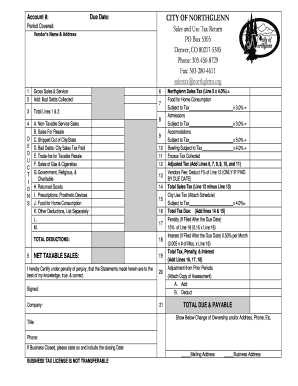

City of Northglenn Sales Tax 2013

What is the City of Northglenn Sales Tax

The city of Northglenn sales tax is a municipal tax imposed on the sale of goods and services within the city limits. This tax is a crucial source of revenue for local government, funding essential services such as public safety, infrastructure maintenance, and community programs. The sales tax rate can vary based on specific goods or services, and it is important for both consumers and businesses to understand how it applies to their transactions.

How to Use the City of Northglenn Sales Tax

Using the city of Northglenn sales tax involves understanding when and how to apply the tax to purchases. Businesses must collect the appropriate sales tax from customers at the point of sale and remit it to the city. Consumers should be aware of the sales tax included in the price of goods and services, as it can affect overall costs. For businesses, accurate record-keeping and timely remittance of collected taxes are essential for compliance with local regulations.

Steps to Complete the City of Northglenn Sales Tax

To complete the city of Northglenn sales tax process, follow these steps:

- Determine the applicable sales tax rate for the goods or services being sold.

- Calculate the total sales tax based on the sale price of the item.

- Collect the sales tax from the customer at the time of purchase.

- Document the transaction, including the sales tax collected.

- Remit the collected sales tax to the city by the required deadlines.

Legal Use of the City of Northglenn Sales Tax

The legal use of the city of Northglenn sales tax is governed by local tax laws and regulations. Businesses must ensure they are registered to collect sales tax and comply with all reporting requirements. Failure to adhere to these regulations can result in penalties and fines. It is advisable for businesses to consult with a tax professional to ensure compliance with all applicable laws.

Required Documents

When dealing with the city of Northglenn sales tax, certain documents may be required for compliance and reporting. These documents can include:

- Sales tax registration certificate.

- Transaction records detailing sales and tax collected.

- Remittance forms for submitting sales tax to the city.

- Any correspondence with the city regarding sales tax matters.

Penalties for Non-Compliance

Failure to comply with the city of Northglenn sales tax regulations can lead to various penalties. These may include fines, interest on unpaid taxes, and potential legal action. Businesses are encouraged to maintain accurate records and submit their sales tax returns on time to avoid these consequences. Understanding the implications of non-compliance is crucial for maintaining good standing with local authorities.

Quick guide on how to complete city of northglenn sales tax

Complete City Of Northglenn Sales Tax effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can access the correct templates and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without hindrance. Manage City Of Northglenn Sales Tax on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign City Of Northglenn Sales Tax effortlessly

- Find City Of Northglenn Sales Tax and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you want to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require new document printing. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign City Of Northglenn Sales Tax and ensure outstanding communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city of northglenn sales tax

Create this form in 5 minutes!

How to create an eSignature for the city of northglenn sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the current city of Northglenn sales tax rate?

The city of Northglenn sales tax rate currently stands at 3%. It's essential for businesses operating in the area to stay updated on tax changes, as the sales tax impacts pricing and profitability.

-

How does airSlate SignNow help businesses manage city of Northglenn sales tax documentation?

airSlate SignNow streamlines the process of sending and signing documents related to the city of Northglenn sales tax. By using our platform, businesses can ensure that tax documents are efficiently managed and electronically signed, saving time and minimizing errors.

-

Are there any fees associated with eSigning documents related to city of Northglenn sales tax?

Using airSlate SignNow to eSign documents incurs minimal fees, making it an affordable choice. Our pricing is transparent, ensuring that businesses can manage their costs while effectively handling documentation related to the city of Northglenn sales tax.

-

What features does airSlate SignNow offer for handling city of Northglenn sales tax forms?

airSlate SignNow provides features like customizable templates, in-app signing, and secure storage to manage city of Northglenn sales tax forms effortlessly. These tools empower businesses to focus on compliance and efficiency instead of paperwork.

-

Can airSlate SignNow integrate with accounting software for city of Northglenn sales tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms. This integration simplifies the process of managing city of Northglenn sales tax records, allowing businesses to maintain accurate financial documentation effortlessly.

-

How can I ensure compliance with city of Northglenn sales tax regulations using airSlate SignNow?

Using airSlate SignNow, you can implement workflows that verify compliance for your paperwork related to city of Northglenn sales tax. Our platform helps keep track of document changes, ensuring that your documents meet local regulations.

-

Is airSlate SignNow suitable for small businesses dealing with city of Northglenn sales tax?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses managing city of Northglenn sales tax. Our solutions scale with your needs, providing the tools necessary for compliance without breaking the bank.

Get more for City Of Northglenn Sales Tax

- Ultrasound cpt codes form

- It handbuch fr fachinformatiker pdf download kostenlos

- Science form 1 exercise with answers

- Fiche didentification personnelle form

- Rhyme scheme worksheet pdf with answers form

- Questionnaire concernant lamp39interrogatoire conform ment lamp39article 54

- Application to rent a bmr unit sunnyvale sunnyvale ca form

- Vanderbilt teacher assessment form

Find out other City Of Northglenn Sales Tax

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter