Form Indiana Department of Revenue MailingContact Information IVT 1 2022

Understanding the Indiana Form IVT-1

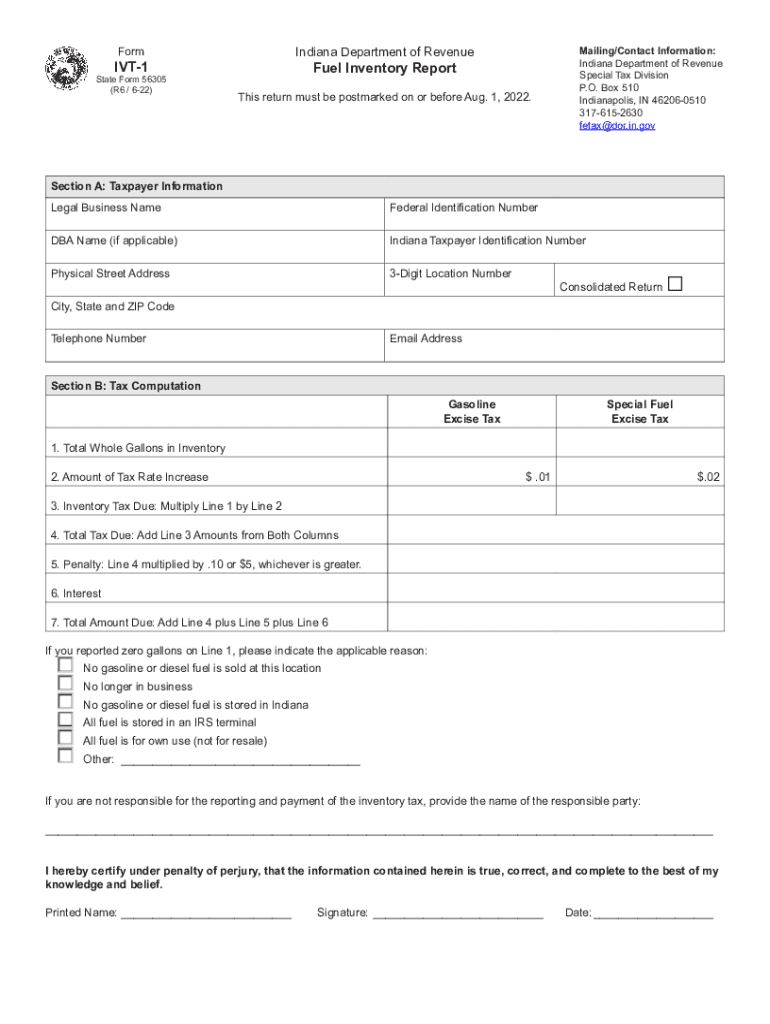

The Indiana Form IVT-1, also known as the Indiana fuel inventory form, is a crucial document required by the Indiana Department of Revenue. This form is primarily used to report fuel inventory for businesses that handle fuel sales or distribution. It ensures compliance with state regulations regarding fuel taxation and inventory management. Proper completion of this form is essential for businesses to avoid penalties and maintain good standing with state authorities.

Steps to Complete the Indiana Form IVT-1

Completing the Indiana Form IVT-1 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your fuel inventory, including purchase records and sales receipts. Next, accurately fill out each section of the form, providing detailed information about the types and quantities of fuel in your inventory. It is crucial to double-check all entries for errors before submission. Finally, submit the completed form by the designated deadline to avoid any potential penalties.

Legal Use of the Indiana Form IVT-1

The Indiana Form IVT-1 is legally binding when completed and submitted in accordance with state regulations. To ensure its legal validity, businesses must adhere to the requirements set forth by the Indiana Department of Revenue. This includes providing accurate information and ensuring that the form is signed by an authorized representative of the business. Failure to comply with these regulations may result in fines or other legal consequences.

Filing Deadlines for the Indiana Form IVT-1

Filing deadlines for the Indiana Form IVT-1 are critical for compliance. Typically, businesses must submit this form on a quarterly basis, with specific due dates established by the Indiana Department of Revenue. It is essential to stay informed about these deadlines to ensure timely submission and avoid penalties. Mark your calendar with these important dates to maintain compliance and avoid any disruptions in your business operations.

Submission Methods for the Indiana Form IVT-1

The Indiana Form IVT-1 can be submitted through various methods, providing flexibility for businesses. Options include online submission through the Indiana Department of Revenue's website, mailing a physical copy of the form, or delivering it in person to a designated office. Each method has its own processing times and requirements, so businesses should choose the option that best suits their needs while ensuring timely compliance with submission deadlines.

Key Elements of the Indiana Form IVT-1

The Indiana Form IVT-1 contains several key elements that must be accurately completed. These include the business's name, address, and taxpayer identification number, as well as detailed information about the fuel types and quantities in inventory. Additionally, the form requires a declaration of the accuracy of the information provided, which must be signed by an authorized representative. Understanding these elements is crucial for ensuring the form is completed correctly and complies with state regulations.

Examples of Using the Indiana Form IVT-1

Businesses across various sectors utilize the Indiana Form IVT-1 to report their fuel inventory. For instance, a gas station would use this form to report the amount of gasoline and diesel fuel in stock at the end of each quarter. Similarly, a trucking company that operates its own fueling stations must report its fuel inventory to ensure compliance with state tax regulations. These examples highlight the form's importance in maintaining accurate records and fulfilling legal obligations regarding fuel inventory management.

Quick guide on how to complete form indiana department of revenue mailingcontact information ivt 1

Prepare Form Indiana Department Of Revenue MailingContact Information IVT 1 easily on any device

Web-based document management has become increasingly popular with businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form Indiana Department Of Revenue MailingContact Information IVT 1 on any device using airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The simplest way to modify and eSign Form Indiana Department Of Revenue MailingContact Information IVT 1 without hassle

- Obtain Form Indiana Department Of Revenue MailingContact Information IVT 1 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Produce your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form Indiana Department Of Revenue MailingContact Information IVT 1 and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form indiana department of revenue mailingcontact information ivt 1

Create this form in 5 minutes!

People also ask

-

What is the Indiana form fuel and how does it work?

The Indiana form fuel is a specific digital document that allows businesses to manage fuel tax compliance efficiently. Using airSlate SignNow, you can easily fill out, eSign, and manage this form, ensuring that you meet all regulatory requirements without hassle.

-

How can airSlate SignNow simplify the process of submitting Indiana form fuel?

airSlate SignNow streamlines the submission of Indiana form fuel by providing a user-friendly platform for completing and signing documents electronically. This not only saves time but also reduces the likelihood of errors associated with manual submissions.

-

What are the costs associated with using airSlate SignNow for Indiana form fuel?

airSlate SignNow offers competitive pricing plans that fit various business needs. Users can choose from different subscription tiers, ensuring that you find a cost-effective solution for handling your Indiana form fuel and other document management tasks.

-

Are there any advanced features for managing Indiana form fuel in airSlate SignNow?

Yes, airSlate SignNow provides advanced features such as document templates, automated workflows, and real-time tracking that enhance the management of Indiana form fuel. These tools help streamline processes and improve overall efficiency in handling important documents.

-

Can I integrate airSlate SignNow with other software for managing Indiana form fuel?

Absolutely! airSlate SignNow offers seamless integrations with various popular applications, enabling you to manage Indiana form fuel alongside your existing tools. This enhances your workflow and ensures that everything is synchronized for better productivity.

-

Is it secure to eSign Indiana form fuel using airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. The platform uses advanced encryption technology to protect your documents, including the Indiana form fuel, ensuring that your sensitive information remains confidential and secure during eSigning processes.

-

What benefits does using airSlate SignNow provide for Indiana form fuel submissions?

Using airSlate SignNow for Indiana form fuel submissions offers numerous benefits, including faster processing times and improved accuracy. Eliminating paper-based processes not only saves resources but also minimizes the chances of losing important documents during submission.

Get more for Form Indiana Department Of Revenue MailingContact Information IVT 1

Find out other Form Indiana Department Of Revenue MailingContact Information IVT 1

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later