Gettingattention Orgform 990 Schedule B DonorForm 990 Schedule B & Donor Disclosures Whats Required? 2022

Understanding the 2018 Form Schedule B

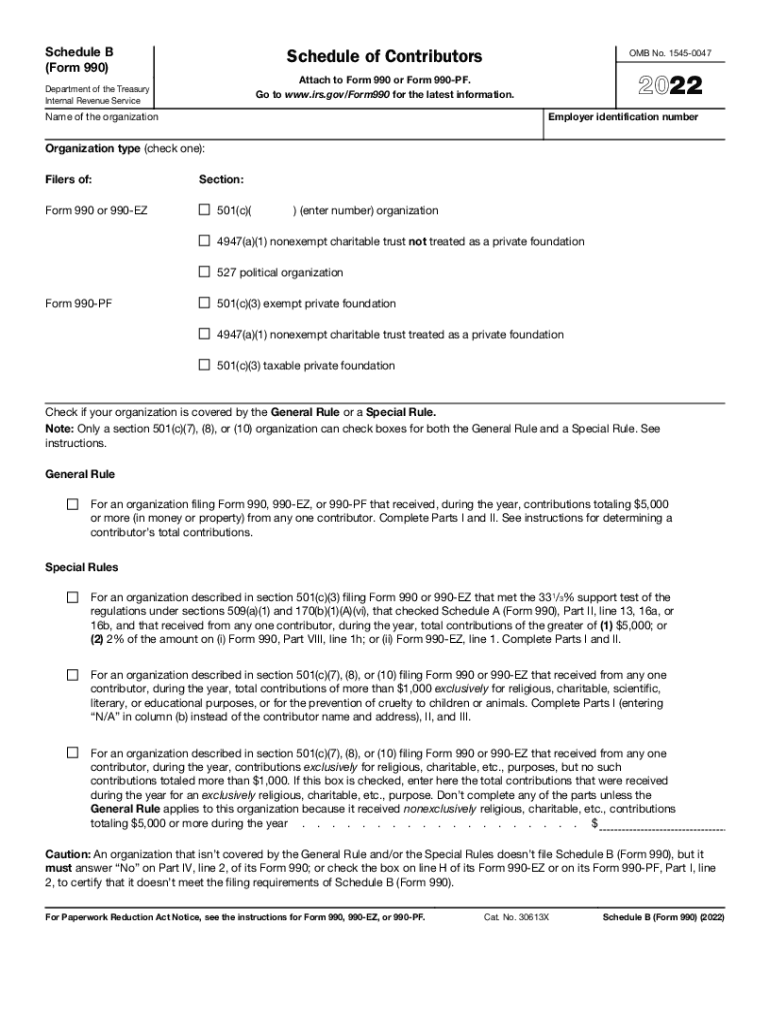

The 2018 Form Schedule B is a crucial document for tax-exempt organizations, specifically designed to disclose information about their significant donors. This form is part of the IRS Form 990 series, which organizations must file annually. Schedule B requires organizations to report the names and addresses of donors who contributed more than a specified amount during the tax year. This transparency is essential for maintaining public trust and ensuring compliance with federal regulations.

Key Elements of the 2018 Form Schedule B

When filling out the 2018 Form Schedule B, certain key elements must be included to ensure accuracy and compliance:

- Donor Information: Names, addresses, and contributions of donors who meet the reporting threshold.

- Contribution Amounts: The total amount contributed by each donor during the reporting period.

- Type of Contribution: Indicate whether the donation was cash, property, or other forms of support.

- Signature: The form must be signed by an authorized representative of the organization.

Steps to Complete the 2018 Form Schedule B

Completing the 2018 Form Schedule B involves several steps to ensure all required information is accurately reported:

- Gather all relevant donor information, including names and addresses.

- Determine which donors meet the reporting threshold based on their contributions.

- Fill out the form, ensuring that all information is complete and accurate.

- Review the form for any errors or omissions before submission.

- Sign the form and retain a copy for your records.

IRS Guidelines for Schedule B Submission

The IRS provides specific guidelines regarding the completion and submission of the 2018 Form Schedule B. Organizations must adhere to these guidelines to avoid penalties:

- Ensure that the form is filed with the appropriate version of Form 990.

- Submit the form by the deadline, which is typically the fifteenth day of the fifth month after the end of the organization’s fiscal year.

- Maintain accurate records of all donations and donor information for at least three years after the filing date.

