Cert 134 2009-2026

What is the Cert 134

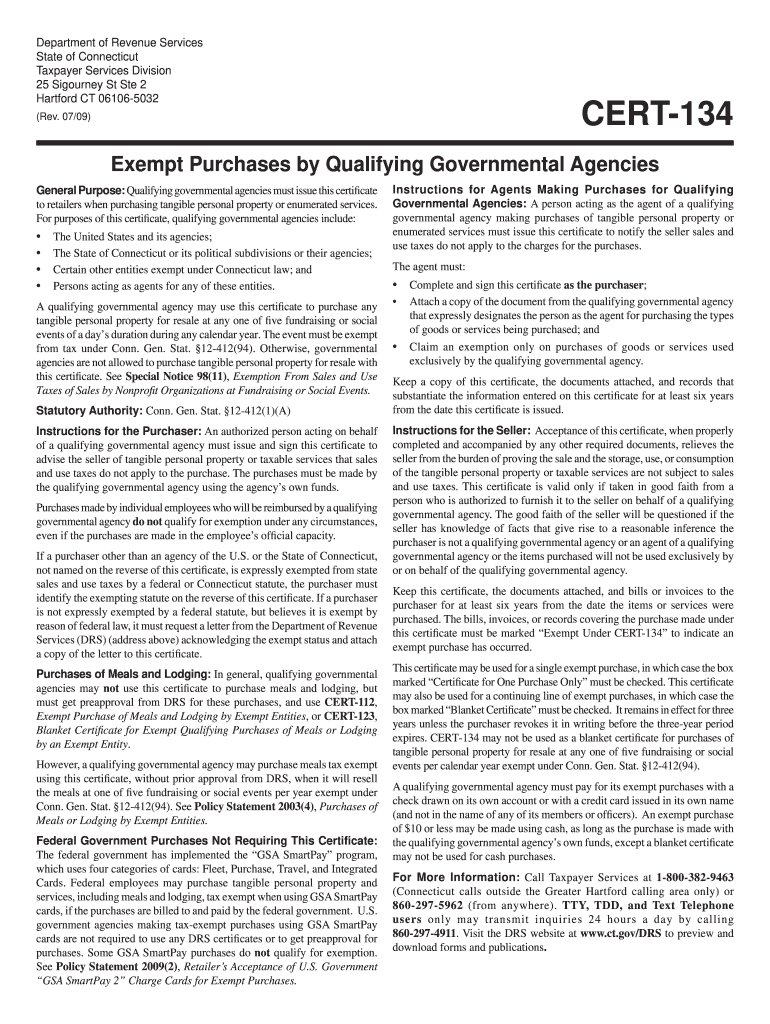

The Cert 134, also known as the Connecticut Cert, is a tax form used by businesses and individuals in the state of Connecticut to certify certain tax-exempt purchases. This form is essential for ensuring compliance with state tax regulations and allows qualifying entities to make tax-exempt purchases without incurring sales tax. The Cert 134 is particularly relevant for organizations that qualify under specific exemptions, such as nonprofit organizations, government entities, and other designated groups.

How to use the Cert 134

Using the Cert 134 involves filling out the form accurately and providing the necessary information to substantiate your tax-exempt status. To utilize this form, you need to complete the fillable sections, which typically include details about the buyer, the seller, and the nature of the purchase. Once completed, the Cert 134 should be presented to the seller at the time of purchase to ensure that no sales tax is applied. It is important to keep a copy of this form for your records, as it may be required for future reference or audits.

Steps to complete the Cert 134

Completing the Cert 134 requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain the latest version of the Cert 134 form, which can be found online.

- Fill in the buyer's name, address, and tax identification number in the designated fields.

- Provide the seller's information, including their name and address.

- Specify the type of exempt purchase being made and the reason for the exemption.

- Sign and date the form to validate it.

After completing these steps, present the form to the seller to complete your tax-exempt transaction.

Legal use of the Cert 134

The legal use of the Cert 134 is governed by Connecticut state tax laws. This form must be used only by eligible entities that meet the criteria for tax exemption. Misuse of the Cert 134, such as using it for non-qualifying purchases, can lead to penalties and fines. It is essential to understand the specific exemptions that apply to your situation and ensure that all information provided on the form is accurate and truthful to maintain compliance with state regulations.

Eligibility Criteria

To be eligible to use the Cert 134, the purchaser must fall into one of the qualifying categories defined by Connecticut law. Common eligible entities include:

- Nonprofit organizations recognized under section 501(c)(3) of the Internal Revenue Code.

- Government entities and agencies.

- Certain educational institutions.

It is important to review the specific eligibility criteria to ensure compliance and avoid any potential issues with tax authorities.

Form Submission Methods

The Cert 134 can be submitted in various ways, depending on the seller's preferences. Typically, the form is presented in person at the time of purchase. However, some sellers may accept it via email or fax. Ensure that you confirm the preferred method of submission with the seller to facilitate a smooth transaction. Keeping a copy of the submitted form is advisable for your records.

Quick guide on how to complete cert 134 form

Your assistance manual on how to prepare your Cert 134

If you’re wondering how to complete and submit your Cert 134, here are a few concise instructions on how to make tax processing signNowly simpler.

To begin, you only need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, create, and finalize your income tax documents with ease. With its editor, you can alternate between text, checkboxes, and eSignatures and revert to change information as needed. Streamline your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Adhere to the steps below to complete your Cert 134 in a matter of minutes:

- Establish your account and start working on PDFs within minutes.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Cert 134 in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if applicable).

- Examine your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can increase return errors and delay refunds. Before e-filing your taxes, be sure to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

Do I need to fill out two I-134 forms for my parents or filling just one would do?

Yes, one form is enough for your father and mother if they are planning to appear together for visa interview. In case they plan to go for visa interview on two seperate occasion have them carry their own I-134.

-

Who needs to fill the I-134 form?

If you are all applying together then no: this is not necessary and indeed, only a lawfully admitted person is qualified to sign. If you are both applying separately to your husband and bank accounts are NOT joint and you are unable to show personal resources or finance AND your husband has been lawfully admitted then it cannot hurt. See I-134 Affidavit of Support for Visitor's Visa | Lee & Garasia, LLC

-

Where can I get the form for migration certificate?

Migration is issued by the Universities themselves.The best way is to inquire your college they will guide you further.In case you happen to be from A.P.J Abdul Kalam Technical Universityhere is the link to get it issued online.Hope it helpsStudent Service (Dashboard) Dr. A.P.J. Abdul Kalam Technical University (Lucknow)Regards

Create this form in 5 minutes!

How to create an eSignature for the cert 134 form

How to create an electronic signature for the Cert 134 Form online

How to generate an eSignature for your Cert 134 Form in Chrome

How to generate an electronic signature for signing the Cert 134 Form in Gmail

How to create an eSignature for the Cert 134 Form right from your smartphone

How to make an electronic signature for the Cert 134 Form on iOS

How to make an eSignature for the Cert 134 Form on Android

People also ask

-

What is Cert 134 and how does it relate to airSlate SignNow?

Cert 134 is a certification that ensures compliance with industry standards for electronic signatures. airSlate SignNow provides a secure platform that meets Cert 134 requirements, empowering businesses to send and eSign documents confidently, knowing they are following the best practices for electronic transactions.

-

How can airSlate SignNow help my business achieve Cert 134 compliance?

By using airSlate SignNow, businesses can streamline their document workflows while ensuring they meet Cert 134 compliance. The platform offers features such as secure storage, audit trails, and encryption, all of which are crucial for maintaining compliance with Cert 134 standards.

-

What are the pricing options for airSlate SignNow with Cert 134 features?

airSlate SignNow offers various pricing plans that cater to different business needs, all of which include features necessary for Cert 134 compliance. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget while enjoying the benefits of eSigning with Cert 134 standards.

-

Can I integrate airSlate SignNow with other applications for Cert 134 documentation?

Yes, airSlate SignNow seamlessly integrates with a range of applications to enhance your workflow for Cert 134 documentation. You can connect it with popular tools like Google Drive, Salesforce, and more, ensuring that your document management process remains efficient and compliant.

-

What are the key features of airSlate SignNow that support Cert 134 compliance?

Key features of airSlate SignNow that support Cert 134 compliance include advanced security measures, customizable templates, and robust audit trails. These features ensure that every signed document is secure and traceable, aligning perfectly with Cert 134 requirements.

-

How user-friendly is airSlate SignNow for businesses seeking Cert 134 compliance?

airSlate SignNow is designed to be extremely user-friendly, making it easy for businesses to adopt it for Cert 134 compliance. The intuitive interface allows users to create, send, and manage documents effortlessly, ensuring a smooth experience even for those new to eSigning.

-

What benefits does airSlate SignNow offer for businesses focused on Cert 134 compliance?

For businesses focused on Cert 134 compliance, airSlate SignNow offers signNow benefits, including reduced processing time and enhanced security. By digitizing the signing process, companies can save costs and ensure that their document management adheres to the high standards set by Cert 134.

Get more for Cert 134

- Graphic novel rubric form

- Customer set up form

- Thedigitalhippies com billofsale form

- Dnr form new mexico

- Law of conservation of mass worksheet fill in the blank with the correct number form

- Equal housing opportunity rental application form 100083213

- Clinician ordersprogress notes patient labelclini form

- Novant health doctors note template form

Find out other Cert 134

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form