Uniform Residential Loan Application PDF

What is the Uniform Residential Loan Application PDF?

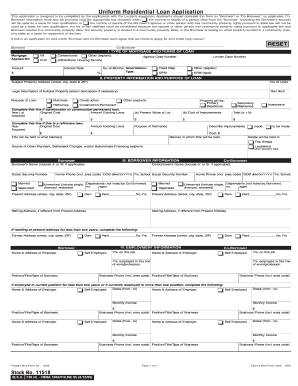

The Uniform Residential Loan Application PDF, commonly referred to as the 1003 mortgage application, is a standardized form used by lenders to assess a borrower's eligibility for a mortgage. This form collects essential information about the applicant, including personal details, employment history, income, and financial obligations. It serves as a critical component in the mortgage approval process, ensuring that lenders have a comprehensive understanding of the borrower's financial situation. The 1003 form is widely recognized and accepted across the United States, making it a vital document for anyone seeking to secure a residential loan.

How to Use the Uniform Residential Loan Application PDF

Using the Uniform Residential Loan Application PDF involves several straightforward steps. First, download the form from a reliable source. Once you have the PDF, open it using a compatible PDF reader. Carefully fill out each section, ensuring that all information is accurate and complete. Pay special attention to the financial details, as these will be scrutinized by lenders. After completing the form, review it for any errors or omissions. Finally, submit the application according to your lender's specified method, whether electronically or via traditional mail.

Steps to Complete the Uniform Residential Loan Application PDF

Completing the Uniform Residential Loan Application PDF requires attention to detail and organization. Follow these steps to ensure a smooth process:

- Gather necessary documents, including proof of income, tax returns, and identification.

- Begin filling out the application by entering personal information such as your name, address, and Social Security number.

- Provide details about your employment history, including employer names, addresses, and job titles.

- List your monthly income and any additional sources of income.

- Detail your financial obligations, including existing debts and monthly payments.

- Review the completed application for accuracy and completeness.

- Submit the application as directed by your lender.

Legal Use of the Uniform Residential Loan Application PDF

The legal use of the Uniform Residential Loan Application PDF is governed by various regulations that ensure its validity in the mortgage lending process. To be considered legally binding, the form must be completed accurately and submitted in accordance with the lender's guidelines. Additionally, electronic submissions must comply with eSignature laws, such as the ESIGN Act and UETA, which establish the legality of electronic signatures. By using a compliant eSignature solution, borrowers can ensure that their application is legally recognized and secure.

Key Elements of the Uniform Residential Loan Application PDF

Understanding the key elements of the Uniform Residential Loan Application PDF is essential for successful completion. The form includes several critical sections, such as:

- Borrower Information: Personal details, including name, address, and contact information.

- Employment Information: Current and previous employment history, including job titles and durations.

- Income Details: Monthly income, bonuses, and any additional earnings.

- Asset Information: Bank accounts, investments, and other assets.

- Liabilities: Existing debts, including credit cards, loans, and other financial obligations.

- Declarations: Questions regarding legal issues, such as bankruptcies or foreclosures.

Form Submission Methods

Submitting the Uniform Residential Loan Application PDF can be done through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders offer secure portals for electronic submission of the application.

- Email Submission: Some lenders may allow you to email the completed PDF directly.

- Mail Submission: Traditional mailing of the application is still an option for those who prefer physical copies.

- In-Person Submission: Applicants may also choose to deliver the form in person at their lender's office.

Quick guide on how to complete uniform residential loan application pdf

Effortlessly prepare Uniform Residential Loan Application Pdf on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and electronically sign your documents swiftly without delays. Manage Uniform Residential Loan Application Pdf on any device using the airSlate SignNow Android or iOS applications and enhance any documentation process today.

The easiest way to edit and eSign Uniform Residential Loan Application Pdf without hassle

- Locate Uniform Residential Loan Application Pdf and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that reason.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in a few clicks from any device you choose. Edit and eSign Uniform Residential Loan Application Pdf and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uniform residential loan application pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is OCR for Form 1003 and how does it work?

OCR for Form 1003 refers to Optical Character Recognition technology designed to digitize and process mortgage application forms. It automatically extracts data from the Form 1003, enhancing efficiency and accuracy in the loan application process. By using airSlate SignNow, businesses can streamline form submissions and minimize manual data entry.

-

What are the key benefits of using airSlate SignNow's OCR for Form 1003?

Using OCR for Form 1003 with airSlate SignNow can signNowly reduce processing time, enhance data accuracy, and improve workflow efficiency. This solution allows users to capture essential data effortlessly, ensuring that applications are handled faster and with fewer errors. Overall, it contributes to a smoother customer experience.

-

Is there a pricing plan available for using OCR for Form 1003?

Yes, airSlate SignNow offers flexible pricing plans tailored to various business needs, including access to OCR for Form 1003. Businesses can choose from monthly or annual subscriptions, allowing them to select a plan that best fits their budget and requirements. Additionally, there’s often a free trial available to explore the features before committing.

-

What features does airSlate SignNow provide with its OCR for Form 1003?

airSlate SignNow enhances the experience of using OCR for Form 1003 by providing features such as automated data extraction, customizable templates, and seamless eSigning capabilities. This integration ensures that users can manage their documents efficiently, from initial data capture to final agreement. These features work together to create a comprehensive document management solution.

-

Can airSlate SignNow's OCR for Form 1003 integrate with other software?

Absolutely! airSlate SignNow's OCR for Form 1003 can seamlessly integrate with various CRM, ERP, and other third-party applications. This capability allows businesses to enhance their existing workflows and ensures that data flows smoothly between platforms. Integrations are designed to save time and bolster productivity.

-

What industries can benefit from OCR for Form 1003?

Several industries, particularly in finance and real estate, can greatly benefit from OCR for Form 1003. Mortgage lenders, banks, and real estate agencies often use this technology to streamline their application processes. Utilization of OCR technology improves accuracy and timing, leading to better client satisfaction across these sectors.

-

How does airSlate SignNow ensure the security of data processed with OCR for Form 1003?

Security is paramount for airSlate SignNow, especially when using OCR for Form 1003. The platform employs advanced encryption protocols, secure data storage, and compliance with industry regulations to protect sensitive information. Users can trust that their data is handled with the highest levels of security.

Get more for Uniform Residential Loan Application Pdf

Find out other Uniform Residential Loan Application Pdf

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile