Ct W4p Fillable Form

What is the Ct W4p Fillable

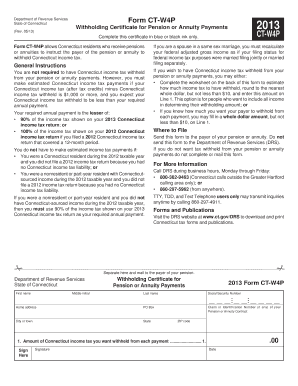

The Ct W4p fillable form is a crucial document used by employees in Connecticut to determine their state income tax withholding. This form allows individuals to provide necessary information about their tax situation, including personal exemptions and additional withholding amounts. By completing the Ct W4p, employees ensure that their employers withhold the correct amount of state taxes from their paychecks, aligning with their financial and tax obligations.

How to use the Ct W4p Fillable

Using the Ct W4p fillable form is straightforward. First, access the form online or through your employer. Fill in your personal information, including your name, address, and Social Security number. Next, indicate your filing status and any exemptions you qualify for. If you wish to have additional amounts withheld, specify that as well. Once completed, submit the form to your employer, who will then use it to adjust your state tax withholding accordingly.

Steps to complete the Ct W4p Fillable

Completing the Ct W4p fillable form involves several key steps:

- Download the Ct W4p fillable form from a reliable source.

- Enter your personal details, including your name and Social Security number.

- Select your filing status (single, married, etc.).

- List any exemptions you are claiming.

- If desired, indicate any additional amount you want withheld from your paycheck.

- Review the information for accuracy.

- Submit the completed form to your employer.

Legal use of the Ct W4p Fillable

The Ct W4p fillable form is legally binding when completed correctly and submitted to your employer. It complies with state tax regulations, ensuring that the information provided is used to calculate the appropriate withholding amounts. To maintain legal validity, it is essential to fill out the form accurately and update it whenever your financial situation changes, such as a change in marital status or number of dependents.

Key elements of the Ct W4p Fillable

Several key elements are essential when filling out the Ct W4p form:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Indicate whether you are single, married, or head of household.

- Exemptions: List any exemptions you qualify for based on your situation.

- Additional Withholding: Specify any extra amount you wish to be withheld from your paycheck.

Who Issues the Form

The Ct W4p fillable form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for managing tax regulations and ensuring compliance with state tax laws. Employees can obtain the form directly from their employer or download it from the official state website, ensuring they have the most current version available.

Quick guide on how to complete ct w4p fillable 16626426

Easily prepare Ct W4p Fillable on any device

Digital document management has gained popularity among both businesses and individuals. It offers an ideal environmentally friendly replacement for traditional printed and signed papers, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Ct W4p Fillable on any platform using airSlate SignNow's Android or iOS applications and streamline your document-based tasks today.

The simplest way to alter and eSign Ct W4p Fillable effortlessly

- Obtain Ct W4p Fillable and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important portions of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for sending your form: via email, SMS, an invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Ct W4p Fillable while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct w4p fillable 16626426

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ctw4p and how does it relate to airSlate SignNow?

Ctw4p is a unique identifier associated with the airSlate SignNow platform, which allows users to send and eSign documents seamlessly. By understanding ctw4p, users can access features tailored to improve document management and enhance business workflows effectively.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Depending on the features and number of users, the ctw4p plan provides cost-effective solutions for small businesses to large enterprises focusing on budget-friendly document management.

-

What features are included in the ctw4p package?

The ctw4p package includes essential features such as document creation, real-time collaboration, and secure eSignature capabilities. These features ensure a streamlined document workflow, making it easier for businesses to manage agreements efficiently.

-

How does airSlate SignNow benefit businesses with ctw4p?

Businesses using ctw4p can benefit from enhanced efficiency, reduced turnaround times, and increased compliance with legal standards. The platform empowers teams to complete tasks faster, enabling a more productive work environment focused on growth.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow supports various integrations, allowing users to connect with popular applications like Salesforce, Google Drive, and Microsoft Office. These integrations enhance the functionality of the ctw4p experience, enabling seamless data transfer and workflow automation.

-

Is ctw4p secure for handling sensitive documents?

Absolutely! The ctw4p solution prioritizes security, employing robust encryption methods and compliance with industry standards. This ensures that your documents remain confidential and secure throughout the signing process.

-

How can I get started with airSlate SignNow using ctw4p?

To get started with ctw4p, visit the airSlate SignNow website and choose your preferred pricing plan. After signing up, you can immediately begin using the platform to send, sign, and manage your documents effectively.

Get more for Ct W4p Fillable

- Mississippi limited 497315284 form

- Letter regarding irrevocable assignment and lien mississippi form

- Civil assault battery form

- Answer mississippi 497315295 form

- Response to affirmative matter mississippi form

- Allowing withdrawal form

- Complaint mississippi 497315298 form

- Complaint mississippi 497315299 form

Find out other Ct W4p Fillable

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template