Penalties for Non-Compliance with Schedule B

Failure to comply with the requirements of the 2018 Form Schedule B can result in significant penalties for tax-exempt organizations. These penalties may include:

- Monetary fines for late or incomplete filings.

- Loss of tax-exempt status if the organization fails to comply repeatedly.

- Increased scrutiny from the IRS, potentially leading to audits.

Digital vs. Paper Version of the 2018 Form Schedule B

Organizations have the option to file the 2018 Form Schedule B either digitally or in paper format. Each method has its advantages:

- Digital Filing: Offers convenience and faster processing times. Electronic submissions are often easier to track and manage.

- Paper Filing: May be preferred by organizations that are not comfortable with digital tools. However, it can lead to longer processing times and potential delays.

Quick guide on how to complete gettingattentionorgform 990 schedule b donorform 990 schedule b ampamp donor disclosures whats required

Effortlessly prepare Gettingattention orgform 990 schedule b donorForm 990 Schedule B & Donor Disclosures Whats Required? on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hold-ups. Manage Gettingattention orgform 990 schedule b donorForm 990 Schedule B & Donor Disclosures Whats Required? on any device using airSlate SignNow's applications for Android or iOS and enhance any document-focused workflow today.

How to modify and electronically sign Gettingattention orgform 990 schedule b donorForm 990 Schedule B & Donor Disclosures Whats Required? with ease

- Find Gettingattention orgform 990 schedule b donorForm 990 Schedule B & Donor Disclosures Whats Required? and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal authority as a traditional ink signature.

- Verify all details and then click the Done button to save your amendments.

- Select how you wish to submit your form, via email, text (SMS), shareable link, or download it onto your computer.

Eliminate concerns about misplaced files, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and electronically sign Gettingattention orgform 990 schedule b donorForm 990 Schedule B & Donor Disclosures Whats Required? and ensure effective communication at any step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gettingattentionorgform 990 schedule b donorform 990 schedule b ampamp donor disclosures whats required

Create this form in 5 minutes!

People also ask

-

What is the 2018 Form Schedule B and why is it important?

The 2018 Form Schedule B is used for reporting interest and ordinary dividends to the IRS. It's important for taxpayers to accurately report their income to avoid penalties and ensure compliance with federal tax laws.

-

How can airSlate SignNow help me with the 2018 Form Schedule B?

airSlate SignNow allows you to easily send and eSign your 2018 Form Schedule B, ensuring that your documents are legally binding and securely stored. Our platform simplifies the preparation and submission of tax forms with a user-friendly interface.

-

Is there a cost associated with using airSlate SignNow for my 2018 Form Schedule B?

Yes, airSlate SignNow offers various pricing plans to cater to your needs, all designed to provide cost-effective solutions for managing your 2018 Form Schedule B and other documents. You can choose a plan that best fits your usage and budget.

-

What features does airSlate SignNow offer for managing the 2018 Form Schedule B?

Key features of airSlate SignNow include document editing, eSignature capabilities, cloud storage, and real-time tracking of document status. These features streamline the process of completing and submitting your 2018 Form Schedule B.

-

Can I integrate airSlate SignNow with other software to manage my 2018 Form Schedule B?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems and accounting software, making it easier to manage your 2018 Form Schedule B within your existing workflow. This enhances efficiency and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the 2018 Form Schedule B?

Using airSlate SignNow for your 2018 Form Schedule B offers numerous benefits, including improved document security, faster processing times, and easier collaboration with stakeholders. It helps eliminate the hassle of paper-based processes.

-

Is airSlate SignNow suitable for individuals filing the 2018 Form Schedule B?

Yes, airSlate SignNow is designed for both individuals and businesses, making it a great solution for anyone needing to file the 2018 Form Schedule B. Its ease of use ensures that even those unfamiliar with eSigning can complete their forms efficiently.

Get more for Gettingattention orgform 990 schedule b donorForm 990 Schedule B & Donor Disclosures Whats Required?

- Time share quitclaim deed three individuals to two individuals nevada form

- Quitclaim deed two individuals to two individuals nevada form

- Nevada time share form

- Nv limited company form

- Quitclaim deed from an individual to three individuals nevada form

- Quitclaim deed time share from two individuals husband and wife to two individuals husband and wife nevada form

- Notice of extension of lien corporation or llc nevada form

- Nv notice 497320602 form

Find out other Gettingattention orgform 990 schedule b donorForm 990 Schedule B & Donor Disclosures Whats Required?

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free