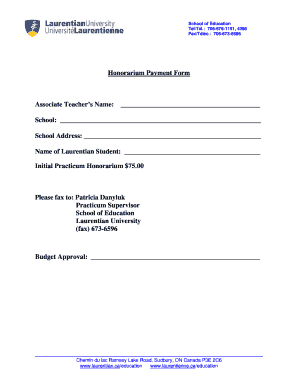

Honorarium Form

What is the Honorarium

An honorarium is a payment made to individuals for services rendered, typically in a professional or academic context, where the individual is not formally employed. This payment acknowledges the expertise or contribution of the individual, such as speakers at conferences, guest lecturers, or consultants. Unlike a salary, an honorarium is often voluntary and is not mandated by a contractual obligation. It serves as a token of appreciation rather than compensation for services rendered.

How to use the Honorarium

Using an honorarium involves a few straightforward steps. First, determine the appropriate amount to offer based on the individual's expertise and the nature of the service provided. Next, communicate clearly with the recipient about the payment, ensuring they understand it is a gesture of appreciation rather than a formal salary. Once agreed upon, prepare an honorarium payment form that includes necessary details such as the recipient's name, the amount, and the purpose of the payment. Finally, process the payment through your accounting system, ensuring compliance with any relevant tax regulations.

Steps to complete the Honorarium

Completing an honorarium payment involves several key steps:

- Identify the recipient and the service they provided.

- Determine the appropriate honorarium amount based on industry standards.

- Draft an honorarium letter or form, detailing the payment amount and purpose.

- Obtain any necessary signatures or approvals from your organization.

- Process the payment through your accounting system, ensuring proper documentation for tax purposes.

Legal use of the Honorarium

The legal use of an honorarium requires adherence to specific guidelines to ensure compliance with tax laws. While honorarium payments are generally not subject to withholding taxes, they must still be reported as income by the recipient. Organizations should provide a Form 1099-MISC to the recipient if the total honorarium payments exceed a certain threshold within a tax year. It is essential to maintain accurate records of all honorarium payments to comply with IRS regulations and avoid potential penalties.

IRS Guidelines

The IRS provides specific guidelines regarding honorarium payments. These payments are typically considered taxable income for the recipient, which means they must report the income on their tax returns. If the total amount paid to an individual exceeds $600 in a calendar year, the payer is required to issue a Form 1099-MISC. This form documents the payment and is used for tax reporting purposes. It is crucial for both the payer and the recipient to understand these guidelines to ensure compliance with federal tax laws.

Examples of using the Honorarium

Honorarium payments can occur in various contexts. Common examples include:

- Payments to guest speakers at conferences or workshops.

- Compensation for academic lectures by visiting professors.

- Fees for expert consultants providing advice or services.

- Payments to artists for performances or exhibitions.

These examples illustrate how honorarium payments serve to recognize contributions in diverse professional fields.

Quick guide on how to complete honorarium

Complete Honorarium effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents quickly without delays. Handle Honorarium on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Honorarium without hassle

- Find Honorarium and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that reason.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Honorarium and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the honorarium

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an honorarium and how can airSlate SignNow assist with it?

An honorarium is a payment given for professional services that are rendered voluntarily without expectation of a fee. With airSlate SignNow, you can efficiently manage the documentation and signing processes related to honorarium agreements, ensuring that both parties have a clear and legally binding record.

-

How does airSlate SignNow simplify the process of issuing honorarium payments?

airSlate SignNow streamlines the honorarium payment process by allowing you to create, send, and sign documents electronically. This eliminates the need for physical paperwork, making it quicker and easier to handle essential agreements, reducing administrative burdens on your team.

-

What features does airSlate SignNow offer for managing honorarium contracts?

airSlate SignNow includes robust features like customizable templates, automated reminders, and secure storage for honorarium contracts. These features help ensure that your agreements are both professional and compliant, giving you peace of mind throughout the payment process.

-

Is there a cost associated with using airSlate SignNow for honorarium documents?

Yes, while airSlate SignNow offers a cost-effective solution, pricing may vary based on your specific needs and the features you select for handling honorarium documents. It's recommended to explore different plans to find one that best suits your business requirements.

-

Can I integrate airSlate SignNow with other tools for processing honorarium payments?

Absolutely! airSlate SignNow integrates seamlessly with various payment systems and CRM tools, allowing for a streamlined workflow when managing honorarium payments. This integration capability ensures that you can easily synchronize your processes and enhance efficiency in your operations.

-

What are the benefits of using airSlate SignNow for honorarium agreements?

Using airSlate SignNow for honorarium agreements offers numerous benefits, including enhanced efficiency, reduced turnaround times, and improved security. By digitizing the signature process, your business can focus on delivering value while ensuring that honorarium payments are processed correctly and promptly.

-

How secure is airSlate SignNow when handling honorarium documents?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your honorarium documents. This ensures that sensitive information remains confidential and only accessible to authorized parties, giving you confidence in your transactions.

Get more for Honorarium

Find out other Honorarium

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe