Arizona Joint Tax Application Jt 1 2019

What is the Arizona Joint Tax Application JT 1

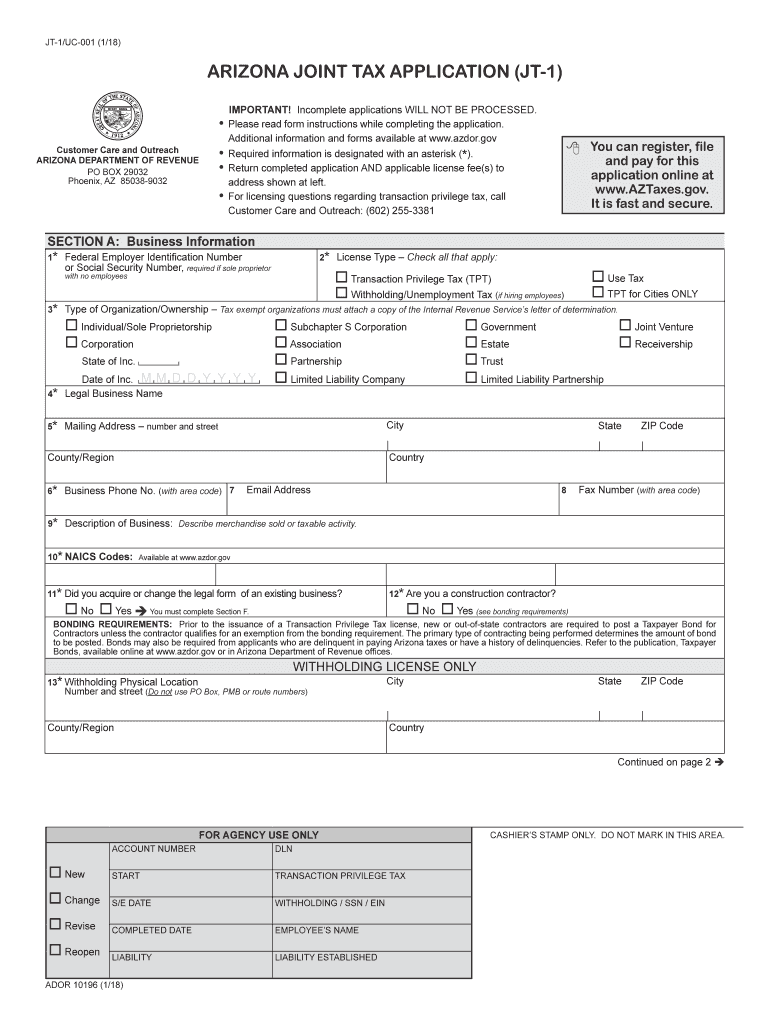

The Arizona Joint Tax Application, commonly referred to as JT 1, is a form used by couples who wish to file their state taxes jointly in Arizona. This application allows both spouses to report their combined income and deductions, potentially benefiting from lower tax rates and higher deductions. The JT 1 form is crucial for ensuring that both parties are recognized as a single tax entity, which can simplify the tax filing process and improve overall tax efficiency.

How to use the Arizona Joint Tax Application JT 1

Using the Arizona Joint Tax Application involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, access the JT 1 form, which can be filled out online or printed for manual completion. Ensure that both spouses provide their personal information, including Social Security numbers, and accurately report all income and deductions. Once completed, review the form for accuracy before submitting it to the Arizona Department of Revenue.

Steps to complete the Arizona Joint Tax Application JT 1

Completing the Arizona Joint Tax Application JT 1 requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, such as income statements and previous tax returns.

- Access the JT 1 form online or obtain a physical copy.

- Fill in both spouses' personal information, including names, addresses, and Social Security numbers.

- Report all sources of income, including wages, interest, and dividends.

- List all applicable deductions and credits that may apply to your joint filing.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail to the Arizona Department of Revenue.

Legal use of the Arizona Joint Tax Application JT 1

The Arizona Joint Tax Application JT 1 is legally recognized as a valid method for couples to file their state taxes. To ensure its legal standing, both spouses must sign the application, either electronically or in writing. The form must be submitted within the designated filing period to avoid penalties. Compliance with state tax laws is essential, as failure to properly file can result in legal repercussions and financial penalties.

Required Documents

When completing the Arizona Joint Tax Application JT 1, several documents are required to ensure accurate reporting and compliance:

- W-2 forms from employers for both spouses

- 1099 forms for any additional income sources

- Records of any deductions or credits claimed

- Previous tax returns for reference

- Any supporting documentation for specific deductions, such as mortgage interest statements

Form Submission Methods

The Arizona Joint Tax Application JT 1 can be submitted through various methods to accommodate different preferences:

- Online: Complete and submit the form electronically through the Arizona Department of Revenue website.

- By Mail: Print the completed form and send it to the appropriate address provided by the Department of Revenue.

- In-Person: Visit a local Department of Revenue office to submit the form directly.

Eligibility Criteria

To file using the Arizona Joint Tax Application JT 1, couples must meet specific eligibility criteria. Both spouses must agree to file jointly, and they should not be legally separated or divorced at the time of filing. Additionally, both parties must report all income earned during the tax year, regardless of whether it was earned individually or jointly. It is important to review any specific guidelines provided by the Arizona Department of Revenue to ensure compliance with state regulations.

Quick guide on how to complete jt 1uc 001 118

Effortlessly Prepare Arizona Joint Tax Application Jt 1 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly, without delays. Handle Arizona Joint Tax Application Jt 1 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and Electronically Sign Arizona Joint Tax Application Jt 1 with Ease

- Obtain Arizona Joint Tax Application Jt 1 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Bid farewell to lost or misplaced files, tedious form searching, and errors that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Arizona Joint Tax Application Jt 1 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct jt 1uc 001 118

Create this form in 5 minutes!

How to create an eSignature for the jt 1uc 001 118

How to make an eSignature for your Jt 1uc 001 118 online

How to create an eSignature for your Jt 1uc 001 118 in Google Chrome

How to make an electronic signature for putting it on the Jt 1uc 001 118 in Gmail

How to create an eSignature for the Jt 1uc 001 118 from your smart phone

How to make an eSignature for the Jt 1uc 001 118 on iOS devices

How to generate an eSignature for the Jt 1uc 001 118 on Android devices

People also ask

-

What is the Arizona joint tax application?

The Arizona joint tax application is a form used by couples who wish to file their state taxes jointly. By completing the Arizona joint tax application, couples can benefit from various tax breaks and potentially lower their overall tax liability. Understanding how to correctly fill out this application is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the Arizona joint tax application?

airSlate SignNow provides an efficient platform to complete and eSign your Arizona joint tax application while ensuring compliance with state regulations. Its user-friendly interface allows couples to collaborate seamlessly, reducing the time spent on paperwork. You can easily send, sign, and store your application securely online.

-

What are the pricing options for airSlate SignNow when using it for the Arizona joint tax application?

airSlate SignNow offers flexible pricing plans that cater to both individual users and businesses. Depending on your needs, the pricing is designed to be cost-effective, especially when managing documents like the Arizona joint tax application. There are also options for yearly subscriptions that provide additional discounts.

-

What features does airSlate SignNow offer for the Arizona joint tax application?

When using airSlate SignNow for the Arizona joint tax application, you can access features such as customizable templates, in-person signing, and automated workflows. These tools help simplify the signing process, enabling you to complete your application quickly and efficiently. Additionally, cloud storage options keep your documents secure and accessible.

-

Is airSlate SignNow secure for filing the Arizona joint tax application?

Yes, airSlate SignNow employs advanced security measures to ensure that your Arizona joint tax application and other documents are protected. With strong encryption and compliance with industry standards, you can trust that your sensitive tax information remains confidential. The platform also provides audit trails to track changes and access.

-

Can I integrate airSlate SignNow with other software for my Arizona joint tax application?

Absolutely! airSlate SignNow integrates with various applications and platforms, enhancing the user experience when managing the Arizona joint tax application. You can connect it with popular accounting and tax software to streamline your workflow and make filing taxes more efficient.

-

What benefits can I expect from using airSlate SignNow for my Arizona joint tax application?

Using airSlate SignNow for your Arizona joint tax application offers numerous benefits such as saving time, reducing paperwork, and improving accuracy. The ability to eSign documents remotely allows you to manage your application conveniently from anywhere. Moreover, its collaborative features enable you and your partner to work together seamlessly.

Get more for Arizona Joint Tax Application Jt 1

- T shirt hoodie order form

- New jamestown lp candlestick heights tenant income certification questionnaire one form per adult member of the household

- Massage therapy minor consent form

- Craniosacral therapy client information form your energy fix

- Traveler profile form

- Early testing exam application american health information ahima

- Chicago association of realtors lead based paint form

- Example of a divorce motion document in michigan form

Find out other Arizona Joint Tax Application Jt 1

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney