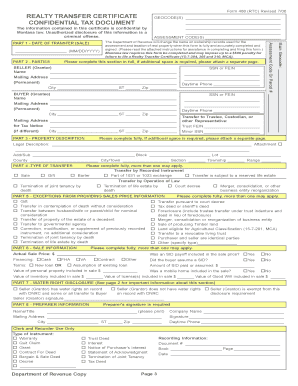

Form 488 Rtc Revised 706

What is the Form 488 Rtc Revised 706

The Form 488 RTC Revised 706 is a specific document used in the context of tax and estate planning in the United States. This form is primarily utilized to report the estate tax liability of a deceased individual. It is crucial for the executor or administrator of the estate to accurately complete this form to ensure compliance with federal tax regulations. The form provides the Internal Revenue Service (IRS) with detailed information regarding the value of the deceased's estate, including assets, liabilities, and deductions. Proper use of this form is essential for the timely settlement of the estate and to avoid potential penalties.

How to use the Form 488 Rtc Revised 706

Using the Form 488 RTC Revised 706 involves several steps to ensure all necessary information is accurately reported. First, gather all relevant financial documents, including bank statements, property appraisals, and any outstanding debts. Once you have the required information, fill out the form by entering details about the decedent's estate, including the total value of assets and any applicable deductions. It is important to double-check all entries for accuracy before submission. If needed, consult a tax professional for assistance to ensure compliance with IRS guidelines.

Steps to complete the Form 488 Rtc Revised 706

Completing the Form 488 RTC Revised 706 requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including the decedent's will, asset valuations, and debt records.

- Begin filling out the form by providing the decedent's personal information, including name, date of birth, and date of death.

- List all assets owned by the decedent at the time of death, categorizing them into real estate, personal property, and financial accounts.

- Include any liabilities, such as outstanding debts or mortgages, which can reduce the taxable estate value.

- Calculate the total estate value by subtracting liabilities from the total asset value.

- Complete any additional sections as required, including deductions for funeral expenses and estate administration costs.

- Review the completed form for accuracy and completeness before submitting it to the IRS.

Legal use of the Form 488 Rtc Revised 706

The legal use of the Form 488 RTC Revised 706 is governed by federal tax laws, which dictate how estate taxes are assessed and collected. To be legally binding, the form must be completed accurately and submitted within the designated time frame. It is essential to ensure that all information is truthful and complete to avoid issues with the IRS. Failure to comply with the legal requirements associated with this form can lead to penalties, including fines or additional taxes owed. Therefore, understanding the legal implications of this form is crucial for executors and administrators managing an estate.

Filing Deadlines / Important Dates

Filing deadlines for the Form 488 RTC Revised 706 are critical to ensure compliance with IRS regulations. Generally, the form must be filed within nine months of the decedent's date of death. However, an extension may be requested, allowing for an additional six months. It is important to note that interest and penalties may accrue on any unpaid taxes if the form is not filed by the deadline. Executors should keep track of these dates to avoid complications during the estate settlement process.

Who Issues the Form

The Form 488 RTC Revised 706 is issued by the Internal Revenue Service (IRS). This federal agency is responsible for the administration of tax laws in the United States, including estate tax regulations. The IRS provides the form and instructions for completing it, ensuring that individuals and estates comply with federal tax obligations. Executors and administrators should refer to the IRS website or contact the agency directly for the most current version of the form and any updates to filing procedures.

Quick guide on how to complete form 488 rtc revised 706

Effortlessly Prepare Form 488 Rtc Revised 706 on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 488 Rtc Revised 706 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Form 488 Rtc Revised 706 with Ease

- Obtain Form 488 Rtc Revised 706 and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious document searches, or mistakes that require new copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 488 Rtc Revised 706 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 488 rtc revised 706

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 488 Rtc Revised 706?

Form 488 Rtc Revised 706 is a specific document required for tax reporting in certain jurisdictions. It enables users to report relevant financial information accurately. Understanding this form is crucial for ensuring compliance with tax regulations.

-

How can airSlate SignNow help with Form 488 Rtc Revised 706?

airSlate SignNow streamlines the process of filling out and signing Form 488 Rtc Revised 706. Our platform allows for easy data entry, electronic signatures, and secure storage, simplifying compliance. This helps businesses save time and avoid potential errors.

-

Is there a cost to use airSlate SignNow for Form 488 Rtc Revised 706?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring Form 488 Rtc Revised 706. We provide a cost-effective solution with transparent pricing, ensuring you only pay for the features relevant to your operations.

-

What features does airSlate SignNow provide for handling Form 488 Rtc Revised 706?

Our platform includes features such as document templates, real-time collaboration, and audit trails specifically designed for Form 488 Rtc Revised 706. Users benefit from seamless navigation, ensuring that all necessary fields are filled correctly. This enhances the overall efficiency of document management.

-

Can I integrate airSlate SignNow with other tools for managing Form 488 Rtc Revised 706?

Yes, airSlate SignNow integrates with various third-party applications designed to enhance the management of Form 488 Rtc Revised 706. This allows you to streamline your workflow by connecting with CRMs, cloud storage solutions, and more. Such integrations simplify document handling and improve operational efficiency.

-

What are the benefits of using airSlate SignNow for Form 488 Rtc Revised 706?

Using airSlate SignNow for Form 488 Rtc Revised 706 provides numerous benefits, including enhanced speed, accuracy, and security. Electronic signatures reduce processing time and enhance turnaround efforts, while secure storage ensures important documents are protected. These advantages together make compliance easier and more efficient.

-

Is airSlate SignNow compliant with regulations regarding Form 488 Rtc Revised 706?

Absolutely! airSlate SignNow is designed to meet regulatory compliance requirements for handling documents like Form 488 Rtc Revised 706. Our platform adheres to standards such as GDPR and eSignature laws, ensuring that your electronic transactions are legally binding and secure.

Get more for Form 488 Rtc Revised 706

Find out other Form 488 Rtc Revised 706

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed