Printable W 8 Form

What is the Printable W-8 Form

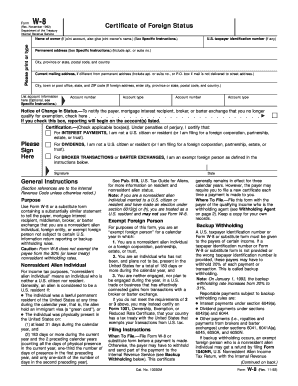

The printable W-8 form, officially known as the IRS Form W-8 Certificate of Foreign Status, is a crucial document used by foreign individuals and entities to certify their foreign status for U.S. tax purposes. It allows these entities to claim a reduced rate of, or exemption from, withholding tax on certain types of income they receive from U.S. sources. The form is essential for ensuring compliance with U.S. tax laws and helps foreign taxpayers avoid unnecessary withholding on payments such as dividends, interest, and royalties.

How to Use the Printable W-8 Form

Using the printable W-8 form involves several steps to ensure accurate completion and submission. First, identify the specific W-8 variant that applies to your situation, such as W-8BEN for individuals or W-8BEN-E for entities. Next, fill out the form by providing the required information, including your name, country of citizenship, and taxpayer identification number if applicable. Once completed, submit the form to the U.S. withholding agent or financial institution requesting it, not to the IRS. This process helps establish your eligibility for reduced withholding rates or exemptions.

Steps to Complete the Printable W-8 Form

Completing the printable W-8 form requires careful attention to detail. Follow these steps:

- Obtain the correct version of the W-8 form based on your status (individual or entity).

- Enter your name and address as they appear on your official documents.

- Provide your country of citizenship or incorporation.

- If applicable, include your U.S. taxpayer identification number or foreign tax identification number.

- Sign and date the form to certify that the information is accurate and complete.

Legal Use of the Printable W-8 Form

The legal use of the printable W-8 form is governed by U.S. tax regulations. It is essential for foreign individuals and entities to submit this form to establish their foreign status and claim any applicable tax treaty benefits. Failure to provide a valid W-8 form may result in a higher withholding tax rate on U.S.-sourced income. Additionally, the form must be kept up to date, as changes in circumstances may require a new submission to maintain compliance.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the printable W-8 form. These guidelines outline the eligibility criteria for using the form, the information required, and the importance of accuracy in reporting. It is crucial to refer to the IRS instructions for the W-8 form to ensure compliance with all regulations. The IRS also emphasizes the necessity of submitting the form to the appropriate withholding agents rather than directly to the IRS, which is vital for maintaining proper tax documentation.

Form Submission Methods

The printable W-8 form can be submitted through various methods, depending on the preferences of the withholding agent or financial institution. Common submission methods include:

- Online submission through secure portals provided by financial institutions.

- Mailing a physical copy of the completed form to the withholding agent.

- In-person delivery at the office of the withholding agent.

It is important to confirm the preferred submission method with the requesting party to ensure timely processing.

Quick guide on how to complete printable w 8 form

Complete Printable W 8 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Printable W 8 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest way to modify and eSign Printable W 8 Form effortlessly

- Obtain Printable W 8 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to secure your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Printable W 8 Form and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable w 8 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample form w 8?

A sample form w 8 is a tax form used by foreign individuals and entities to signNow their non-U.S. status. It helps to claim reduced withholding rates on certain types of income received from U.S. sources. Using a properly filled sample form w 8 can facilitate smoother transactions and compliance with IRS regulations.

-

How can I create a sample form w 8 using airSlate SignNow?

Creating a sample form w 8 with airSlate SignNow is straightforward. Our platform allows you to customize and fill out templates, ensuring all required fields are accurately completed. Once it's filled out, you can easily send it for eSignature to expedite the process.

-

Is airSlate SignNow cost-effective for managing sample form w 8 documents?

Yes, airSlate SignNow offers a cost-effective solution for managing sample form w 8 documents. Our pricing plans are designed to fit various business needs, ensuring you can efficiently eSign and send documents without breaking the bank. This makes it an ideal choice for businesses of all sizes.

-

What features does airSlate SignNow provide for sample form w 8 transactions?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for sample form w 8 transactions. These features help streamline the document management process, ensuring compliance and efficiency. Additionally, our user-friendly interface makes it easy for anyone to navigate and utilize.

-

Can I integrate airSlate SignNow with other tools for sample form w 8 processes?

Absolutely! airSlate SignNow can integrate seamlessly with various tools, enhancing your workflow for managing sample form w 8 processes. Whether you need to connect with CRM systems, storage solutions, or financial software, our platform provides integration options that keep your operations running smoothly.

-

What are the benefits of using airSlate SignNow for sample form w 8?

Using airSlate SignNow for your sample form w 8 needs offers numerous benefits, including time-saving automation and enhanced document security. You'll also enjoy improved collaboration as you can easily share, track, and manage your documents. This leads to faster processing times and less hassle for your team.

-

How secure is the information on my sample form w 8 when using airSlate SignNow?

Your security is a top priority at airSlate SignNow. We employ advanced encryption and strict access controls to ensure your sample form w 8 and any associated data remain confidential and secure. You can confidently manage sensitive documents knowing that they are protected.

Get more for Printable W 8 Form

Find out other Printable W 8 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors