Form Ptax 763 Illinois

What is the Form Ptax 763 Illinois

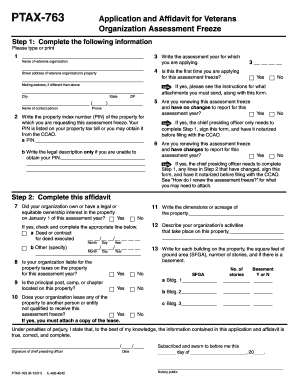

The Form Ptax 763 Illinois is a property tax exemption application specifically designed for certain types of property owners in Illinois. This form allows eligible individuals to apply for a property tax exemption based on specific criteria set forth by the state. The primary purpose of the form is to provide tax relief to qualifying property owners, thereby reducing their overall tax burden. Understanding the nuances of this form is essential for those looking to benefit from available exemptions.

How to use the Form Ptax 763 Illinois

Using the Form Ptax 763 Illinois involves several key steps to ensure proper submission and compliance with state regulations. First, applicants must obtain the form from the appropriate local government office or online resources. Once in possession of the form, it is crucial to fill it out accurately, providing all required information, such as property details and personal identification. After completing the form, applicants must submit it to the local assessor's office by the specified deadline to be considered for the exemption.

Steps to complete the Form Ptax 763 Illinois

Completing the Form Ptax 763 Illinois requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documentation, including proof of ownership and identification.

- Fill in the property details, ensuring accuracy in descriptions and addresses.

- Provide personal information, including your name and contact details.

- Review the form for completeness and accuracy before submission.

- Submit the form to your local assessor's office by the required deadline.

Key elements of the Form Ptax 763 Illinois

The Form Ptax 763 Illinois includes several key elements that applicants must understand. These elements typically encompass:

- Property identification information, including parcel number and location.

- Owner's personal information, such as name and address.

- Details regarding the type of exemption being requested.

- Signature of the applicant, affirming the accuracy of the information provided.

Legal use of the Form Ptax 763 Illinois

The legal use of the Form Ptax 763 Illinois is governed by state laws regarding property tax exemptions. To ensure that the form is legally binding, applicants must adhere to the guidelines set forth by the Illinois Department of Revenue. This includes providing truthful information and submitting the form within the designated time frame. Failure to comply with these regulations may result in denial of the exemption or potential penalties.

Form Submission Methods

The Form Ptax 763 Illinois can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local assessor's office website.

- Mailing the completed form to the appropriate office.

- In-person delivery to the local assessor's office.

Quick guide on how to complete form ptax 763 illinois

Effortlessly Prepare Form Ptax 763 Illinois on Any Device

Digital document management has become widely embraced by both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Form Ptax 763 Illinois on any device with airSlate SignNow's Android or iOS applications and enhance your document-based workflows today.

How to Edit and Electronically Sign Form Ptax 763 Illinois with Ease

- Find Form Ptax 763 Illinois and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any gadget you choose. Edit and electronically sign Form Ptax 763 Illinois and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ptax 763 illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the kane county il ptax 763 form?

The kane county il ptax 763 form is a property tax exemption application used in Kane County, Illinois. It allows property owners to apply for various exemptions on their property taxes, simplifying the process for taxpayers. Completing the kane county il ptax 763 form accurately ensures that you receive the financial benefits you're entitled to.

-

How can airSlate SignNow help with the kane county il ptax 763 process?

airSlate SignNow streamlines the submission of the kane county il ptax 763 form by enabling you to eSign and send documents electronically. This saves you time and reduces the risk of errors associated with traditional paperwork. With airSlate SignNow, completing and submitting the kane county il ptax 763 form is efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for the kane county il ptax 763?

airSlate SignNow offers cost-effective pricing plans, making it accessible for individuals and businesses needing to handle the kane county il ptax 763. The investment in using our platform can save you money in the long run by enhancing efficiency and reducing potential filing errors. Check our pricing page for specific plans related to the kane county il ptax 763 form.

-

What features does airSlate SignNow offer for handling the kane county il ptax 763?

airSlate SignNow includes a variety of features ideal for managing the kane county il ptax 763 form, such as customizable templates, secure eSignatures, and document tracking. These features facilitate an organized workflow, ensuring that your property tax exemption applications are completed accurately and responsibly. Experience a seamless way to manage the kane county il ptax 763 with our platform.

-

Can I integrate airSlate SignNow with other tools when working on the kane county il ptax 763?

Yes, airSlate SignNow supports numerous integrations with popular applications, enhancing your experience while completing the kane county il ptax 763. You can connect with tools like Google Drive, Dropbox, or your CRM for seamless document management. This integration capability simplifies the workflow and ensures that all necessary documents are readily available.

-

How secure is airSlate SignNow when processing the kane county il ptax 763?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption protocols to protect your documents, including the kane county il ptax 763 form, throughout the entire signing process. With our commitment to data security, you can confidently submit your property tax exemption application without concerns about unauthorized access.

-

Can multiple people sign the kane county il ptax 763 through airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to eSign the kane county il ptax 763 form concurrently, making it easy for all relevant parties to participate in the signing process. This feature is particularly useful for organizations where several approvals are needed before submitting the property tax exemption application. Collaborate efficiently with airSlate SignNow.

Get more for Form Ptax 763 Illinois

- To the clerk county of form

- B signed and delivered this document as hishertheir act and deed and form

- Ex 1019 sec form

- Internal revenue bulletin 2019 02internal revenue service form

- Criminal case information statement appellate criminal cis appellate criminal cis

- Respondents attorney form

- Court transcript request form

- Get the uniform arbitration statement of facts appendix

Find out other Form Ptax 763 Illinois

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template