Instructions for Form it 230 Tax NY Gov New York State 2023

What is the IT-230 Form?

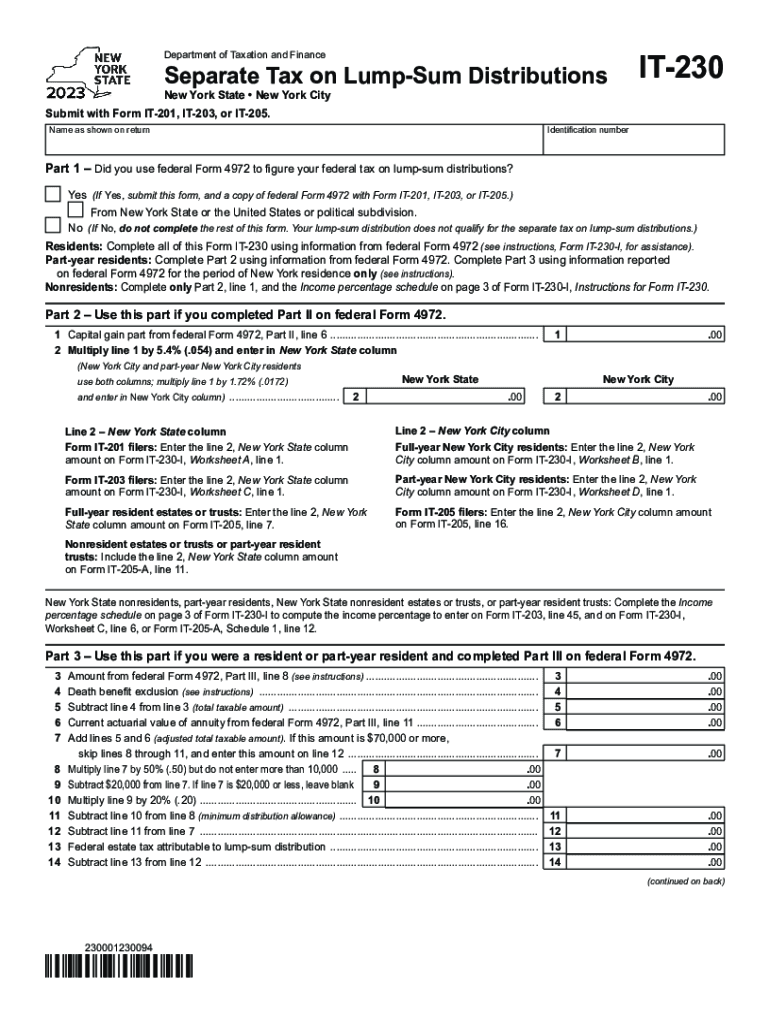

The IT-230 form is a New York State tax document used to report certain tax distributions. It is specifically designed for taxpayers who have received a lump sum distribution from a retirement plan or pension. The form allows individuals to calculate the taxable portion of these distributions and ensures compliance with state tax regulations. Understanding the purpose of the IT-230 is crucial for accurate tax reporting and to avoid potential penalties.

Key Elements of the IT-230 Form

The IT-230 form includes several important sections that taxpayers must complete. Key elements include:

- Personal Information: Taxpayers must provide their name, address, and Social Security number.

- Distribution Details: This section requires information about the retirement plan or pension from which the distribution was received.

- Taxable Amount: Taxpayers need to calculate the taxable portion of the distribution, which is essential for accurate tax reporting.

- Signature: The form must be signed and dated by the taxpayer to validate the information provided.

Steps to Complete the IT-230 Form

Completing the IT-230 form involves several steps:

- Gather necessary documents, including your retirement plan statement and any prior tax returns.

- Fill in your personal information accurately at the top of the form.

- Provide details about the distribution, including the total amount received and the taxable portion.

- Review the form for accuracy and completeness before signing.

- Submit the form according to the specified submission methods.

Eligibility Criteria for the IT-230 Form

To be eligible to use the IT-230 form, taxpayers must have received a lump sum distribution from a qualified retirement plan or pension. This typically includes distributions from 401(k) plans, IRAs, or similar retirement accounts. It is important to verify that the distribution meets the criteria set forth by New York State tax regulations to ensure proper filing.

Filing Deadlines for the IT-230 Form

Taxpayers must adhere to specific filing deadlines when submitting the IT-230 form. Generally, the form should be filed along with your annual New York State tax return. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines, as these can vary each tax year.

Form Submission Methods

The IT-230 form can be submitted through various methods, including:

- Online: Taxpayers may file electronically using approved tax software that supports New York State forms.

- Mail: The completed form can be mailed to the address specified in the instructions.

- In-Person: Taxpayers can also submit the form in person at designated tax offices, if available.

Quick guide on how to complete instructions for form it 230 tax ny gov new york state

Effortlessly Prepare Instructions For Form IT 230 Tax NY gov New York State on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without interruptions. Manage Instructions For Form IT 230 Tax NY gov New York State on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign Instructions For Form IT 230 Tax NY gov New York State with Ease

- Obtain Instructions For Form IT 230 Tax NY gov New York State and click Get Form to initiate.

- Employ the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Modify and electronically sign Instructions For Form IT 230 Tax NY gov New York State and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 230 tax ny gov new york state

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 230 tax ny gov new york state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to IT 230?

airSlate SignNow is a powerful eSignature solution designed for businesses looking to streamline document signing processes. With its features optimized for IT 230 environments, it enables users to securely sign, send, and manage documents efficiently.

-

How can airSlate SignNow benefit my business operating under IT 230?

By utilizing airSlate SignNow, businesses under IT 230 can enhance workflow efficiency and reduce administrative burdens. It offers seamless document management, ensuring teams can focus on core business activities while maintaining compliance with IT 230 standards.

-

What are the key features of airSlate SignNow that support IT 230?

airSlate SignNow includes features such as reusable templates, automated workflows, and secure storage, all crucial for managing documents in an IT 230 framework. These functionalities ensure that users can create, send, and track documents effectively while adhering to IT 230 requirements.

-

Is airSlate SignNow cost-effective for businesses within IT 230?

Yes, airSlate SignNow offers competitive pricing models that cater to businesses operating under IT 230. The cost-effective nature of the solution allows companies to optimize their document processes without overspending, making it an ideal choice for tech-savvy organizations.

-

Can airSlate SignNow integrate with other tools commonly used in IT 230?

Absolutely! airSlate SignNow provides integrations with popular software applications that businesses in IT 230 frequently use. This compatibility ensures a seamless experience, allowing teams to leverage their existing tools without disruption.

-

What compliance standards does airSlate SignNow meet for IT 230?

airSlate SignNow is designed to comply with various legal and industry standards relevant to IT 230, including GDPR and eIDAS. This compliance guarantees that users can trust their document processes are secure and legally binding.

-

How does airSlate SignNow handle security for IT 230 users?

With advanced security protocols in place, airSlate SignNow ensures that data remains protected for IT 230 users. Features like encryption and secure access control help safeguard sensitive information throughout the document lifecycle.

Get more for Instructions For Form IT 230 Tax NY gov New York State

- Falk pharmacy patient enrollment form

- Breast center prescription form az tech radiology

- State pef article 17 out of title work form

- Northern arizona radiology form

- Qifa primary school parent volunteer form

- Building permit form 63658932

- 2nd round office of general services new york state form

- Part 1 pre application questionnaire form

Find out other Instructions For Form IT 230 Tax NY gov New York State

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT