-standard encryption protocols, ensuring that your documents and data remain safe. With features like two-factor authentication and secure storage, you can confidently manage your Jt 1 Forms without worrying about unauthorized access.

-

Can I track the status of my Jt 1 Forms in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Jt 1 Forms in real time. You will receive notifications regarding when the document is viewed, signed, or completed, so you always know where your paperwork stands. This tracking feature enhances accountability and ensures timely follow-ups.

Get more for Jt 1 Form

- Mmr declination form

- Denneroll time chart form

- Halstead international form

- Cell membrane coloring worksheet pdf form

- Brevard county subcontractor authorization form

- Mbsa borang online form

- Kappa psi omega chapter alpha kappa alpha sorority inc home form

- Policy surrender full withdrawal 8 25 16 axa com ph axa com form

Find out other Jt 1 Form

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA