Az Joint Tax Application 2022-2026

What is the Arizona Joint Tax Application?

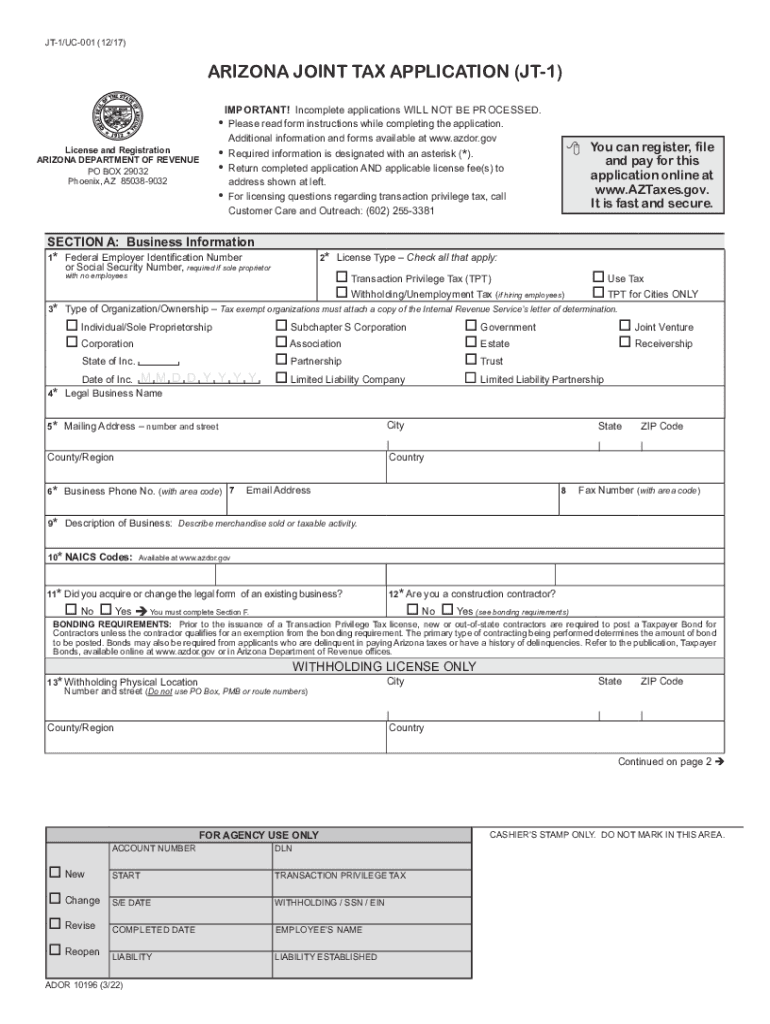

The Arizona Joint Tax Application, often referred to as the JT-1 application, is a crucial form for couples filing their state taxes jointly in Arizona. This application allows taxpayers to combine their incomes and deductions, potentially leading to a lower overall tax liability. The form is designed to streamline the filing process for married couples, making it easier to report income and claim credits or deductions available to joint filers. Understanding this application is essential for ensuring compliance with Arizona tax laws and maximizing potential benefits.

Steps to Complete the Arizona Joint Tax Application

Completing the Arizona Joint Tax Application involves several key steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather necessary documents, including W-2s, 1099s, and any other income statements for both spouses.

- Determine eligibility for joint filing, ensuring both parties meet the requirements set by the Arizona Department of Revenue.

- Fill out the JT-1 application form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions before submission.

- Submit the application either online, by mail, or in person, following the guidelines provided by the Arizona Department of Revenue.

Legal Use of the Arizona Joint Tax Application

The legal validity of the Arizona Joint Tax Application hinges on compliance with state tax regulations. To ensure that the form is legally binding, it must be filled out correctly and submitted by the applicable deadlines. Additionally, electronic submissions are accepted, provided they adhere to the requirements set forth by the Arizona Department of Revenue. Utilizing a reliable eSignature solution can further enhance the legal standing of the application, as it provides the necessary authentication and security measures.

Required Documents for the Arizona Joint Tax Application

When preparing to complete the Arizona Joint Tax Application, several documents are essential to ensure a smooth filing process. These include:

- W-2 forms from employers for both spouses.

- 1099 forms for any additional income sources.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return, if available, for reference.

- Any other relevant financial documents that support your income and deductions.

Form Submission Methods for the Arizona Joint Tax Application

Submitting the Arizona Joint Tax Application can be done through various methods, allowing taxpayers flexibility in how they file. The available submission methods include:

- Online: Use the Arizona Department of Revenue's online portal for electronic submission.

- Mail: Send the completed form to the designated address provided by the state.

- In-Person: Visit a local Arizona Department of Revenue office to submit the application directly.

Filing Deadlines for the Arizona Joint Tax Application

Awareness of filing deadlines is crucial for avoiding penalties and ensuring timely submission of the Arizona Joint Tax Application. Typically, the deadline for filing state taxes in Arizona aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and ensure they file within the specified timeframe to maintain compliance.

Quick guide on how to complete az joint tax application

Complete Az Joint Tax Application effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and electronically sign your documents quickly and without interruptions. Handle Az Joint Tax Application on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Az Joint Tax Application with ease

- Obtain Az Joint Tax Application and click on Get Form to begin.

- Take advantage of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Az Joint Tax Application to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct az joint tax application

Create this form in 5 minutes!

People also ask

-

What is the Arizona joint tax application?

The Arizona joint tax application is a form that couples must complete to file taxes jointly in Arizona. It simplifies the process of reporting income and claiming deductions for married couples. Using tools like airSlate SignNow, you can easily eSign and submit your Arizona joint tax application electronically.

-

How can airSlate SignNow help with my Arizona joint tax application?

airSlate SignNow allows you to send, eSign, and manage your Arizona joint tax application effortlessly. Our platform provides an intuitive interface that streamlines document workflows, making it easy for both spouses to review and sign. This quickens the tax filing process, ensuring you meet all deadlines.

-

What are the costs associated with using airSlate SignNow for tax applications?

airSlate SignNow offers competitive pricing plans to accommodate various needs, including those for filing the Arizona joint tax application. Our pricing is transparent, and you can choose a plan that best fits your usage frequency and document management requirements. Enjoy the benefits of our services without hidden fees.

-

Are there any integrations available for airSlate SignNow when filing an Arizona joint tax application?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, allowing you to enhance your experience while handling your Arizona joint tax application. These integrations help you keep all your documents organized and easily accessible. Connect with your favorite apps to streamline your workflow.

-

What features does airSlate SignNow offer for managing my Arizona joint tax application?

airSlate SignNow includes features such as customizable templates, document tracking, and secure eSign capabilities to simplify your Arizona joint tax application process. You can easily set reminders for signatures and collaborate with your spouse in real-time. These features ensure that your filing is efficient and compliant.

-

Is airSlate SignNow secure for submitting sensitive tax documents like the Arizona joint tax application?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure storage, to protect your sensitive tax documents such as the Arizona joint tax application. You can trust that your information remains confidential and protected throughout the entire signing process.

-

What are the benefits of using airSlate SignNow for tax applications like the Arizona joint tax application?

Using airSlate SignNow for your Arizona joint tax application offers numerous benefits, including enhanced efficiency and reduced paperwork. The platform's user-friendly design allows for quick completion and signing of documents, saving you time. Furthermore, our cost-effective solutions can help you manage tax-related tasks seamlessly.

Get more for Az Joint Tax Application

Find out other Az Joint Tax Application

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now