Pep Loans Form

What is the Pep Loans

Pep loans are financial products designed to assist individuals in need of quick access to funds. These loans typically cater to various personal financial needs, such as unexpected expenses, medical bills, or home repairs. They are often characterized by their relatively straightforward application process and quick approval times, making them accessible to a broad audience.

How to obtain the Pep Loans

Obtaining a pep loan involves several steps to ensure a smooth application process. First, individuals should gather necessary documentation, such as proof of income, identification, and any other relevant financial information. Next, applicants can complete the online application form, which is typically straightforward and user-friendly. After submission, applicants may receive a decision within a short period, often the same day, depending on the lender's policies.

Steps to complete the Pep Loans

To complete the pep loan application, follow these steps:

- Gather required documents, including proof of income and identification.

- Fill out the online application form accurately.

- Submit the application and wait for a response.

- If approved, review the loan terms carefully before accepting.

- Sign the loan agreement electronically, ensuring all details are correct.

Legal use of the Pep Loans

Using pep loans legally involves understanding the terms and conditions set forth by the lender. Borrowers should ensure they are aware of repayment terms, interest rates, and any potential fees associated with the loan. Compliance with local and federal regulations regarding lending practices is crucial to avoid legal issues. Additionally, borrowers should use the funds for the intended purpose as outlined in the loan agreement.

Required Documents

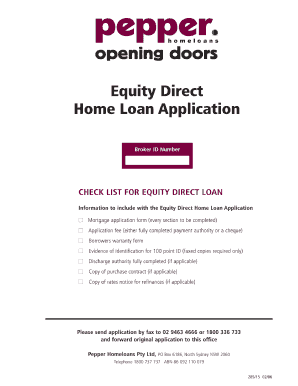

When applying for a pep loan, specific documents are typically required to verify the applicant's identity and financial status. Commonly required documents include:

- Government-issued identification (e.g., driver’s license or passport).

- Proof of income (e.g., pay stubs or tax returns).

- Bank statements to verify financial stability.

- Social Security number for identity verification.

Eligibility Criteria

Eligibility for pep loans generally depends on several factors, including credit history, income level, and residency status. Most lenders require applicants to be at least eighteen years old and have a steady source of income. Additionally, some lenders may consider credit scores, while others may focus more on income stability and ability to repay the loan.

Quick guide on how to complete pep loans

Prepare Pep Loans effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Pep Loans on any device using airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to modify and eSign Pep Loans with ease

- Find Pep Loans and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Pep Loans and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pep loans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a capfin loan and how does it work?

A capfin loan is a financial product designed to provide quick access to cash for various needs. It typically involves a streamlined application process that can be conducted online, allowing users to secure funds efficiently. To understand the specifics of the capfin loan and how to apply for it pdf, you can refer to the official documentation provided by capfin.

-

How can I apply for a capfin loan?

To apply for a capfin loan, you need to fill out an online application form, which is straightforward and user-friendly. You may also need to upload necessary documents for verification. For a detailed guide on the process, you can refer to the capfin loan and how to apply for it pdf.

-

What are the eligibility criteria for a capfin loan?

Eligibility for a capfin loan generally includes being at least 18 years old, being a South African citizen, and having a stable source of income. Additionally, a good credit history may be a factor in your approval. Check the capfin loan and how to apply for it pdf for specifics on eligibility requirements.

-

What are the interest rates associated with a capfin loan?

Interest rates for capfin loans can vary based on factors like the amount borrowed and your creditworthiness. While the rates are competitive, it's essential to review the detailed terms outlined in the capfin loan and how to apply for it pdf. This document will provide a comprehensive breakdown of the rates and repayment terms.

-

Can I use a capfin loan for any purpose?

Yes, capfin loans are generally versatile and can be used for various purposes, such as home improvements, medical expenses, or debt consolidation. However, it's advised to refer to the capfin loan and how to apply for it pdf for any specific limitations on usage.

-

What features make capfin loans a good choice?

Capfin loans offer quick processing times, flexible repayment options, and a user-friendly application process. These features are designed to cater to the needs of borrowers looking for immediate financial assistance. For more details on loan features, consult the capfin loan and how to apply for it pdf.

-

How long does it take to receive funds from a capfin loan?

Once your application for a capfin loan is approved, funds may typically be disbursed within a few hours to a couple of days. This rapid funding process helps borrowers manage urgent financial needs effectively. For more precise information, see the capfin loan and how to apply for it pdf.

Get more for Pep Loans

Find out other Pep Loans

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors