Account #Due DateCITY of NORTHGLENNPeriod Covere 2017-2026

Understanding the Northglenn Sales Tax

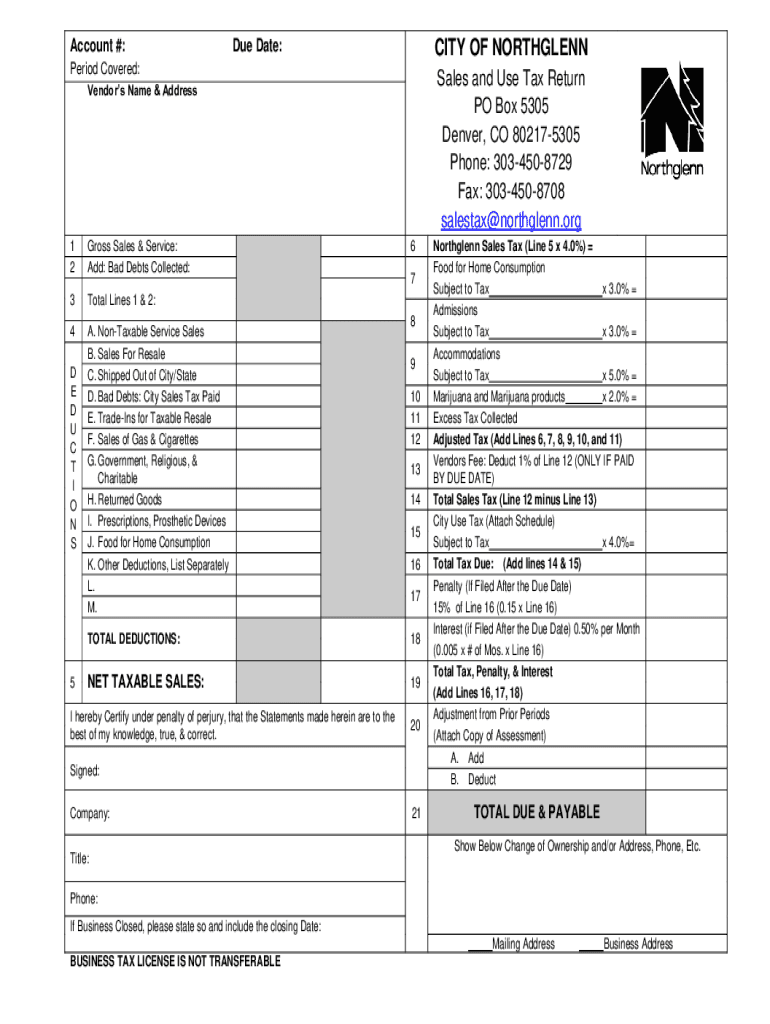

The Northglenn sales tax is a crucial aspect of local commerce, impacting both consumers and businesses within the city. This tax is applied to the sale of tangible personal property and certain services, contributing to the city's revenue for essential services such as public safety, infrastructure, and community programs. The current sales tax rate in Northglenn is a combination of state, county, and city taxes, which can vary based on the type of goods or services purchased.

How to Calculate Northglenn Sales Tax

To calculate the sales tax in Northglenn, you need to know the applicable sales tax rate, which is currently set at a specific percentage. Multiply the total purchase amount by this percentage to determine the total sales tax owed. For example, if you purchase an item for one hundred dollars, and the sales tax rate is 8.5%, the sales tax would be calculated as follows: $100 x 0.085 = $8.50. Therefore, the total cost of the item including tax would be $108.50.

Filing Sales Tax Returns in Northglenn

Businesses operating in Northglenn are required to file sales tax returns periodically, typically on a monthly or quarterly basis. The filing process involves reporting the total sales made during the period, the amount of sales tax collected, and any exemptions claimed. It is important to keep accurate records of all transactions to ensure compliance with local regulations. Returns can be filed online, by mail, or in person at designated locations.

Penalties for Non-Compliance

Failure to comply with Northglenn sales tax regulations can result in penalties and interest charges. If a business does not file its sales tax return on time or fails to remit the collected sales tax, it may face fines. The penalties can escalate based on the duration of the non-compliance, making it essential for businesses to stay informed about their filing obligations and deadlines.

Required Documents for Sales Tax Filing

When preparing to file sales tax returns in Northglenn, businesses should gather several key documents. These include sales records, receipts, and any exemption certificates that may apply. Accurate documentation is vital for substantiating the amounts reported on tax returns and for defending against any audits that may arise.

Northglenn Sales Tax Exemptions

Certain transactions may be exempt from sales tax in Northglenn. Common exemptions include sales to non-profit organizations, sales of certain food items, and sales for resale. Businesses should familiarize themselves with the specific criteria for exemptions to ensure they are not over-collecting sales tax from customers.

Resources for Northglenn Sales Tax Information

For more information about Northglenn sales tax, businesses and individuals can refer to the City of Northglenn's official website, which provides resources, forms, and contact information for the finance department. Staying informed through official channels helps ensure compliance and supports local economic growth.

Quick guide on how to complete account due datecity of northglennperiod covere

Prepare Account #Due DateCITY OF NORTHGLENNPeriod Covere effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without hold-ups. Manage Account #Due DateCITY OF NORTHGLENNPeriod Covere across any platform with airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

How to modify and electronically sign Account #Due DateCITY OF NORTHGLENNPeriod Covere with ease

- Obtain Account #Due DateCITY OF NORTHGLENNPeriod Covere and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Adjust and electronically sign Account #Due DateCITY OF NORTHGLENNPeriod Covere and promote effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct account due datecity of northglennperiod covere

Create this form in 5 minutes!

How to create an eSignature for the account due datecity of northglennperiod covere

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the current northglenn co sales tax rate?

The current northglenn co sales tax rate is 8.1%. This includes the state, county, and city taxes. It's important for businesses operating in Northglenn to stay updated on this rate to ensure compliance.

-

How can airSlate SignNow help with northglenn co sales tax documentation?

airSlate SignNow simplifies the process of managing documents related to northglenn co sales tax. With our eSignature capabilities, you can easily send, sign, and store tax-related documents securely, ensuring you meet all local requirements.

-

Are there any additional fees associated with northglenn co sales tax filings?

While airSlate SignNow does not charge additional fees for northglenn co sales tax filings, businesses should be aware of potential state or local fees. It's advisable to consult with a tax professional to understand any extra costs involved.

-

What features does airSlate SignNow offer for managing northglenn co sales tax?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage, which are essential for managing northglenn co sales tax documents. These tools help streamline the process and reduce the risk of errors.

-

Can I integrate airSlate SignNow with my accounting software for northglenn co sales tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage northglenn co sales tax. This integration allows for automatic updates and ensures that all tax documents are accurately reflected in your financial records.

-

What are the benefits of using airSlate SignNow for northglenn co sales tax compliance?

Using airSlate SignNow for northglenn co sales tax compliance offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are legally binding and easily accessible when needed.

-

Is airSlate SignNow suitable for small businesses dealing with northglenn co sales tax?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it ideal for small businesses managing northglenn co sales tax. Our solution helps you save time and resources while ensuring compliance with local tax regulations.

Get more for Account #Due DateCITY OF NORTHGLENNPeriod Covere

- Proposed defendant intervenors motion to intervene 417 cv form

- Files this answer and responds to the complaint as follows form

- Files its requests for admission to be answered in form

- This case was tried to a jury of twelve persons in the circuit form

- By and through counsel and files this hisher complaint form

- Prosecution and it appearing to the court that notice of said motion has been given to all form

- A minor by and through hisher parents form

- Plaintiffs response to motion for summary judgment form

Find out other Account #Due DateCITY OF NORTHGLENNPeriod Covere

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement