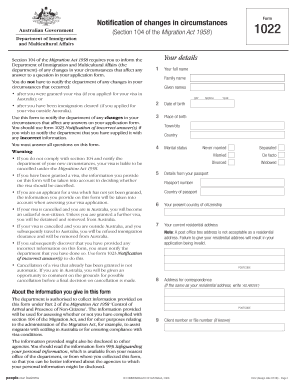

1022 Form

What is the 1022 Form

The 1022 tax form is a document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately complete this form to ensure compliance with U.S. tax laws. The form is often associated with particular tax situations, such as changes in circumstances that may affect tax liability or eligibility for certain deductions and credits.

How to use the 1022 Form

Using the 1022 form involves several steps to ensure that all necessary information is accurately reported. First, gather all required documentation related to your financial situation. This may include income statements, previous tax returns, and any relevant correspondence from the IRS. Next, fill out the form carefully, ensuring that all sections are completed as required. It is important to review the form for accuracy before submission to avoid any potential penalties or delays in processing.

Steps to complete the 1022 Form

Completing the 1022 form involves a systematic approach:

- Gather necessary documents, such as income statements and previous tax returns.

- Obtain the latest version of the 1022 form from the IRS website or authorized sources.

- Fill out the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form either online, by mail, or in person, depending on your preference and the instructions provided.

Form Submission Methods (Online / Mail / In-Person)

The 1022 form can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers prefer to submit the form electronically through the IRS e-file system, which is secure and efficient.

- Mail Submission: If you choose to submit the form by mail, ensure you send it to the correct IRS address listed in the form instructions.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the form at a local IRS office is an option.

Legal use of the 1022 Form

The legal use of the 1022 form is defined by IRS regulations. It must be filled out accurately and submitted within the specified deadlines to ensure compliance. Failure to adhere to these regulations can result in penalties, including fines or additional scrutiny from the IRS. It is crucial to understand the legal implications of the information reported on the form and to maintain accurate records in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the 1022 form can vary depending on the specific circumstances of the taxpayer. Generally, forms must be submitted by the annual tax filing deadline, which is typically April 15 for most individuals. However, if you are filing for an extension or if your situation involves specific events, such as changes in circumstances, it is important to check the IRS guidelines for any adjusted deadlines that may apply.

Quick guide on how to complete 1022 form

Prepare 1022 Form effortlessly on any device

The management of online documents has become increasingly popular among companies and individuals. It provides an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 1022 Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign 1022 Form with ease

- Find 1022 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Edit and electronically sign 1022 Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1022 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1022 tax form and who needs to use it?

The 1022 tax form is used for reporting specific types of income and financial transactions to the IRS. Businesses and individuals who engage in activities requiring detailed documentation of their earnings or expenditures should consider filing this form to maintain compliance and avoid penalties.

-

How can airSlate SignNow assist in preparing the 1022 tax form?

airSlate SignNow simplifies the process of preparing the 1022 tax form by providing an intuitive platform to create, send, and eSign necessary documents. Users can easily share forms with their accountants or collaborators, ensuring that all required information is accurately captured and securely documented.

-

What are the key features of airSlate SignNow related to the 1022 tax form?

AirSlate SignNow offers features like customizable templates, digital signatures, and real-time tracking that can help streamline the completion of the 1022 tax form. These tools enable users to efficiently manage documents and ensure that they are completed and submitted on time.

-

Is airSlate SignNow cost-effective for individuals and small businesses needing the 1022 tax form?

Yes, airSlate SignNow provides a cost-effective solution tailored for both individuals and small businesses that require the 1022 tax form. With competitive pricing plans, users can access powerful features without the burden of high costs, making it accessible for everyone.

-

What integrations does airSlate SignNow offer for users who need the 1022 tax form?

AirSlate SignNow integrates seamlessly with various accounting and financial applications, making it easier for users to manage the 1022 tax form alongside their other financial documents. This connectivity ensures that users can streamline their workflow and minimize manual data entry.

-

Can airSlate SignNow help ensure compliance when submitting the 1022 tax form?

Absolutely, airSlate SignNow promotes compliance by allowing users to utilize legally binding electronic signatures on their 1022 tax form. Additionally, the platform's audit trails and secure storage options help ensure that necessary documentation is kept safe and accessible.

-

What are the benefits of using airSlate SignNow for eSigning the 1022 tax form?

Using airSlate SignNow for eSigning the 1022 tax form offers several benefits, including improved efficiency and convenience. Users can sign documents from anywhere, at any time, reducing delays and speeding up the submission process, which is crucial during tax season.

Get more for 1022 Form

- Colorado general deed form

- Colorado llc 497299744 form

- Colorado limited company form

- Postnuptial agreement colorado template form

- Colorado property 497299747 form

- Amendment to postnuptial property agreement colorado colorado form

- Colorado final form

- Unconditional waiver and release upon progress payment colorado form

Find out other 1022 Form

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now