Form ST 809 New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers Revised 1022 2022

Understanding the ST 809 Form

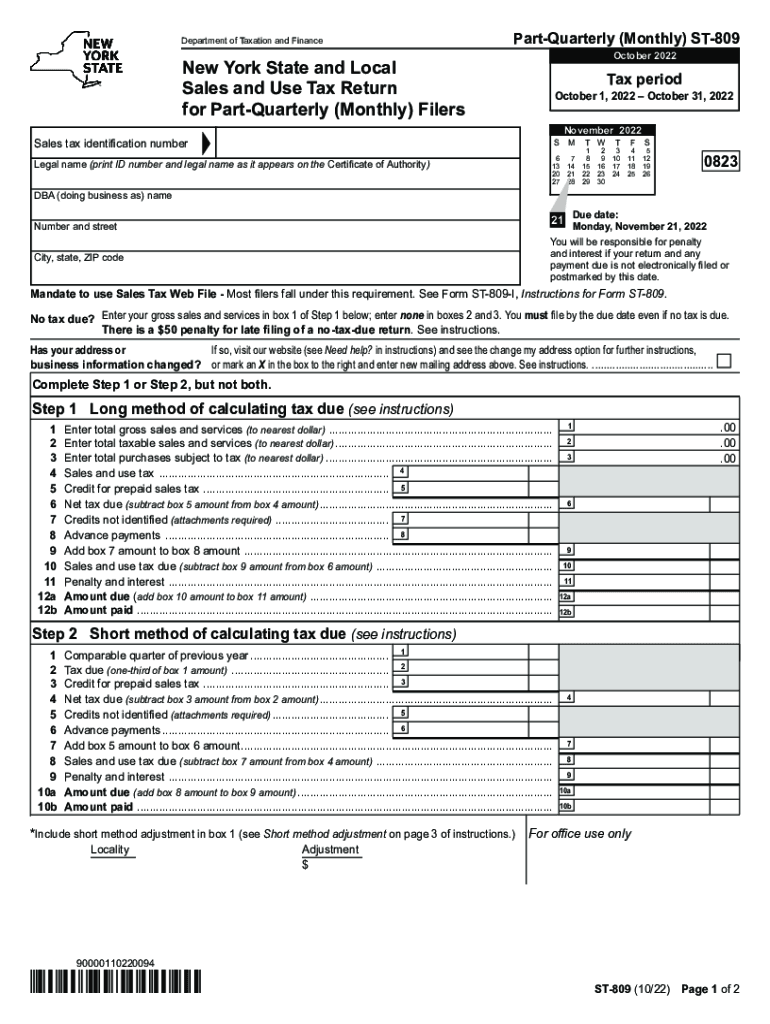

The ST 809 form, officially known as the New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers, is a crucial document for businesses operating in New York. This form is used to report sales and use tax liabilities on a monthly or quarterly basis, depending on the business's tax filing status. It is essential for businesses to accurately report their sales tax collections and remit the appropriate amounts to the state to remain compliant with New York tax laws.

Steps to Complete the ST 809 Form

Completing the ST 809 form involves several key steps. First, gather all necessary sales records, including gross sales, exempt sales, and any sales tax collected. Next, accurately fill out each section of the form, ensuring that all figures are correct and correspond to your records. After completing the form, review it for accuracy and ensure that all required signatures are included. Finally, submit the form by the designated deadline, either electronically or via mail, depending on your filing preference.

Key Elements of the ST 809 Form

The ST 809 form consists of several important sections that must be filled out correctly. Key elements include:

- Sales Information: Report total sales, exempt sales, and the sales tax collected.

- Tax Calculation: Calculate the total sales tax due based on reported sales.

- Payment Information: Include details on payment methods and any prior payments made.

- Signature Section: Ensure the form is signed by an authorized representative of the business.

Filing Deadlines for the ST 809 Form

Filing deadlines for the ST 809 form vary based on whether a business is a monthly or quarterly filer. Monthly filers must submit their returns by the 20th of the month following the reporting period, while quarterly filers have deadlines on the 20th of the month following the end of each quarter. It is important for businesses to mark these dates on their calendars to avoid late penalties.

Legal Use of the ST 809 Form

The ST 809 form is legally binding and must be completed in accordance with New York State tax regulations. Accurate reporting of sales and use tax is critical, as failure to comply can result in penalties, interest, and potential audits. Businesses should ensure they maintain proper records to support the figures reported on the ST 809 form.

Obtaining the ST 809 Form

The ST 809 form can be obtained directly from the New York State Department of Taxation and Finance website. It is available in a downloadable PDF format, allowing businesses to print and fill it out as needed. Additionally, many tax preparation software programs include the ST 809 form, facilitating easier completion and submission.

Quick guide on how to complete form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1022

Complete Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1022 effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without any delays. Manage Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1022 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1022 effortlessly

- Find Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1022 and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1022 and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1022

Create this form in 5 minutes!

People also ask

-

What is the st 809 form and how can airSlate SignNow help with it?

The st 809 form is a key document used in various business transactions. airSlate SignNow provides an efficient platform to send and eSign the st 809 securely, ensuring that your documents are processed quickly and efficiently, allowing you to focus on your core business activities.

-

How much does it cost to use airSlate SignNow for st 809 implementation?

airSlate SignNow offers competitive pricing plans, tailored to fit different business needs. By choosing the right plan, you can manage the costs effectively while utilizing the powerful features that streamline the eSigning process for your st 809 form and other documents.

-

What features does airSlate SignNow offer for managing st 809 documents?

With airSlate SignNow, you can easily upload, edit, and eSign the st 809 document. Features like automated workflows and templates help ensure that your document management process is not only efficient but also user-friendly, making it easier to handle all your electronic signing needs.

-

Can I integrate airSlate SignNow with other platforms for handling st 809 forms?

Yes, airSlate SignNow offers seamless integrations with various CRM and productivity tools. This means you can easily connect your existing systems to manage the st 809 forms alongside your other critical business documents.

-

What are the benefits of using airSlate SignNow for the st 809 form?

Using airSlate SignNow for the st 809 form streamlines the document signing process, increases efficiency, and reduces errors. Additionally, it provides a secure and legally binding way to obtain signatures, enhancing compliance and trust in your transactions.

-

Is airSlate SignNow easy to use for signing the st 809 form?

Absolutely! airSlate SignNow is designed with user experience in mind, allowing you to easily upload and eSign the st 809 form in just a few clicks. Its intuitive interface ensures that even those unfamiliar with digital signing can navigate the process without any hassle.

-

Is there a trial available for airSlate SignNow for st 809 handling?

Yes, airSlate SignNow offers a free trial that allows you to explore all its features, including those for managing the st 809 form. This trial is a great opportunity to assess how the platform can meet your document signing needs without any initial investment.

Get more for Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1022

Find out other Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1022

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now