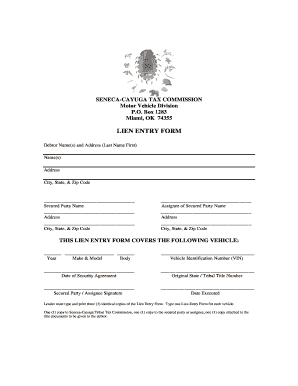

Seneca Cayuga Tax Commission Form

What is the Seneca Cayuga Tax Commission Form

The Seneca Cayuga Tax Commission Form is a crucial document used for tax purposes within the jurisdiction of the Seneca-Cayuga Nation. This form is essential for individuals and businesses operating within the nation to report income, claim deductions, and ensure compliance with local tax regulations. Understanding the purpose and requirements of this form is vital for accurate tax filing and maintaining good standing with the tax authority.

How to use the Seneca Cayuga Tax Commission Form

Using the Seneca Cayuga Tax Commission Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the form for any errors before submission. Finally, submit the form according to the specified guidelines, which may include online submission or mailing it to the appropriate tax office.

Steps to complete the Seneca Cayuga Tax Commission Form

Completing the Seneca Cayuga Tax Commission Form requires attention to detail. Follow these steps for a successful submission:

- Collect all relevant financial documents, such as W-2s and 1099s.

- Access the form from the official Seneca Cayuga Tax Commission website or designated office.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Report your total income and any applicable deductions.

- Double-check all entries for accuracy.

- Sign and date the form as required.

- Submit the completed form by the designated deadline.

Legal use of the Seneca Cayuga Tax Commission Form

The legal use of the Seneca Cayuga Tax Commission Form is governed by tax laws applicable within the Seneca-Cayuga Nation. This form serves as an official declaration of income and tax obligations. When completed correctly, it can protect taxpayers from penalties and ensure compliance with local tax regulations. It is essential to understand the legal implications of submitting this form, as inaccuracies or omissions may lead to legal consequences.

Required Documents

To successfully complete the Seneca Cayuga Tax Commission Form, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Identification documents, such as a driver's license or tribal ID.

Form Submission Methods

The Seneca Cayuga Tax Commission Form can be submitted through various methods to accommodate different preferences. Options typically include:

- Online submission through the official Seneca Cayuga Tax Commission portal.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices during business hours.

Quick guide on how to complete seneca cayuga tax commission form

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to locate the right form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that task.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and guarantee exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the seneca cayuga tax commission form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Seneca Cayuga Tax Commission Form?

The Seneca Cayuga Tax Commission Form is a document required for reporting and filing tax information specific to the Seneca and Cayuga counties. It helps ensure compliance with local tax regulations and streamlines the submission process for businesses and individuals.

-

How can airSlate SignNow assist with the Seneca Cayuga Tax Commission Form?

airSlate SignNow offers an easy-to-use platform for electronically signing and submitting the Seneca Cayuga Tax Commission Form. This service not only speeds up the filing process but also ensures that your documents are securely signed and stored.

-

Is there a cost associated with using airSlate SignNow for the Seneca Cayuga Tax Commission Form?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. The cost-effective solutions ensure that you can submit your Seneca Cayuga Tax Commission Form without breaking the bank.

-

What features does airSlate SignNow offer for the Seneca Cayuga Tax Commission Form?

airSlate SignNow includes features such as document templates, customizable workflows, and secure eSignature capabilities specifically designed for the Seneca Cayuga Tax Commission Form. These features help increase the efficiency of your tax filing process.

-

Can I integrate airSlate SignNow with other software for the Seneca Cayuga Tax Commission Form?

Absolutely, airSlate SignNow seamlessly integrates with various applications and platforms, allowing you to coordinate filing the Seneca Cayuga Tax Commission Form with your existing tools. This integration enhances your workflow and manages your documents more effectively.

-

What are the benefits of using airSlate SignNow for the Seneca Cayuga Tax Commission Form?

Using airSlate SignNow for the Seneca Cayuga Tax Commission Form offers numerous benefits, including improved speed of document processing, reduced paperwork errors, and enhanced security for sensitive information. These advantages help you manage compliance more efficiently.

-

How do I get started with airSlate SignNow for the Seneca Cayuga Tax Commission Form?

Getting started with airSlate SignNow is easy. Simply visit our website, sign up for an account, and access our user-friendly tools to create and submit your Seneca Cayuga Tax Commission Form in no time.

Get more for Seneca Cayuga Tax Commission Form

- Resnet home energy rating standard disclosure southface form

- Broadway cafe cohesion case answers form

- Cao email address for documents form

- Shg loan bapplicationb forms office of the state coordinator for bb megselfhelp gov

- Nldecompose stata form

- Student counselling questionnaire pdf form

- Magnet academy for cultural arts student application st landry form

- Gis metadata template form

Find out other Seneca Cayuga Tax Commission Form

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form