Workerslife Loans Form

What is the Workerslife Loans

The Workerslife loans are financial products designed to assist individuals in managing their personal or business expenses. These loans are tailored to meet the needs of workers, providing them with access to funds for various purposes, such as home improvements, education, or unexpected expenses. Understanding the specific terms and conditions of these loans is crucial for potential borrowers.

How to use the Workerslife Loans

Using Workerslife loans involves a straightforward process. First, individuals should assess their financial needs and determine the amount they wish to borrow. Next, they can apply for the loan through the appropriate channels, often requiring the submission of personal and financial information. Once approved, borrowers can use the funds for their intended purpose, ensuring they adhere to the repayment terms outlined in the loan agreement.

Steps to complete the Workerslife Loans

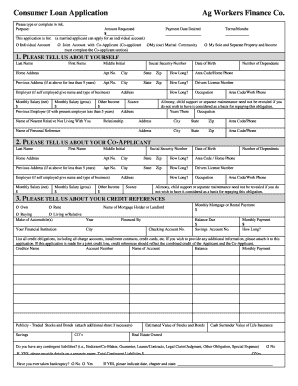

Completing the Workerslife loans application typically involves several key steps:

- Gather necessary documentation, such as proof of income and identification.

- Fill out the application form accurately, providing all required information.

- Submit the application through the designated platform, whether online or in person.

- Await approval, which may involve a review of credit history and financial status.

- Once approved, review the loan agreement carefully before accepting the terms.

Legal use of the Workerslife Loans

The legal use of Workerslife loans is governed by federal and state regulations. Borrowers must ensure that they comply with all applicable laws when applying for and utilizing these loans. This includes understanding interest rates, repayment schedules, and any potential penalties for late payments. It is essential to keep records of all transactions related to the loan for future reference.

Eligibility Criteria

Eligibility for Workerslife loans may vary depending on the lender’s requirements. Generally, applicants must meet certain criteria, which may include:

- Being at least eighteen years old.

- Having a steady source of income.

- Possessing a valid identification document.

- Having a satisfactory credit history, although some lenders may offer options for those with less-than-perfect credit.

Required Documents

To apply for Workerslife loans, individuals typically need to provide several documents, including:

- Proof of identity, such as a driver's license or passport.

- Proof of income, which may include recent pay stubs or tax returns.

- Bank statements to verify financial stability.

- Any additional documentation requested by the lender, such as employment verification.

Quick guide on how to complete workerslife loans

Complete Workerslife Loans effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage Workerslife Loans on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign Workerslife Loans without any hassle

- Obtain Workerslife Loans and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Workerslife Loans and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the workerslife loans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are workerslife loans and how can they benefit me?

Workerslife loans are specially designed financial products tailored to meet the needs of employees seeking quick and accessible funding. With competitive interest rates and flexible repayment options, these loans empower you to manage unexpected expenses and achieve your financial goals.

-

What features do workerslife loans offer?

Workerslife loans come with key features such as fast approval, easy online applications, and a variety of repayment terms. Additionally, the transparent fee structure ensures that borrowers know exactly what to expect, making it simpler to manage your loan.

-

How does the application process for workerslife loans work?

Applying for workerslife loans is straightforward and can typically be completed online in just a few minutes. Simply fill out the application form with your personal and financial information, and submit it for review. Upon approval, funds can be disbursed very quickly.

-

Are there any fees associated with workerslife loans?

While workerslife loans may have processing fees, these are clearly outlined in the application process, ensuring transparency. Understanding the total cost of your loan, including any interest and fees, is essential to making an informed decision.

-

What makes workerslife loans different from traditional loans?

Workerslife loans are designed with convenience and accessibility in mind, catering specifically to working individuals. Unlike traditional loans that may require extensive documentation, workerslife loans often have a simplified application process and quicker approval times.

-

Can I manage my workerslife loans online?

Yes, most providers of workerslife loans offer online account management tools that let you track your loan status, make payments, and access customer support. This digital interface simplifies the entire loan management process, making it more user-friendly.

-

What are the benefits of choosing workerslife loans?

Choosing workerslife loans provides numerous benefits, including fast access to funds, easy repayment terms, and no hidden fees. These loans are particularly beneficial in emergencies or when unexpected expenses arise, giving you peace of mind.

Get more for Workerslife Loans

Find out other Workerslife Loans

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF