Ga Form 500 Ez

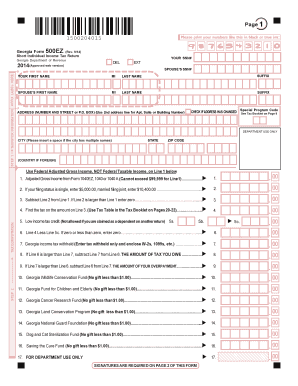

What is the GA Form 500 EZ?

The GA Form 500 EZ is a simplified income tax return form designed for eligible Georgia residents. This form is primarily used by individuals who have a straightforward tax situation, such as those who do not claim dependents and have limited income sources. The 500 EZ form streamlines the filing process, allowing taxpayers to report their income and calculate their tax liability efficiently. It is essential for individuals to understand the specific criteria that qualify them to use this form to ensure compliance with state tax regulations.

Steps to Complete the GA Form 500 EZ

Completing the GA Form 500 EZ involves several straightforward steps:

- Gather necessary documents, including W-2s and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your income, ensuring to include all applicable sources.

- Calculate your tax liability using the provided tax tables or software.

- Sign and date the form to certify that the information is accurate.

Following these steps carefully will help ensure that the form is completed correctly and submitted on time.

How to Obtain the GA Form 500 EZ

The GA Form 500 EZ can be obtained through various channels. Taxpayers can download the form directly from the Georgia Department of Revenue's website. Additionally, physical copies may be available at local government offices or libraries. It is advisable to ensure that you are using the most current version of the form to avoid any issues during submission.

Legal Use of the GA Form 500 EZ

The GA Form 500 EZ is legally recognized for filing state income taxes in Georgia, provided that it is completed accurately and submitted within the designated filing period. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Georgia Department of Revenue. Using this form appropriately can help avoid penalties and ensure that taxpayers fulfill their legal obligations.

Eligibility Criteria for the GA Form 500 EZ

To qualify for using the GA Form 500 EZ, taxpayers must meet specific criteria. Eligible individuals typically include those with a total income below a certain threshold, individuals who do not claim any dependents, and those who do not have complex tax situations, such as multiple income sources or itemized deductions. Understanding these criteria is crucial for ensuring that the correct form is used for tax filing.

Form Submission Methods

Taxpayers can submit the GA Form 500 EZ through various methods. The most common submission methods include:

- Online: Filing electronically through the Georgia Department of Revenue’s e-filing system.

- Mail: Sending a completed paper form to the appropriate address provided by the Department of Revenue.

- In-Person: Delivering the form directly to a local Department of Revenue office.

Each method has its own advantages, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete ga form 500 ez

Complete Ga Form 500 Ez effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents quickly and seamlessly. Manage Ga Form 500 Ez on any device using airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

The simplest method to edit and eSign Ga Form 500 Ez with ease

- Locate Ga Form 500 Ez and click on Get Form to begin.

- Use the available tools to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Ga Form 500 Ez and guarantee superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ga form 500 ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 500ez?

The form 500ez is a simplified tax return form designed to make filing taxes easier for eligible individuals. By using the form 500ez, taxpayers can quickly report their income, deductions, and credits without the complexity of standard tax forms.

-

How can airSlate SignNow assist with the form 500ez?

airSlate SignNow allows users to electronically sign and send the form 500ez securely and efficiently. Our platform ensures that your documents remain legally binding and easily accessible, simplifying the overall filing process.

-

What are the pricing options for using airSlate SignNow for the form 500ez?

airSlate SignNow offers a variety of pricing plans to accommodate different user needs, starting from a free trial to more comprehensive monthly subscriptions. Each plan provides access to essential features for managing the form 500ez and other documents.

-

What features of airSlate SignNow are most beneficial for handling the form 500ez?

With airSlate SignNow, features like document templates, collaboration tools, and automatic reminders enhance the user experience when working with the form 500ez. These tools streamline the process of filling out and signing documents efficiently.

-

Can I integrate airSlate SignNow with other software for the form 500ez?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when managing the form 500ez. Popular integrations include CRM systems, project management tools, and cloud storage services to ensure your data is interconnected.

-

What are the benefits of using airSlate SignNow for the form 500ez?

Using airSlate SignNow for the form 500ez simplifies the document signing process, saves time, and reduces the likelihood of errors. Additionally, our solution enhances security by providing audit trails and encrypted storage for sensitive information.

-

Is airSlate SignNow secure for signing the form 500ez?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your documents, including the form 500ez. You can trust that your sensitive information remains safe throughout the signing process.

Get more for Ga Form 500 Ez

Find out other Ga Form 500 Ez

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself