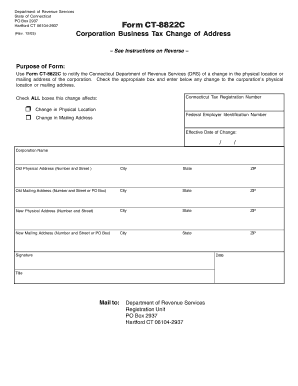

Ct 8822c Form

What is the Ct 8822c Form

The Ct 8822c Form is a document used by taxpayers in the United States to notify the Internal Revenue Service (IRS) of a change in address. This form is essential for ensuring that the IRS has the correct information on file, which helps in the timely delivery of tax-related correspondence and refunds. By using this form, individuals can maintain accurate records with the IRS, which is crucial for effective communication and compliance with tax obligations.

How to use the Ct 8822c Form

To use the Ct 8822c Form, taxpayers need to fill it out with their current and previous addresses, along with their Social Security number or Employer Identification Number. After completing the form, it must be submitted to the IRS. This can be done by mailing the form to the address specified in the instructions. It is important to ensure that all information is accurate and complete to avoid any delays in processing.

Steps to complete the Ct 8822c Form

Completing the Ct 8822c Form involves several straightforward steps:

- Obtain the form from the IRS website or other authorized sources.

- Provide your personal information, including your full name, Social Security number, and previous address.

- Enter your new address where you would like the IRS to send future correspondence.

- Review the form for accuracy and completeness.

- Sign and date the form.

- Mail the completed form to the designated IRS address.

Legal use of the Ct 8822c Form

The Ct 8822c Form is legally recognized as a valid method for taxpayers to inform the IRS of their address changes. This legal standing is important because it ensures that any correspondence, including tax refunds or notices, is sent to the correct address. Adhering to the proper filing procedures and timelines is essential to maintain compliance with IRS regulations.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the Ct 8822c Form, it is advisable to file it as soon as you change your address. Timely submission helps prevent any issues with receiving important tax documents and ensures that your records with the IRS remain current. Additionally, if you are expecting a refund, updating your address promptly can help avoid delays in processing.

Who Issues the Form

The Ct 8822c Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides this form as part of its efforts to help taxpayers maintain accurate records and ensure effective communication regarding tax matters.

Quick guide on how to complete ct 8822c form

Accomplish [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly with no delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-driven process today.

The easiest method to alter and eSign [SKS] without any hassle

- Locate [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Ct 8822c Form

Create this form in 5 minutes!

How to create an eSignature for the ct 8822c form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct 8822c Form and why do I need it?

The Ct 8822c Form is a crucial document used for reporting specific tax information to the IRS. Understanding how to accurately fill out and submit this form can prevent potential issues with tax compliance. Utilizing airSlate SignNow can streamline the process of signing and sending your completed Ct 8822c Form securely.

-

How much does airSlate SignNow cost for handling the Ct 8822c Form?

airSlate SignNow offers flexible pricing plans that cater to various needs, starting with affordable options for individuals and small businesses. Depending on your requirements for handling the Ct 8822c Form, you can choose a plan that best fits your budget. Our cost-effective solutions ensure that you can easily manage your documentation without breaking the bank.

-

What features does airSlate SignNow provide for managing the Ct 8822c Form?

With airSlate SignNow, you gain access to essential features like customizable templates, real-time tracking, and secure cloud storage for your Ct 8822c Form. These tools enhance the efficiency of your workflow by making it easier to manage, eSign, and share your documents quickly. Our user-friendly interface ensures you can navigate all features effortlessly.

-

Can I integrate airSlate SignNow with other applications when working on the Ct 8822c Form?

Yes, airSlate SignNow offers seamless integrations with a variety of applications, including CRM systems, project management tools, and more. This means you can easily incorporate your workflows involving the Ct 8822c Form into your existing software ecosystem. Efficient integration leads to a smoother process overall.

-

What are the benefits of using airSlate SignNow for the Ct 8822c Form?

Using airSlate SignNow to handle your Ct 8822c Form can save you signNow time and reduce errors in document management. The platform allows for quick eSigning, ensuring that you can complete and send your forms without unnecessary delays. Plus, its reliable security features protect your sensitive information.

-

Is airSlate SignNow user-friendly for someone unfamiliar with the Ct 8822c Form?

Absolutely! airSlate SignNow is designed with user experience in mind and provides intuitive navigation and helpful guides, making it accessible for beginners who are not familiar with the Ct 8822c Form. We also offer customer support to assist you through your usage, allowing you to efficiently complete your forms with confidence.

-

How can I track the status of my Ct 8822c Form after sending it through airSlate SignNow?

Once you send your Ct 8822c Form via airSlate SignNow, you can easily track its status in real-time. Our platform provides notifications and updates, letting you know when your document has been viewed and signed. This transparency enhances your experience, ensuring that you're always informed about your document's progress.

Get more for Ct 8822c Form

Find out other Ct 8822c Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors