Zimra Vat Return Form Excel

What is the Zimra Vat Return Form Excel

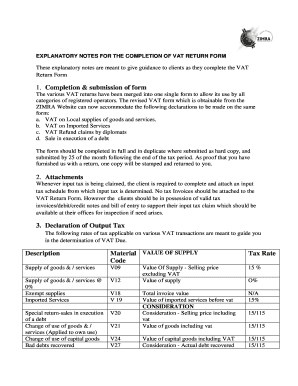

The Zimra VAT Return Form Excel is a structured document used by businesses in Zimbabwe to report their Value Added Tax (VAT) obligations. This form captures essential financial data, including sales, purchases, and the VAT collected and paid. It is crucial for ensuring compliance with tax regulations and for the accurate calculation of tax liabilities. By utilizing an Excel format, users can easily input data, perform calculations, and maintain organized records for their VAT filings.

How to use the Zimra Vat Return Form Excel

Using the Zimra VAT Return Form Excel involves several straightforward steps. First, download the form from a reliable source. Open the Excel file and familiarize yourself with its layout, including sections for inputting sales, purchases, and VAT amounts. Enter the required data accurately, ensuring that all calculations are correct. Once completed, review the form for any errors before saving it. This digital format allows for easy adjustments and updates as needed.

Steps to complete the Zimra Vat Return Form Excel

Completing the Zimra VAT Return Form Excel requires careful attention to detail. Follow these steps for accuracy:

- Download the form and open it in Excel.

- Fill in your business details, including name and tax identification number.

- Input total sales and purchases in the designated fields.

- Calculate the VAT collected and paid, ensuring all figures are accurate.

- Review the completed form for any discrepancies.

- Save the file securely for submission.

Legal use of the Zimra Vat Return Form Excel

The Zimra VAT Return Form Excel is legally binding when completed and submitted in accordance with tax regulations. To ensure its legal validity, it must be filled out accurately, reflecting true financial data. Additionally, businesses should maintain records of their submissions and any correspondence with tax authorities. Compliance with local tax laws is essential to avoid penalties and ensure that the form is accepted by the Zimbabwe Revenue Authority.

Filing Deadlines / Important Dates

Filing deadlines for the Zimra VAT Return Form are critical for compliance. Typically, businesses must submit their VAT returns on a monthly basis, with specific due dates set by the Zimbabwe Revenue Authority. It is essential to stay informed about these deadlines to avoid late submissions, which can result in penalties. Mark your calendar with these important dates to ensure timely filing and compliance with tax obligations.

Penalties for Non-Compliance

Failure to submit the Zimra VAT Return Form on time or inaccuracies in the form can lead to significant penalties. These may include fines, interest on unpaid taxes, or even legal action. It is crucial for businesses to understand the implications of non-compliance and to take proactive steps to ensure that their VAT returns are filed accurately and on time. Maintaining good records and seeking professional advice can help mitigate these risks.

Quick guide on how to complete zimra vat return form excel

Effortlessly prepare Zimra Vat Return Form Excel on any gadget

Digital document management has gained traction among companies and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, revise, and eSign your documents quickly and efficiently. Manage Zimra Vat Return Form Excel on any device using airSlate SignNow's Android or iOS applications and streamline any documentation process today.

The easiest method to alter and eSign Zimra Vat Return Form Excel effortlessly

- Find Zimra Vat Return Form Excel and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Alter and eSign Zimra Vat Return Form Excel and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zimra vat return form excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are VAT declaration forms in Excel?

VAT declaration forms in Excel are documents used by businesses to report value-added tax transactions. These forms help in calculating the VAT owed or reclaimable for a specific period. Using an Excel format simplifies the data entry process and allows for easy manipulation of numbers.

-

How can airSlate SignNow help me with VAT declaration forms in Excel?

airSlate SignNow provides a user-friendly platform for businesses to create, send, and eSign VAT declaration forms in Excel. By integrating your Excel templates, you can streamline the process and reduce errors. This ensures compliance and efficiency in managing your VAT obligations.

-

Is there a cost associated with using airSlate SignNow for VAT declaration forms in Excel?

Yes, airSlate SignNow offers various pricing plans based on your business needs. Whether you're a small business or a larger enterprise, you'll find a plan that accommodates your requirements for handling VAT declaration forms in Excel. Each plan provides features tailored to enhance your document management workflow.

-

Can I integrate airSlate SignNow with my existing accounting software for VAT declaration forms in Excel?

Absolutely! airSlate SignNow offers integrations with a wide range of accounting software, allowing you to easily manage your VAT declaration forms in Excel. This seamless integration helps streamline your financial processes and ensures all your data is synchronized and readily available.

-

What features does airSlate SignNow offer for managing VAT declaration forms in Excel?

airSlate SignNow includes features like customizable templates, eSignature capabilities, and automated workflows for VAT declaration forms in Excel. These tools help you reduce paperwork, speed up the approval process, and ensure that all necessary parties can sign documents remotely.

-

Are VAT declaration forms in Excel secure with airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your VAT declaration forms in Excel. The platform employs robust security measures, including encryption and access controls, to safeguard your sensitive data. This ensures your compliance documents are protected throughout the signing process.

-

How do I get started with airSlate SignNow to create VAT declaration forms in Excel?

Getting started with airSlate SignNow is easy! Simply sign up for an account, upload your existing VAT declaration forms in Excel, and customize your templates as needed. You can then start sending documents for eSignature in just a few clicks.

Get more for Zimra Vat Return Form Excel

Find out other Zimra Vat Return Form Excel

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF