Form 40, Full Year Resident Individual Income Tax Oregon Gov Oregon

Understanding the Form 40, Full Year Resident Individual Income Tax Oregon

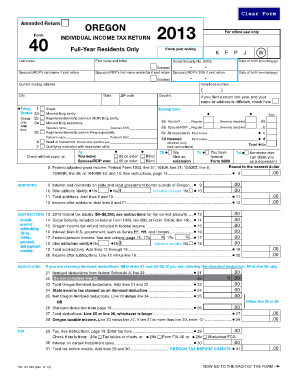

The Form 40 is the official document used by residents of Oregon to report their annual income and calculate their state income tax liability. This form is specifically designed for individuals who have lived in Oregon for the entire tax year and need to declare all sources of income, including wages, interest, dividends, and other earnings. It is essential for ensuring compliance with Oregon tax laws and for determining the amount of tax owed or refund due.

Steps to Complete the Form 40, Full Year Resident Individual Income Tax Oregon

Completing the Form 40 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, follow these steps:

- Fill in your personal information, including name, address, and Social Security number.

- Report your total income from all sources on the designated lines.

- Calculate your adjustments to income, if applicable, to arrive at your adjusted gross income.

- Apply the appropriate deductions and credits to determine your taxable income.

- Calculate the tax owed using the Oregon tax tables provided.

- Complete any additional schedules if required for specific deductions or credits.

- Sign and date the form before submission.

How to Obtain the Form 40, Full Year Resident Individual Income Tax Oregon

The Form 40 can be obtained through various methods to ensure accessibility for all taxpayers. Residents can download the form directly from the Oregon Department of Revenue's website or request a physical copy by contacting their local tax office. Additionally, many tax preparation software programs include the Form 40 as part of their offerings, allowing for easier digital completion and submission.

Legal Use of the Form 40, Full Year Resident Individual Income Tax Oregon

The Form 40 is legally binding when completed and submitted according to Oregon state regulations. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or audits. Utilizing a reliable digital platform for eSigning can enhance the legal validity of the form, ensuring compliance with eSignature laws and regulations.

Filing Deadlines and Important Dates for the Form 40, Full Year Resident Individual Income Tax Oregon

Timely filing of the Form 40 is essential to avoid penalties. The standard deadline for submitting the form is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be applicable and ensure that they file for any necessary extensions before the original deadline.

Required Documents for the Form 40, Full Year Resident Individual Income Tax Oregon

To complete the Form 40 accurately, several documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources, such as rental income or investment earnings

- Documentation for deductions, such as mortgage interest statements or medical expenses

Having these documents ready will streamline the completion process and help ensure that all income and deductions are reported correctly.

Quick guide on how to complete form 40 full year resident individual income tax oregon gov oregon

Handle Form 40, Full Year Resident Individual Income Tax Oregon gov Oregon seamlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without inconvenience. Manage Form 40, Full Year Resident Individual Income Tax Oregon gov Oregon on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The most efficient way to modify and electronically sign Form 40, Full Year Resident Individual Income Tax Oregon gov Oregon with ease

- Locate Form 40, Full Year Resident Individual Income Tax Oregon gov Oregon and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your updates.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 40, Full Year Resident Individual Income Tax Oregon gov Oregon and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 40 full year resident individual income tax oregon gov oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing income tax in Oregon?

Filing your income tax in Oregon is straightforward. Start by gathering all necessary documents, including W-2s, 1099s, and any other relevant income. You can file your income tax Oregon online with various tax software or through the Oregon Department of Revenue's e-filing system, which streamlines the process.

-

How much does it cost to eSign documents related to income tax in Oregon?

Using airSlate SignNow to eSign income tax documents is a cost-effective solution for your business. Our pricing plans are designed to fit different budgets and needs, starting with a free trial that allows you to test features. The specific costs for signing and sending documents depend on the plan you choose but always offer great value for your time and resources.

-

What features does airSlate SignNow offer for managing income tax documents in Oregon?

airSlate SignNow provides a variety of powerful features tailored for managing income tax documents in Oregon. These include customizable templates, secure cloud storage, and a user-friendly interface that makes eSigning documents easy. The platform is designed to ensure compliance and security, making tax document management seamless.

-

Can airSlate SignNow help streamline income tax preparations in Oregon?

Absolutely! With airSlate SignNow, you can streamline your income tax preparations in Oregon by automating document workflows. The platform allows you to collect signatures, send reminders, and store all your tax-related documents securely. This will save you time and reduce the stress associated with income tax preparation.

-

Is airSlate SignNow compliant with Oregon's income tax regulations?

Yes, airSlate SignNow is compliant with income tax regulations in Oregon. We prioritize keeping current with state laws and regulatory requirements to ensure that your documents meet all necessary criteria. By using SignNow, you can have peace of mind knowing that your eSigned income tax documents adhere to Oregon's legal standards.

-

How does airSlate SignNow integrate with other accounting software for income tax in Oregon?

airSlate SignNow offers seamless integrations with various accounting software that can aid in filing income tax in Oregon. Popular platforms like QuickBooks and Xero can be connected easily, allowing for efficient management of tax documents. This integration streamlines your workflow and keeps all your financial data synchronized.

-

What are the benefits of using airSlate SignNow for income tax in Oregon?

Using airSlate SignNow for your income tax needs in Oregon provides numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security for your sensitive documents. The ease of sending and signing documents online saves you time while ensuring that your tax filings are accurate and timely. Moreover, the platform's compliance with regulations further protects your business.

Get more for Form 40, Full Year Resident Individual Income Tax Oregon gov Oregon

- Restraining order ct form

- Red dot optic 25 yard adjusted zero target form

- Firstline therapy menu plan worksheet form

- Toileting tracking sheet form

- St387 form

- Dc 635 form

- Printable reading award certificate k12readercom printable reading award certificates for home and classroom use k12reader form

- Eng form 4264 r application for shoreline use permit

Find out other Form 40, Full Year Resident Individual Income Tax Oregon gov Oregon

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement