Form Bca 4 15 4 20 2003

What is the Form Bca 4 15 4 20

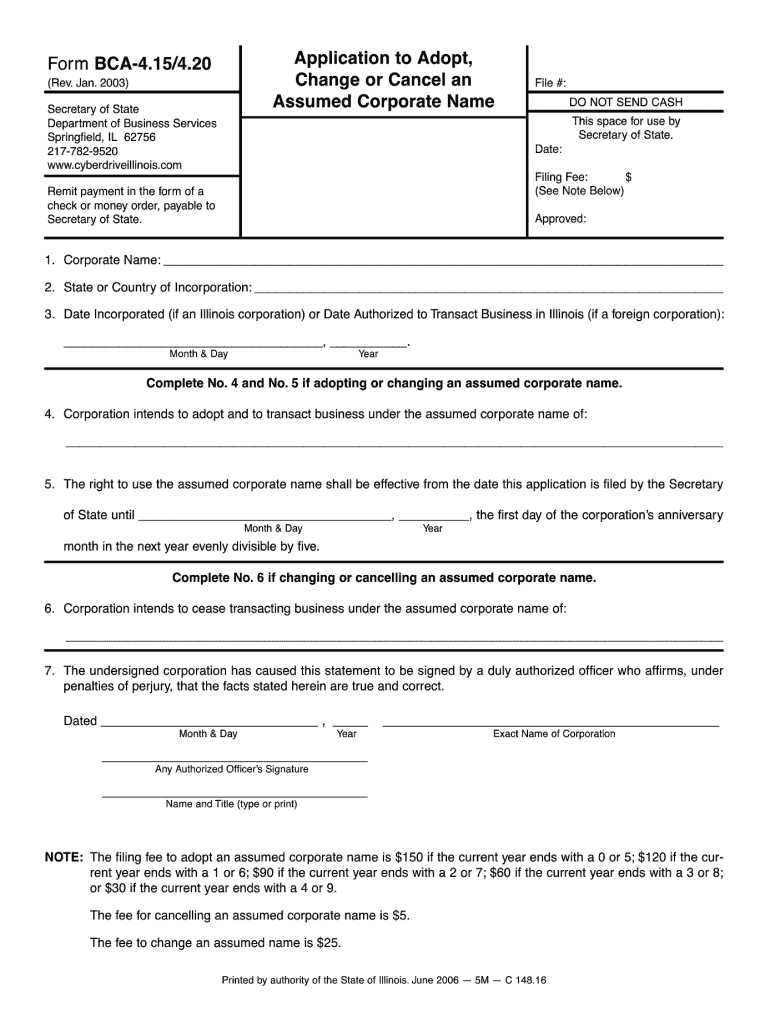

The Form Bca 4 15 4 20 is a specific document used in business contexts, particularly for filings related to business entity registrations or modifications. It serves as a formal request or declaration to the relevant state authorities, ensuring that businesses comply with local regulations. Understanding the purpose and requirements of this form is crucial for maintaining legal standing and operational integrity.

How to use the Form Bca 4 15 4 20

Using the Form Bca 4 15 4 20 involves several steps. First, ensure you have the correct version of the form, as updates may occur. Fill out the required fields accurately, providing all necessary information about your business entity. Once completed, the form can be submitted to the appropriate state agency either online or via mail, depending on the options provided by that agency. Always keep a copy of the submitted form for your records.

Steps to complete the Form Bca 4 15 4 20

Completing the Form Bca 4 15 4 20 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the state’s official website.

- Read the instructions carefully to understand what information is required.

- Fill in your business name, address, and identification numbers as needed.

- Provide details regarding the nature of the filing, such as amendments or new registrations.

- Review the completed form for accuracy before submission.

- Submit the form according to the guidelines provided by the state agency.

Legal use of the Form Bca 4 15 4 20

The legal use of the Form Bca 4 15 4 20 is essential for ensuring compliance with state laws governing business entities. This form must be completed accurately and submitted within specified timelines to avoid penalties. It is advisable to consult legal counsel if there are uncertainties about the form's requirements or implications for your business.

Key elements of the Form Bca 4 15 4 20

Key elements of the Form Bca 4 15 4 20 include:

- Business name and address

- Type of business entity (e.g., LLC, Corporation)

- Specific changes or filings being requested

- Signature of an authorized representative

- Date of submission

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form Bca 4 15 4 20 can typically be done through various methods, which may include:

- Online submission via the state’s business portal.

- Mailing the completed form to the designated state office.

- In-person submission at the local office of the state agency.

Quick guide on how to complete form bca 4 15 4 20 2003

Manage Form Bca 4 15 4 20 anywhere, anytime

Your routine business operations may require additional focus when handling state-specific forms. Reclaim your working hours and reduce the costs related to paperwork with airSlate SignNow. airSlate SignNow offers a variety of pre-designed business forms, including Form Bca 4 15 4 20, which you can utilize and share with your associates. Handle your Form Bca 4 15 4 20 with ease using powerful editing and eSignature tools and send it directly to your recipients.

Steps to obtain Form Bca 4 15 4 20 in just a few clicks:

- Select a form that is applicable to your state.

- Just click Learn More to view the document and ensure it is correct.

- Click Get Form to start using it.

- Form Bca 4 15 4 20 will instantly open in the editor. No further steps are needed.

- Utilize airSlate SignNow’s advanced editing features to complete or modify the form.

- Locate the Sign tool to create your custom signature and eSign your document.

- When ready, click Done, save changes, and access your document.

- Share the form via email or SMS, or use a link-to-fill option with your partners or allow them to download the documents.

airSlate SignNow signNowly streamlines your process with Form Bca 4 15 4 20 and helps you find essential documents in one place. A comprehensive library of forms is organized and tailored to support vital business processes necessary for your organization. The advanced editor reduces the chance of errors, allowing you to easily correct mistakes and review your documents on any device before sending them out. Start your free trial today to discover all the benefits of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

Find and fill out the correct form bca 4 15 4 20 2003

FAQs

-

Is it acceptable to form, pour, waterproof, and back-fill a concrete foundation in less than 4 days; in 15 to 20 degree weather?

D.R. Horton is the largest home builder in the US which, in and of itself, is a huge accomplishment. But even more stunning is that D.R. Horton has been doing it for more than 30 years. Any construction company that has weathered the economic cycles of the past 30 years, especially that which took place in 2008, deserves a lot of respect.One of the reasons it is the largest is because the market (buyers) perceive that they receive a lot of value relative to the cost. D.R. Horton specializes in production homes. To provide this high value/cost ratio, methodologies must be employed to streamline the construction process.Possibly, in an ideal world, a new home would take a year or more to build and employ only the best craftsmen. Unfortunately only a handful of people could afford a home like that. That means a lot of people would never be able to achieve the American Dream of home ownership.Having been a production home builder myself, the schedule you described was standard operating procedure. We would form on day one, pour on day two, strip the forms the morning of day three, waterproof that afternoon, and back fill on day four. The only difference is that the winters here (Atlanta, Georgia) are generally warmer. To offset that, chemicals can be added to the concrete (like calcium chloride) to help it set up faster.A typical homeowner lives an their home about 7 years before selling. Consequently, people are not able nor willing to pay what it would cost for a home that will last longer than they will.D.R. Horton know what it is doing.

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How much do accountants charge for helping you fill out a W-4 form?

A W-4 is a very simple form to instruct your employer to withhold the proper tax. It's written in very plain English and is fairly easy to follow. I honestly do not know of a CPA that will do one of these. If you're having trouble and cannot find a tutorial you like on line see if you can schedule a probing meeting. It should take an accounting student about 10 minutes to walk you through. There is even a worksheet on the back.If you have mitigating factors such as complex investments, partnership income, lies or garnishments, talk to your CPA about those, and then ask their advice regarding the W4 in the context of those issues.

Create this form in 5 minutes!

How to create an eSignature for the form bca 4 15 4 20 2003

How to make an electronic signature for your Form Bca 4 15 4 20 2003 in the online mode

How to generate an eSignature for your Form Bca 4 15 4 20 2003 in Google Chrome

How to create an eSignature for putting it on the Form Bca 4 15 4 20 2003 in Gmail

How to make an eSignature for the Form Bca 4 15 4 20 2003 straight from your mobile device

How to make an electronic signature for the Form Bca 4 15 4 20 2003 on iOS devices

How to create an eSignature for the Form Bca 4 15 4 20 2003 on Android devices

People also ask

-

What is Form Bca 4 15 4 20 and how can airSlate SignNow help?

Form Bca 4 15 4 20 is a specific document often required for business compliance. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring that all necessary signatures are collected promptly and securely. Our platform streamlines the process, making it user-friendly and efficient.

-

How much does it cost to use airSlate SignNow for Form Bca 4 15 4 20?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting at an affordable rate. This makes it cost-effective for handling documents like Form Bca 4 15 4 20 without compromising on features. Check our pricing page for detailed information on subscription options.

-

What features does airSlate SignNow offer for managing Form Bca 4 15 4 20?

airSlate SignNow includes features like customizable templates, real-time tracking, and automated reminders specifically for documents like Form Bca 4 15 4 20. These tools ensure that your signing process is efficient and organized, enabling you to focus on your business needs.

-

Can I integrate airSlate SignNow with other software for Form Bca 4 15 4 20 management?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and CRM systems. This integration allows you to manage Form Bca 4 15 4 20 alongside your other business applications, streamlining your workflow and enhancing productivity.

-

Is airSlate SignNow compliant with legal standards for Form Bca 4 15 4 20?

Absolutely! airSlate SignNow complies with all relevant legal standards, including eSignature laws, ensuring that your Form Bca 4 15 4 20 is legally binding. Our platform provides an audit trail and secure storage, giving you peace of mind regarding compliance.

-

How can I ensure the security of my Form Bca 4 15 4 20 documents?

airSlate SignNow prioritizes security with advanced encryption and authentication features for all documents, including Form Bca 4 15 4 20. This protects your sensitive information and ensures that only authorized individuals can access or sign your documents.

-

What support options are available for airSlate SignNow users working with Form Bca 4 15 4 20?

We offer various support options, including a comprehensive help center, live chat, and email support to assist you with Form Bca 4 15 4 20 and other queries. Our dedicated team is ready to help you navigate the platform and resolve any issues you may encounter.

Get more for Form Bca 4 15 4 20

Find out other Form Bca 4 15 4 20

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors