Menards Tax Exempt Form

What is the Menards Tax Exempt

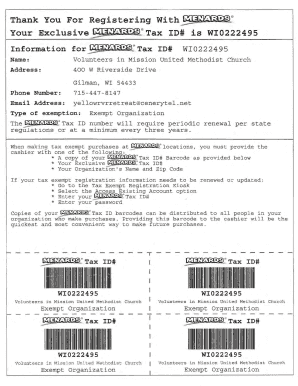

The Menards tax exempt status allows eligible customers to make purchases without paying sales tax. This exemption is typically granted to organizations such as non-profits, government entities, and certain educational institutions. By obtaining a tax exempt status, these organizations can save money on purchases made at Menards, which can be particularly beneficial for budget-conscious entities.

How to obtain the Menards Tax Exempt

To obtain tax exempt status at Menards, eligible customers must complete a tax exempt application. This process usually involves providing documentation that verifies the organization's tax-exempt status, such as a letter from the IRS or a state-issued exemption certificate. Once the application is submitted and approved, customers can create a Menards tax exempt account to streamline future purchases.

Steps to complete the Menards Tax Exempt

Completing the Menards tax exempt process involves several key steps:

- Gather necessary documentation, including proof of tax-exempt status.

- Fill out the Menards tax exempt application form accurately.

- Submit the application either online or in person at a Menards location.

- Wait for confirmation of approval from Menards, which may take a few business days.

- Once approved, log in to your Menards tax exempt account to make tax-free purchases.

Legal use of the Menards Tax Exempt

The legal use of the Menards tax exempt status requires adherence to specific guidelines. Customers must ensure that their purchases align with the purposes outlined in their tax-exempt status. Misuse of the tax exempt status, such as using it for personal purchases or items not covered under the exemption, can lead to penalties and loss of tax exempt privileges.

Key elements of the Menards Tax Exempt

Several key elements define the Menards tax exempt process:

- Eligibility criteria, which typically include being a non-profit organization, government agency, or educational institution.

- Required documentation to prove tax-exempt status.

- The application process, which may vary by state and organization type.

- Account management, allowing users to track purchases and maintain their tax exempt status.

Examples of using the Menards Tax Exempt

Examples of using the Menards tax exempt status include:

- A non-profit organization purchasing supplies for community projects.

- A school district acquiring materials for educational programs.

- A government agency buying equipment for public services.

Quick guide on how to complete menards tax exempt

Effortlessly Prepare Menards Tax Exempt on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and store it securely online. airSlate SignNow provides you with all the resources required to create, amend, and electronically sign your documents swiftly without any delays. Manage Menards Tax Exempt on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign Menards Tax Exempt With Ease

- Find Menards Tax Exempt and click Get Form to begin.

- Utilize the tools available to complete your document.

- Mark important sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet-ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you prefer to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you opt for. Modify and electronically sign Menards Tax Exempt and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the menards tax exempt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for applying for menards tax exempt status?

To apply for menards tax exempt status, you need to fill out the appropriate tax-exempt form and provide any required documentation. Once your application is submitted, it typically takes a few business days to process. Receiving menards tax exempt status allows you to make purchases without being charged sales tax, which can lead to signNow savings for your business.

-

How does airSlate SignNow help with menards tax exempt documentation?

airSlate SignNow enables you to easily create, send, and eSign the necessary tax exempt documentation for Menards. With our platform, you can streamline the entire process, ensuring that your menards tax exempt forms are properly filled out and quickly approved. This can help you manage purchases more efficiently and avoid any tax-related issues.

-

Are there any fees associated with the menards tax exempt process?

Generally, obtaining menards tax exempt status does not involve any fees from Menards directly. However, businesses may incur charges if they require legal assistance to prepare their tax exemption documentation. Utilizing airSlate SignNow can help you save on potential costs by simplifying your documentation needs for tax exemption.

-

Can I use airSlate SignNow for other tax exempt purchases besides Menards?

Yes, airSlate SignNow can be utilized for managing tax exempt documentation for various vendors beyond Menards. Our platform is flexible and allows you to create tax-exempt forms tailored to different requirements. This versatility can enhance your purchasing processes and help you effectively manage your menards tax exempt documentation alongside others.

-

What are the benefits of getting menards tax exempt status?

Obtaining menards tax exempt status allows your business to save money by avoiding sales tax on qualifying purchases. This can contribute to larger overall savings, especially for frequent buyers. With effective management through airSlate SignNow, you can ensure that all your transactions remain compliant while maximizing benefits.

-

How can I integrate my menards tax exempt status with airSlate SignNow?

To integrate your menards tax exempt status with airSlate SignNow, you simply need to set up your account and customize your document templates to include the relevant tax exemption information. Our platform supports easy data uploads and template creation that meets your menards tax exempt needs. With our user-friendly interface, managing integrations becomes seamless.

-

Is airSlate SignNow suitable for large organizations managing multiple menards tax exempt accounts?

Absolutely! airSlate SignNow is designed to support large organizations and can handle multiple menards tax exempt accounts efficiently. Our platform offers robust features for team collaboration, ensuring that all relevant staff members can access and manage tax exemption documentation easily. This centralized management is key for larger entities maintaining tax exempt statuses.

Get more for Menards Tax Exempt

Find out other Menards Tax Exempt

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors