Form At3 51

What is the Form AT3 51

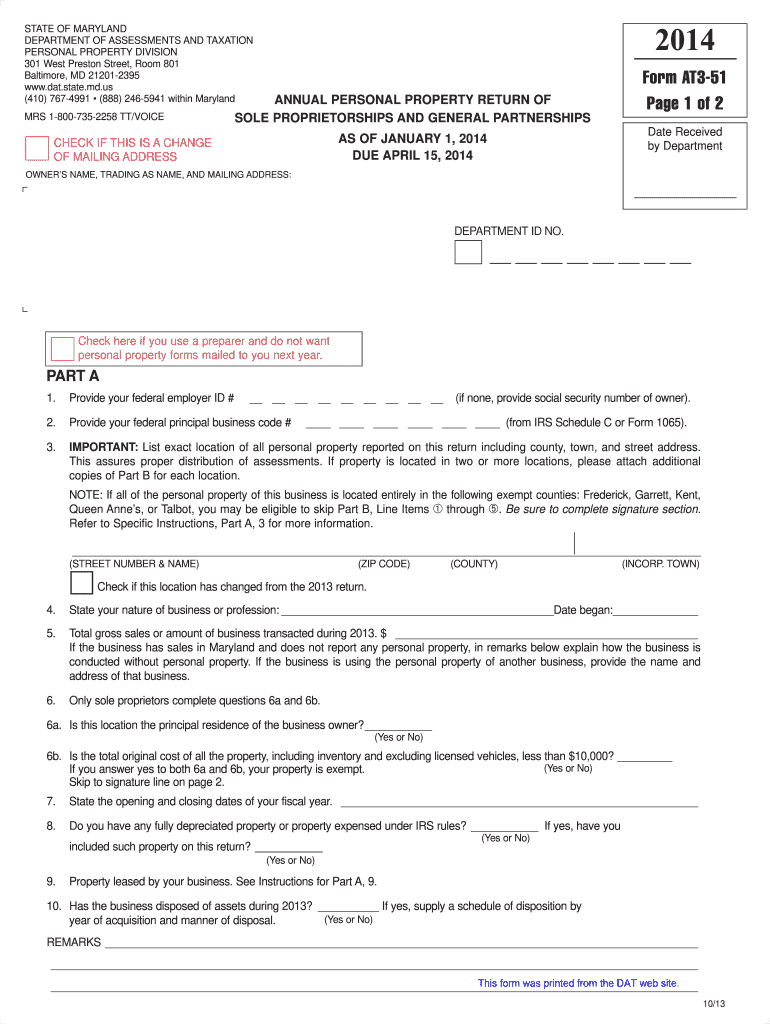

The 2018 Form AT3 51 is a specific document used in the state of Maryland, primarily for tax purposes. This form is utilized by businesses and individuals to report certain types of income or transactions to the Maryland state government. Understanding the purpose and requirements of this form is crucial for compliance with state tax laws.

How to Use the Form AT3 51

Using the 2018 Form AT3 51 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to the income or transactions you are reporting. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, you can submit it either online or via traditional mail, depending on your preference and the guidelines provided by the Maryland state tax authority.

Steps to Complete the Form AT3 51

Completing the 2018 Form AT3 51 requires attention to detail. Here are the steps to follow:

- Review the form instructions carefully to understand the information required.

- Gather supporting documents, such as income statements or transaction records.

- Fill in your personal and financial information accurately.

- Double-check all entries for errors or omissions.

- Submit the completed form according to the preferred submission method.

Legal Use of the Form AT3 51

The 2018 Form AT3 51 is legally binding when filled out correctly and submitted in accordance with Maryland state laws. It is important to adhere to the guidelines set forth by the state to avoid penalties. E-signatures are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations.

Filing Deadlines / Important Dates

Timely submission of the 2018 Form AT3 51 is essential to avoid penalties. The filing deadline typically aligns with the Maryland tax filing schedule. It is advisable to check the Maryland state tax website for specific dates each year, as they may vary. Marking these dates on your calendar can help ensure compliance.

Required Documents

To successfully complete the 2018 Form AT3 51, you will need several documents, including:

- Income statements relevant to the reporting period.

- Transaction records that support the information reported on the form.

- Any previous tax documents that may be necessary for reference.

Form Submission Methods (Online / Mail / In-Person)

The 2018 Form AT3 51 can be submitted through various methods, providing flexibility for users. You may choose to file online through the Maryland state tax portal, which often allows for quicker processing. Alternatively, you can mail the completed form to the appropriate state office or submit it in person at designated locations. Each method has its own processing times and requirements, so selecting the one that best suits your needs is important.

Quick guide on how to complete form at3 51

Complete Form At3 51 easily on any device

Online document management has gained popularity among businesses and individuals. It presents a perfect eco-friendly alternative to conventional printed and signed documents, as you can find the suitable form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Form At3 51 on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Form At3 51 effortlessly

- Find Form At3 51 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign Form At3 51 and ensure excellent communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form at3 51

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 form at3 51 and why do I need it?

The 2018 form at3 51 is a crucial document used for specific tax-related purposes. It simplifies the reporting of financial information, ensuring compliance with guidelines. Using airSlate SignNow, you can eSign and send this form quickly, streamlining your submission process.

-

How can airSlate SignNow help me with the 2018 form at3 51?

With airSlate SignNow, you can easily prepare and eSign the 2018 form at3 51 online. Our platform provides a user-friendly interface that allows you to manage all your document needs efficiently. Plus, you can track your document status in real-time.

-

Is there a cost associated with using airSlate SignNow for the 2018 form at3 51?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, including those who need to handle the 2018 form at3 51. Our cost-effective solution ensures you only pay for what you use, maximizing your investment. Check our website for detailed pricing information and plan options.

-

What features does airSlate SignNow offer to assist with the 2018 form at3 51?

AirSlate SignNow provides several features to assist with the 2018 form at3 51, including customizable templates, eSigning capabilities, and real-time tracking. These features help streamline the process and enhance productivity for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other software for the 2018 form at3 51?

Yes, airSlate SignNow seamlessly integrates with various software solutions, making it easier to manage the 2018 form at3 51 alongside your existing tools. This integration can help automate workflows and improve efficiency, enabling better document management.

-

Is airSlate SignNow secure for handling the 2018 form at3 51?

Absolutely! AirSlate SignNow prioritizes security and complies with industry standards to protect your sensitive information, including details on the 2018 form at3 51. Our platform uses encryption and authentication processes to keep your documents safe.

-

How long does it take to get the 2018 form at3 51 completed using airSlate SignNow?

Completing the 2018 form at3 51 with airSlate SignNow is typically a swift process. With our intuitive interface and eSigning features, you can prepare and send this form in minutes, drastically reducing the time it takes compared to traditional methods.

Get more for Form At3 51

- Of compensation g form

- Nurses section referral formnorth carolina forms workflow

- The use of this form is required under the provisions of

- Form 28b nc industrial commission ncgov

- Report of employer or carrieradministrator of form

- Gs97 181b and gs97 321 nc industrial form

- What is a form 28u in north carolina workers compensation

- Form 19 compensation claims solutions

Find out other Form At3 51

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document