Ctw4p Form

What is the Ctw4p?

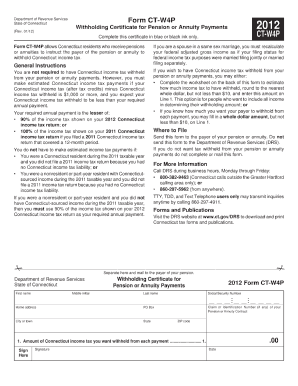

The Ctw4p, also known as the Connecticut Employee's Withholding Certificate, is a crucial tax form used by employees in Connecticut. This form allows employees to indicate their tax withholding preferences to their employers, ensuring that the correct amount of state income tax is withheld from their paychecks. Understanding the Ctw4p is essential for both employees and employers to maintain compliance with state tax regulations.

How to use the Ctw4p

Using the Ctw4p involves filling out the form accurately to reflect your personal tax situation. Employees should provide information such as their filing status, number of allowances, and any additional withholding amounts. This information helps employers calculate the appropriate withholding amount from each paycheck. It is important to review the form annually or whenever there is a change in personal circumstances, such as marriage or the birth of a child.

Steps to complete the Ctw4p

Completing the Ctw4p involves several straightforward steps:

- Obtain the Ctw4p form from your employer or the Connecticut Department of Revenue Services website.

- Fill in your personal information, including your name, address, and Social Security number.

- Select your filing status and the number of allowances you wish to claim.

- Indicate any additional withholding amounts if necessary.

- Sign and date the form before submitting it to your employer.

Legal use of the Ctw4p

The Ctw4p is legally binding when filled out correctly and submitted to an employer. It is important to provide accurate information, as incorrect details can lead to under-withholding or over-withholding of state taxes. This form must comply with Connecticut tax laws and regulations to ensure that employees meet their tax obligations without incurring penalties.

Filing Deadlines / Important Dates

While the Ctw4p itself does not have a specific filing deadline, it should be submitted to your employer as soon as you start a new job or experience a change in tax situation. Employers are required to withhold the appropriate amount of state tax based on the information provided on the Ctw4p. It is advisable to review and update the form at least once a year or whenever significant life changes occur.

Required Documents

To complete the Ctw4p, you may need the following documents:

- Your Social Security number.

- Details of your filing status (single, married, etc.).

- Information regarding any dependents.

- Previous year’s tax return, if available, to help determine your allowances.

Who Issues the Form

The Ctw4p is issued by the Connecticut Department of Revenue Services. Employers in Connecticut are responsible for providing this form to their employees and ensuring that it is completed and returned in a timely manner. The department also provides guidance and resources to help employees understand how to fill out the form correctly.

Quick guide on how to complete ctw4p

Complete Ctw4p effortlessly on any device

Online document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and store it securely online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without interruptions. Handle Ctw4p on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Ctw4p with ease

- Find Ctw4p and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Ctw4p and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ctw4p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ctw4p and how does it relate to airSlate SignNow?

Ctw4p is a powerful eSigning solution that enables businesses to streamline their document management processes using airSlate SignNow. This feature is designed to facilitate fast and secure signatures, enhancing productivity across various business functions.

-

What are the key features of airSlate SignNow's ctw4p?

The ctw4p feature includes customizable templates, real-time tracking, and advanced security measures. With airSlate SignNow, users can create, send, and manage documents efficiently while ensuring compliance and protection of sensitive information.

-

How does ctw4p improve the document signing process?

Ctw4p signNowly improves the document signing process by allowing users to send and sign documents electronically in a matter of minutes instead of days. This leads to faster turnaround times and enhanced communication among teams and clients.

-

What is the pricing structure for airSlate SignNow's ctw4p?

The pricing structure for ctw4p with airSlate SignNow is flexible and designed to cater to different business sizes. You'll find competitive rates that provide excellent value for features offered, ensuring that you only pay for what you use.

-

Can I integrate ctw4p with other software tools?

Yes, airSlate SignNow's ctw4p can be seamlessly integrated with numerous other software tools to enhance your business workflows. This includes CRM systems, project management apps, and cloud storage services, allowing for a more cohesive business environment.

-

What benefits can I expect from using ctw4p in my business?

By incorporating ctw4p through airSlate SignNow, businesses can expect increased efficiency and reduced operational costs. The ability to manage documents digitally helps eliminate paper-related expenses and accelerates the overall workflow.

-

Is ctw4p secure for handling sensitive documents?

Absolutely. Ctw4p employs advanced encryption and security protocols within airSlate SignNow to protect your sensitive documents. This ensures that all information transmitted is secure and compliant with industry standards.

Get more for Ctw4p

Find out other Ctw4p

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe