Irs Tax Form 4868 Extension Printable

What is the IRS Tax Form 4868 Extension Printable

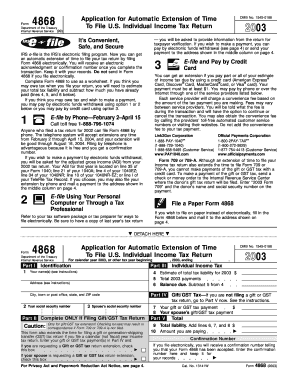

The IRS Tax Form 4868, also known as the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, allows taxpayers to request an extension for filing their federal income tax returns. This form is particularly useful for individuals who may need additional time to gather necessary documents or complete their tax returns accurately. By submitting the printable IRS Form 4868, taxpayers can receive an automatic six-month extension, extending the filing deadline to October 15. It is important to note that this extension only applies to the filing of the return, not the payment of any taxes owed. Taxpayers are still required to estimate and pay any tax liability by the original due date to avoid penalties and interest.

How to Use the IRS Tax Form 4868 Extension Printable

Using the IRS Tax Form 4868 is a straightforward process. First, download the printable version of the form from the IRS website or a trusted source. Once you have the form, fill it out with your personal information, including your name, address, and Social Security number. You will also need to provide an estimate of your total tax liability for the year. After completing the form, you can submit it either electronically or by mail. If you choose to file electronically, ensure that you use a compatible e-filing software that supports Form 4868. If mailing, send the completed form to the appropriate address based on your location as indicated in the IRS instructions.

Steps to Complete the IRS Tax Form 4868 Extension Printable

Completing the IRS Form 4868 involves several key steps:

- Download the printable IRS Form 4868 from a reliable source.

- Enter your personal information, including your name, address, and Social Security number.

- Estimate your total tax liability for the year and enter this amount on the form.

- Calculate any payments you have already made and enter this information.

- Sign and date the form to certify that the information provided is accurate.

- Submit the form electronically through e-filing software or mail it to the appropriate IRS address.

Legal Use of the IRS Tax Form 4868 Extension Printable

The legal use of the IRS Form 4868 is defined by the IRS guidelines. This form is legally binding when filled out correctly and submitted within the specified time frame. It is essential to ensure that the information provided is accurate to avoid complications with the IRS. The form must be signed to certify its authenticity. Additionally, when submitting electronically, using a reputable e-signature platform that complies with federal e-signature laws, such as the ESIGN Act, ensures that the submission is legally recognized.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the IRS Form 4868 is crucial for taxpayers. The original due date for individual income tax returns is typically April 15. By submitting Form 4868 by this date, taxpayers can receive an automatic six-month extension, pushing the filing deadline to October 15. It is important to remember that this extension does not extend the time to pay any taxes owed. Payments must still be made by the April deadline to avoid penalties and interest.

Required Documents

When completing the IRS Form 4868, certain documents may be necessary to provide accurate information. Taxpayers should have their previous year's tax return on hand for reference, as it contains essential details such as income, deductions, and credits. Additionally, any documents that support income estimates, such as W-2s or 1099s, should be gathered. Having this information readily available will facilitate the accurate completion of the form and help ensure compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the IRS Form 4868. The form can be filed electronically using IRS-approved e-filing software, which is often the quickest method. Alternatively, taxpayers can print and mail the completed form to the appropriate IRS address based on their state of residence. It is important to check the IRS guidelines for the correct mailing address. In-person submission is generally not an option for Form 4868, as it is primarily designed for electronic or mail filing. Regardless of the method chosen, ensuring timely submission is essential to avoid penalties.

Quick guide on how to complete irs tax form 4868 extension printable

Accomplish Irs Tax Form 4868 Extension Printable seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without holdups. Manage Irs Tax Form 4868 Extension Printable on any platform using airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to edit and eSign Irs Tax Form 4868 Extension Printable effortlessly

- Find Irs Tax Form 4868 Extension Printable and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Irs Tax Form 4868 Extension Printable and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs tax form 4868 extension printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the printable IRS form 4868?

The printable IRS form 4868 is an application for an automatic extension of time to file your individual income tax return. By completing this form, taxpayers can receive an additional six months to submit their returns without incurring late fees. It's essential to file this form if you are unable to meet the original deadline.

-

How do I obtain a printable IRS form 4868?

You can easily obtain a printable IRS form 4868 by visiting the IRS website or using online tax preparation software. Many tax services also offer downloadable versions of this form. Simply ensure you have a printer ready if you wish to print the document for submission.

-

Can I use airSlate SignNow to eSign my printable IRS form 4868?

Yes, airSlate SignNow allows you to eSign your printable IRS form 4868 quickly and securely. This solution makes it easy to sign documents electronically, ensuring compliance and reducing the time spent on traditional paper methods. With airSlate SignNow, you can streamline your tax filing process.

-

What are the benefits of using airSlate SignNow for IRS form 4868?

Using airSlate SignNow for your printable IRS form 4868 offers numerous benefits, such as enhanced security and easy access to your documents. The eSigning feature speeds up the process and reduces the risk of error. Additionally, it saves you time and resources by eliminating the need for physical paperwork.

-

Is there a cost associated with using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs. While some features may be available for free, access to premium functionalities, such as eSigning or document management, will require a subscription. Evaluate the available plans to find one that meets your requirements for managing printable IRS forms.

-

Does airSlate SignNow integrate with other applications for managing tax forms?

Yes, airSlate SignNow integrates seamlessly with various applications that can help manage your tax documents, including accounting software and file storage services. This integration allows for a more streamlined workflow when handling your printable IRS form 4868 and other related documents.

-

How secure is airSlate SignNow for signing sensitive documents like IRS forms?

airSlate SignNow prioritizes security, offering encryption and compliance with global data protection regulations. When you eSign your printable IRS form 4868 using their platform, you can trust that your personal information and sensitive data are protected. Robust security features ensure that your signed documents are safe from unauthorized access.

Get more for Irs Tax Form 4868 Extension Printable

- Alien addition maze fourth grade addition practice worksheet fourth grade addition practicewith a fun math maze form

- Torrid return address form

- Outcome rating scale ors vermont legislature form

- Formulaire de demande de prime reward request form

- Aoc 005 a fillable form

- Jesuit oath pdf form

- C104a p65 use form r85 to tell your bank or building society that you qualify for tax interest on your account

- Application for scheme retirement benefitsto be c form

Find out other Irs Tax Form 4868 Extension Printable

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer