P13 Form

What is the P13 Form

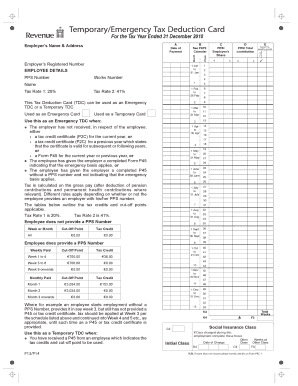

The P13 form is a document commonly used in the United States for tax purposes. It serves as a tax deduction card, allowing individuals to claim specific deductions when filing their taxes. Understanding the purpose and function of the P13 form is essential for accurate tax reporting and compliance with IRS regulations. This form is particularly relevant for those who wish to optimize their tax returns by documenting eligible deductions.

How to Use the P13 Form

Using the P13 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and previous tax returns. Next, fill out the form by entering your personal information, income details, and any deductions you wish to claim. It is crucial to double-check the entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the requirements of the IRS.

Steps to Complete the P13 Form

Completing the P13 form requires careful attention to detail. Follow these steps:

- Begin by downloading the P13 form from the appropriate source.

- Provide your personal information, including name, address, and Social Security number.

- List all sources of income, ensuring that each amount is correctly reported.

- Identify and document any deductions you are eligible for, such as business expenses or educational costs.

- Review the completed form for any errors or omissions.

- Submit the form through the chosen method, ensuring that you keep a copy for your records.

Legal Use of the P13 Form

The P13 form is legally recognized as a valid document for tax purposes when completed correctly. To ensure its legality, it must comply with IRS guidelines and be submitted within the designated filing deadlines. Utilizing an eSignature solution, like signNow, can enhance the security and validity of the form, ensuring that all signatures and entries are legally binding. This compliance is crucial for avoiding potential penalties associated with incorrect filings.

Required Documents

To complete the P13 form accurately, several documents are necessary:

- W-2 forms from employers, detailing annual income.

- 1099 forms for any freelance or contract work.

- Receipts or documentation for claimed deductions.

- Previous tax returns for reference.

Having these documents on hand will streamline the completion process and help ensure that all information is accurate and complete.

Form Submission Methods

The P13 form can be submitted through various methods, providing flexibility based on individual preferences. The options include:

- Online submission through the IRS e-file system, which is fast and secure.

- Mailing a hard copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if preferred.

Choosing the right submission method can affect the processing time, so it is advisable to consider the most efficient option based on your circumstances.

Quick guide on how to complete p13 form

Effortlessly Set Up P13 Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. This offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without any holdups. Handle P13 Form on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

How to Modify and Electronically Sign P13 Form Effortlessly

- Find P13 Form and click Obtain Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Finish button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form hunts, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign P13 Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p13 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the zra p13 online application login?

The zra p13 online application login is a secure gateway that allows users to access their applications easily and efficiently. By logging in, users can manage their documents and eSignatures effortlessly, enhancing their workflow.

-

How do I create a zra p13 online application login?

Creating a zra p13 online application login is simple. You need to visit our registration page, enter the required information, and verify your email address. Once completed, you will have immediate access to start using our services.

-

Is there a cost associated with the zra p13 online application login?

The zra p13 online application login is part of our pricing plans for airSlate SignNow, which are designed to be flexible and affordable. We offer various subscription tiers to meet different business needs, ensuring you get the best value for your money.

-

What features are available with the zra p13 online application login?

The zra p13 online application login provides access to features like document eSigning, template management, and collaboration tools. These features not only streamline your document processes but also improve overall productivity.

-

Can I integrate other applications with my zra p13 online application login?

Yes, the zra p13 online application login supports integrations with several popular applications including CRM and document management systems. This ensures a seamless workflow and enhances your business efficiency.

-

What benefits can I expect from using the zra p13 online application login?

By using the zra p13 online application login, you can expect increased productivity, reduced turnaround times for document signing, and enhanced security for your documents. It's designed to empower businesses to function efficiently.

-

What types of documents can I eSign using the zra p13 online application login?

You can eSign a wide range of documents using the zra p13 online application login, including contracts, agreements, and forms. Our platform is versatile, accommodating various document types needed for business operations.

Get more for P13 Form

- Citizenship in society merit badge worksheet form

- Firpta affidavit form

- Marriage in saipan form

- Efu surrender form

- Introductory phonology bruce hayes answer key pdf form

- Security guard employment status notification form

- Asb kiwisaver scheme changing your fund switch f form

- Inz 1002 residence guide form

Find out other P13 Form

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document