Gain Ss Form

What is the Gain SS Form

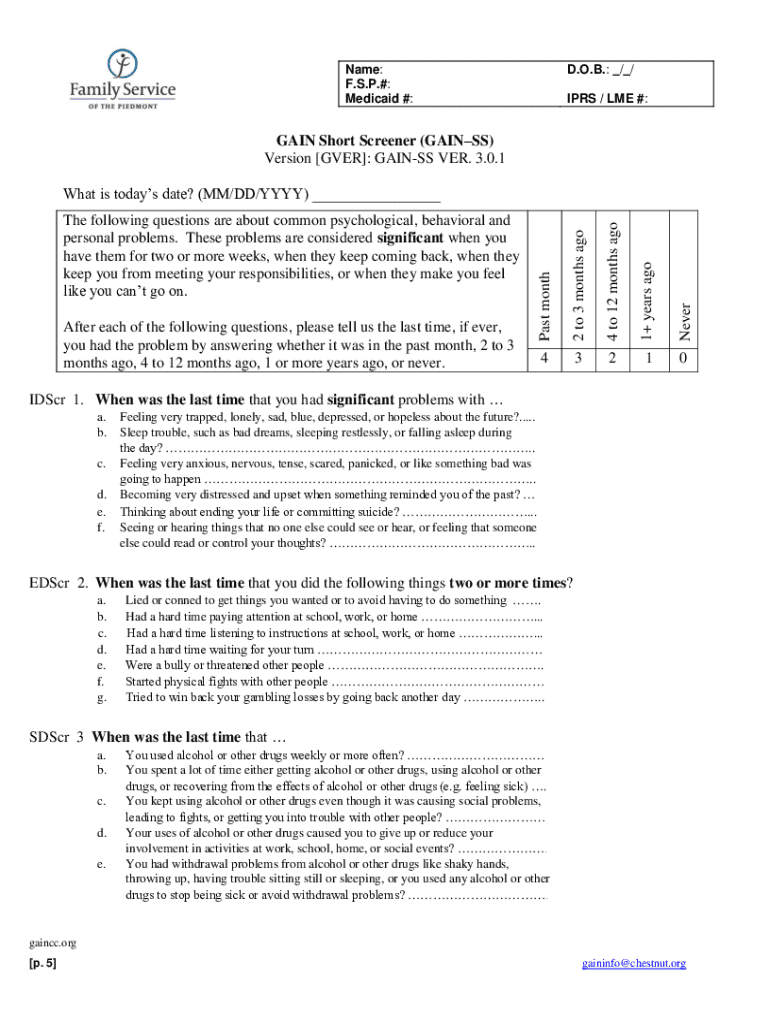

The Gain SS form is a document utilized primarily for reporting gains related to specific transactions or investments. It is often required by the Internal Revenue Service (IRS) to ensure accurate tax reporting. This form is crucial for individuals and businesses that have realized gains from various sources, including the sale of assets or investments. Proper completion of the Gain SS form is essential for compliance with U.S. tax laws and regulations.

How to use the Gain SS Form

Using the Gain SS form involves several steps to ensure accurate reporting of gains. First, gather all necessary financial documents that detail your transactions. This includes records of sales, purchases, and any relevant financial statements. Next, accurately fill out the form by inputting the required information, such as the dates of transactions and amounts gained. Finally, review the completed form for accuracy before submission, ensuring that all figures align with your financial records.

Steps to complete the Gain SS Form

Completing the Gain SS form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documentation, including transaction records.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Detail each transaction, including dates, amounts, and descriptions of assets sold.

- Calculate your total gains and losses as required by the form.

- Review the form for accuracy and completeness.

- Submit the form to the appropriate IRS office or through an approved electronic filing method.

Legal use of the Gain SS Form

The Gain SS form is legally binding when filled out correctly and submitted in accordance with IRS guidelines. It is essential to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or legal issues. Compliance with tax laws is critical, and using the Gain SS form appropriately helps maintain transparency in financial reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Gain SS form are typically aligned with the annual tax return deadlines. Generally, forms must be submitted by April fifteenth of the following tax year. However, it is important to verify specific deadlines each year, as they may change due to holidays or other factors. Keeping track of these dates ensures timely compliance and avoids potential penalties.

Who Issues the Form

The Gain SS form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations and the necessary steps for proper submission.

Quick guide on how to complete gain ss form

Prepare Gain Ss Form effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Gain Ss Form on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to alter and eSign Gain Ss Form with ease

- Find Gain Ss Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred way to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Gain Ss Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gain ss form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help businesses gain ss?

airSlate SignNow is a digital document signing platform that empowers businesses to gain ss by streamlining their document workflow. By enabling secure eSignatures and easy document management, businesses can enhance productivity and reduce turnaround times. This user-friendly tool is designed to help organizations gain efficiency and improve their overall operations.

-

How does airSlate SignNow's pricing model work for those looking to gain ss?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes aiming to gain ss. Whether you're a small startup or a large organization, our competitive pricing ensures that you only pay for what you need. Additionally, a free trial is available so you can test our features and see how they benefit your workflow before committing.

-

What features does airSlate SignNow provide to help users gain ss?

airSlate SignNow includes a variety of features that help users gain ss, such as customizable templates, secure cloud storage, and mobile functionality. These tools enable quick document preparation and signing, which facilitates smoother transactions and communications. The platform is designed to adapt to your business needs, ensuring maximum efficiency.

-

Can airSlate SignNow integrate with other software to enhance my workflow and gain ss?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to enhance your workflow and ultimately gain ss. Popular integrations include CRM systems, productivity tools, and cloud storage services. This flexibility ensures that you can streamline processes and work more effectively within your existing tech ecosystem.

-

How secure is airSlate SignNow for my sensitive documents while trying to gain ss?

airSlate SignNow prioritizes security, ensuring that your sensitive documents remain protected while you gain ss. Our platform uses industry-standard encryption and complies with various regulatory requirements to keep your data safe. You can confidently send and eSign documents, knowing that your information is secure at all times.

-

What benefits can businesses expect when they switch to airSlate SignNow to gain ss?

Businesses that switch to airSlate SignNow can expect to gain ss through reduced paperwork, faster turnaround times, and improved document accuracy. The platform enhances collaborative efforts by allowing team members to access and manage documents seamlessly. Overall, this leads to a more efficient workflow and an increase in productivity.

-

Is there customer support available to help me gain ss with airSlate SignNow?

Absolutely! airSlate SignNow provides excellent customer support to assist you in gaining ss. Whether you have questions about features, troubleshooting, or best practices, our dedicated support team is available via various channels. We'll help ensure you make the most of our platform and enhance your document processes.

Get more for Gain Ss Form

Find out other Gain Ss Form

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure