About Form 2106, Employee Business ExpensesInternal Revenue Service 2022

Understanding Form 2106: Employee Business Expenses

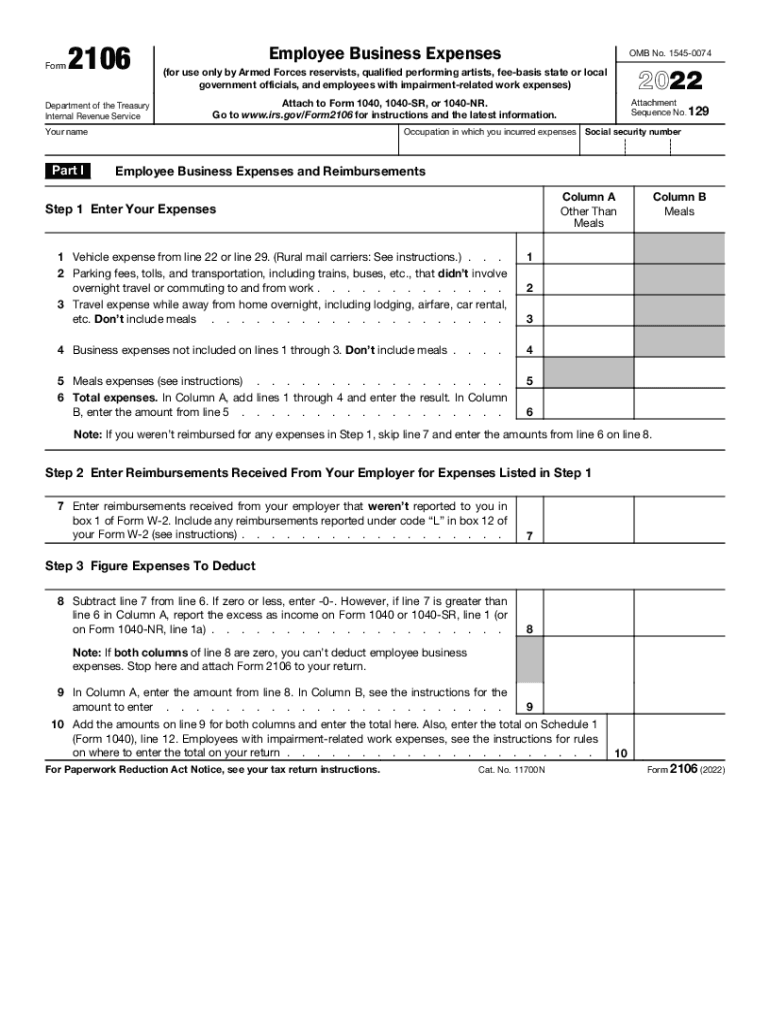

The IRS Form 2106 is designed for employees to report business expenses that are not reimbursed by their employers. This form is essential for individuals who incur costs while performing their job duties, such as travel, meals, or supplies. By accurately completing Form 2106, employees can potentially lower their taxable income by deducting these expenses. It is important to understand the specific guidelines and requirements set forth by the IRS to ensure compliance and maximize potential deductions.

Steps to Complete Form 2106

Filling out Form 2106 requires careful attention to detail. Here are the key steps to complete the form:

- Gather all necessary documentation, including receipts and records of expenses.

- Start by entering your personal information, such as your name and Social Security number.

- Detail your business expenses in the appropriate sections, categorizing them as needed (e.g., travel, meals, and entertainment).

- Calculate the total expenses and ensure they align with the documentation provided.

- Review the completed form for accuracy before submission.

Eligibility Criteria for Using Form 2106

To use Form 2106, certain eligibility criteria must be met. Primarily, the form is intended for employees who incur unreimbursed business expenses while performing their job duties. Additionally, these expenses must be ordinary and necessary for the business. Employees must also be able to substantiate their expenses with appropriate documentation, such as receipts and invoices. Understanding these criteria helps ensure that only valid expenses are claimed, reducing the risk of issues with the IRS.

IRS Guidelines for Form 2106

The IRS provides specific guidelines for completing Form 2106. It is crucial to adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Expenses must be directly related to your job and necessary for your work performance.

- Keep detailed records and receipts to substantiate all claimed expenses.

- Be aware of the limitations on certain deductions, such as the 50% limit on meal expenses.

- Understand the difference between employee business expenses and personal expenses to avoid improper claims.

Form Submission Methods for Form 2106

Form 2106 can be submitted in several ways, depending on your preference and the requirements for your tax filing. The primary submission methods include:

- Electronically through IRS e-file services, which can streamline the process and reduce errors.

- By mail, sending the completed form to the appropriate IRS address based on your location.

- In-person at a local IRS office, if assistance is needed or if you prefer direct submission.

Common Penalties for Non-Compliance with Form 2106

Failure to comply with the requirements associated with Form 2106 can result in penalties. Common issues include:

- Underreporting income due to improper deductions, which may lead to back taxes and interest charges.

- Filing inaccuracies that could result in fines or additional scrutiny from the IRS.

- Failure to maintain adequate documentation, which can jeopardize the legitimacy of claimed expenses.

Quick guide on how to complete about form 2106 employee business expensesinternal revenue service

Complete About Form 2106, Employee Business ExpensesInternal Revenue Service effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents quickly without delays. Manage About Form 2106, Employee Business ExpensesInternal Revenue Service on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign About Form 2106, Employee Business ExpensesInternal Revenue Service with ease

- Obtain About Form 2106, Employee Business ExpensesInternal Revenue Service and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign About Form 2106, Employee Business ExpensesInternal Revenue Service and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 2106 employee business expensesinternal revenue service

Create this form in 5 minutes!

People also ask

-

What is Form 2106 and how does it relate to airSlate SignNow?

Form 2106 is used for claiming employee business expenses. airSlate SignNow facilitates the completion and e-signing of Form 2106, allowing businesses to streamline their expense reporting process efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 2106?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans provide you with the tools necessary to manage and e-sign documents, including Form 2106, at an affordable rate.

-

What features does airSlate SignNow offer for Form 2106 processing?

airSlate SignNow includes features like document templates, customizable workflows, and secure cloud storage. These functionalities enhance the experience of preparing and signing Form 2106, making it easier for users.

-

Can I integrate airSlate SignNow with my existing software for Form 2106 usage?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems and accounting software. This integration ensures that you can manage Form 2106 alongside your other business processes without interruption.

-

How does airSlate SignNow ensure the security of my Form 2106 documents?

Security is a priority at airSlate SignNow, which employs industry-leading encryption to protect your documents. This includes Form 2106, ensuring that your sensitive information remains confidential during the e-signing process.

-

What are the benefits of using airSlate SignNow for Form 2106 e-signatures?

Using airSlate SignNow for Form 2106 e-signatures saves time and eliminates paper waste. The platform enhances the efficiency of submitting this important document while providing a smooth and professional experience for your business.

-

How do I get started with airSlate SignNow for Form 2106?

Getting started is simple! Sign up for an account on airSlate SignNow’s website, then search for Form 2106 templates to start creating your documents with ease. You can also access helpful guides to assist you through the process.

Get more for About Form 2106, Employee Business ExpensesInternal Revenue Service

Find out other About Form 2106, Employee Business ExpensesInternal Revenue Service

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word