Learn About the IRS Form 656 Take Action Now 2024

Understanding IRS Form 656

The IRS Form 656 is a crucial document for taxpayers seeking to settle their tax debts through an Offer in Compromise (OIC). This form allows individuals to propose a settlement amount that is less than the total tax liability owed to the IRS. The goal is to provide a manageable resolution for those facing financial hardship. Understanding the purpose and implications of this form is essential for anyone considering this option.

Steps to Complete IRS Form 656

Completing IRS Form 656 involves several key steps:

- Gather necessary financial information, including income, expenses, and assets.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

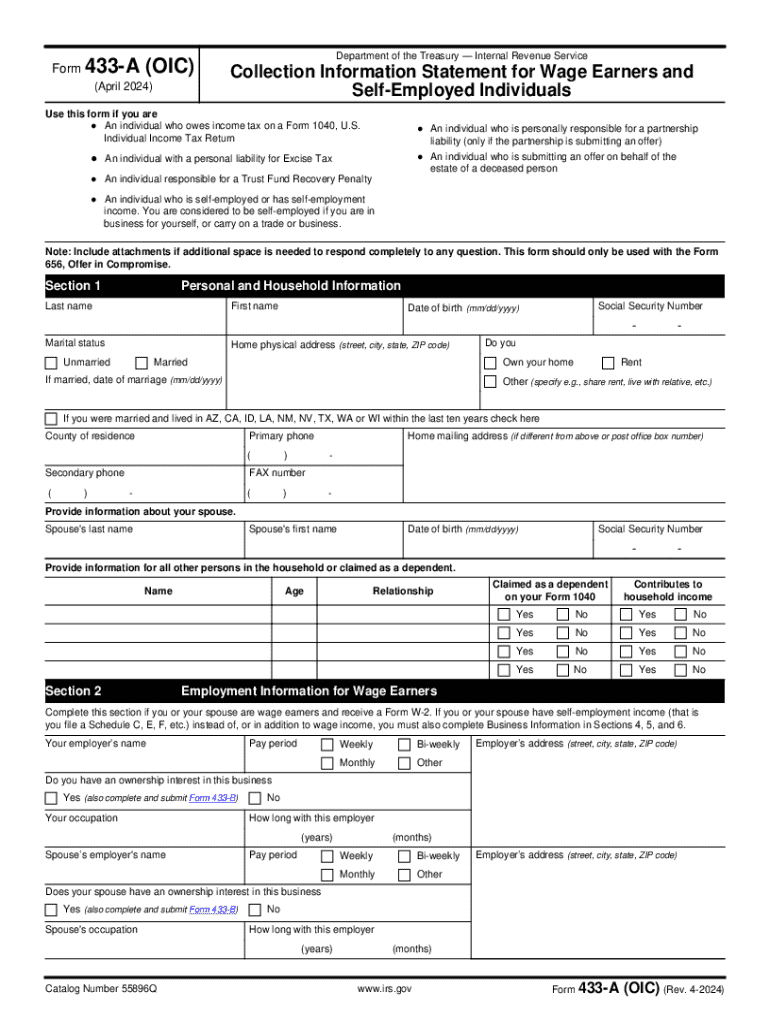

- Attach required documentation, such as Form 433-A (OIC) or Form 433-B (OIC), which detail your financial situation.

- Review the form for accuracy before submission.

Taking these steps carefully can increase the likelihood of your offer being accepted.

Eligibility Criteria for IRS Debt Forgiveness

To qualify for debt forgiveness through the IRS Offer in Compromise program, taxpayers must meet specific eligibility criteria. These include:

- Demonstrating an inability to pay the full tax liability.

- Submitting the offer within the allowable timeframe.

- Being current with all required tax filings.

Understanding these criteria is vital for determining if you can successfully apply for an offer.

Required Documents for Submission

When submitting IRS Form 656, several documents are required to support your offer. These typically include:

- Completed Form 433-A (OIC) or Form 433-B (OIC), detailing your financial situation.

- Proof of income, such as pay stubs or bank statements.

- Documentation of monthly expenses, including bills and other obligations.

Providing comprehensive documentation can help substantiate your claim and facilitate the review process.

Form Submission Methods

IRS Form 656 can be submitted through various methods, ensuring convenience for taxpayers. These methods include:

- Online submission via the IRS website.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Choosing the right submission method can impact the processing time of your offer.

IRS Guidelines for Offer in Compromise

The IRS has established guidelines that govern the Offer in Compromise program. Key points include:

- Offers must be based on the taxpayer's reasonable collection potential.

- The IRS will review offers based on the taxpayer's financial situation.

- Taxpayers must remain compliant with tax obligations during the offer process.

Familiarizing yourself with these guidelines can enhance your understanding of the process and improve your chances of acceptance.

Quick guide on how to complete learn about the irs form 656 take action now

Effortlessly Prepare Learn About The IRS Form 656 Take Action Now on Any Device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without issues. Handle Learn About The IRS Form 656 Take Action Now on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

Edit and eSign Learn About The IRS Form 656 Take Action Now with Ease

- Find Learn About The IRS Form 656 Take Action Now and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Learn About The IRS Form 656 Take Action Now to ensure smooth communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct learn about the irs form 656 take action now

Create this form in 5 minutes!

How to create an eSignature for the learn about the irs form 656 take action now

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS debt forgiveness?

IRS debt forgiveness refers to the process where the IRS cancels or reduces a taxpayer's debt under certain conditions. This can provide signNow financial relief for individuals struggling with tax liabilities. Understanding the criteria for IRS debt forgiveness is crucial for those seeking to alleviate their tax burdens.

-

How can airSlate SignNow help with IRS debt forgiveness documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to IRS debt forgiveness. Our platform allows users to create, send, and eSign necessary forms quickly and securely. This efficiency can be vital when dealing with time-sensitive IRS matters.

-

What features does airSlate SignNow offer for managing IRS debt forgiveness forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing IRS debt forgiveness forms. These tools help ensure that all necessary paperwork is completed accurately and submitted on time. Additionally, our platform is user-friendly, making it accessible for everyone.

-

Is there a cost associated with using airSlate SignNow for IRS debt forgiveness?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage your IRS debt forgiveness documentation without breaking the bank. We provide a free trial, allowing you to explore our features before committing to a plan.

-

Can I integrate airSlate SignNow with other tools for IRS debt forgiveness?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for IRS debt forgiveness. Whether you use CRM systems, cloud storage, or accounting software, our integrations ensure that your document management process is streamlined and efficient.

-

What are the benefits of using airSlate SignNow for IRS debt forgiveness?

Using airSlate SignNow for IRS debt forgiveness offers numerous benefits, including increased efficiency, reduced paperwork errors, and enhanced security. Our platform allows you to manage all your documents in one place, making it easier to track your IRS debt forgiveness progress. Additionally, eSigning speeds up the process, allowing for quicker resolutions.

-

How secure is airSlate SignNow when handling IRS debt forgiveness documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your IRS debt forgiveness documents. Our compliance with industry standards ensures that your sensitive information remains confidential and safe from unauthorized access.

Get more for Learn About The IRS Form 656 Take Action Now

Find out other Learn About The IRS Form 656 Take Action Now

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple