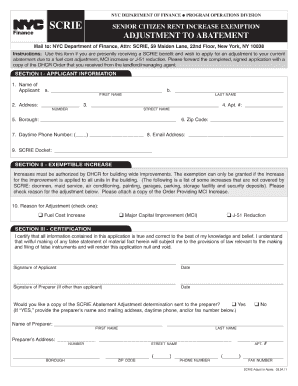

Mci Scrie Adjustment Form

What is the MCI SCRIE Adjustment

The MCI SCRIE adjustment refers to the Major Capital Improvement (MCI) adjustments made to the Senior Citizens Rent Increase Exemption (SCRIE) program in New York City. This adjustment allows landlords to pass on the costs of significant improvements to their properties to tenants who are enrolled in the SCRIE program. The MCI SCRIE adjustment is designed to ensure that tenants benefit from improvements made to their living conditions while also protecting them from excessive rent increases.

Eligibility Criteria for the MCI SCRIE Adjustment

To qualify for the MCI SCRIE adjustment, tenants must meet specific criteria. Generally, applicants must be senior citizens aged sixty-two or older and have a total household income below a certain threshold. Additionally, the property must be rent-regulated, and the improvements made must meet the criteria set by the New York City Department of Housing Preservation and Development (HPD). Understanding these eligibility requirements is crucial for tenants seeking to benefit from the MCI SCRIE adjustment.

Steps to Complete the MCI SCRIE Adjustment

Completing the MCI SCRIE adjustment involves several steps. First, tenants need to gather the necessary documentation, including proof of age, income, and the details of the capital improvements made. Next, they must fill out the appropriate forms, such as the SCRIE application form, and submit them to the HPD. It is essential to ensure that all information is accurate and complete to avoid delays in processing. Once submitted, the HPD will review the application and notify the tenant of the outcome.

Required Documents for the MCI SCRIE Adjustment

When applying for the MCI SCRIE adjustment, tenants must provide several key documents. These typically include:

- Proof of age (e.g., birth certificate or government-issued ID)

- Income verification documents (e.g., tax returns, pay stubs)

- Documentation of the capital improvements made (e.g., receipts, invoices)

- Completed SCRIE application form

Having these documents ready can streamline the application process and ensure compliance with HPD requirements.

How to Obtain the MCI SCRIE Adjustment

To obtain the MCI SCRIE adjustment, tenants must first confirm their eligibility and gather the required documentation. After preparing the necessary forms, they can submit their application to the HPD either online or by mail. It is advisable to keep copies of all submitted documents for personal records. The HPD will process the application and communicate the decision, which may include any adjustments to the rent based on the approved MCI costs.

Legal Use of the MCI SCRIE Adjustment

The MCI SCRIE adjustment is governed by specific legal frameworks established by New York City regulations. Landlords must adhere to the guidelines set forth by the HPD when applying for MCI adjustments. This includes ensuring that the improvements meet the necessary criteria and that the adjustments do not exceed allowable limits. Tenants should also be aware of their rights under the SCRIE program, including protections against unjustified rent increases.

Quick guide on how to complete mci scrie adjustment

Complete Mci Scrie Adjustment effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides you with all the resources required to generate, modify, and electronically sign your documents swiftly without delays. Manage Mci Scrie Adjustment on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Mci Scrie Adjustment seamlessly

- Locate Mci Scrie Adjustment and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form hunting, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device you prefer. Modify and electronically sign Mci Scrie Adjustment to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mci scrie adjustment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the scrie benefits that exceed tax assessment excess abatement applied to different condo unit?

The scrie benefits that exceed tax assessment excess abatement applied to different condo unit can provide signNow tax relief to homeowners. These benefits help lower property taxes based on specific eligibility criteria, ultimately making homeownership more affordable. Understanding these advantages is essential for maximizing savings and utilizing available resources effectively.

-

How can I apply for scrie benefits related to tax assessment excess abatement?

To apply for scrie benefits related to tax assessment excess abatement applied to different condo unit, you must complete the required application forms and gather necessary documentation. This typically involves submitting proof of income and property ownership. It is advisable to consult local guidelines for any specific requirements related to your application.

-

What features does airSlate SignNow offer to assist with document signing for scrie benefits applications?

airSlate SignNow offers intuitive features such as electronic signatures, customizable templates, and document tracking which streamline the application process for scrie benefits. Users can easily prepare and send documents, ensuring that all necessary signatures are collected promptly. This simplifies the process of applying for benefits to exceed tax assessment excess abatement applied to different condo unit.

-

Can airSlate SignNow help in managing documents related to scrie benefits and tax assessment?

Yes, airSlate SignNow provides powerful document management tools that help keep track of any paperwork related to scrie benefits and your tax assessment. Users can organize, store, and retrieve documents as needed, making it easier to monitor ongoing applications for excess abatement applied to different condo unit. This ensures that you are always prepared when dealing with tax matters.

-

Is there a cost associated with using airSlate SignNow for scrie benefits applications?

airSlate SignNow offers a range of pricing plans to cater to different needs, making it a cost-effective solution for applications related to scrie benefits. You can choose a subscription that fits your budget and usage requirements, allowing you to manage documents efficiently without excessive costs. This investment can ultimately save you money in the long run, especially when dealing with tax assessments.

-

How does airSlate SignNow integrate with other software for scrie benefits management?

airSlate SignNow integrates seamlessly with various software platforms to enhance your scrie benefits management experience. By connecting with tools like CRM systems and cloud storage solutions, you can streamline the workflow surrounding your documents and applications. This makes it easier to handle all aspects of exceeding tax assessment excess abatement applied to different condo unit.

-

Are there specific eligibility criteria to qualify for scrie benefits exceeding tax assessment?

Yes, there are specific eligibility criteria that you need to meet to qualify for scrie benefits that exceed tax assessment excess abatement applied to different condo unit. Typically, these criteria include income limits, age, and ownership details. It is crucial to review the requirements carefully to determine your eligibility and ensure you apply correctly.

Get more for Mci Scrie Adjustment

Find out other Mci Scrie Adjustment

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now