Form 3537 2022

What is the Form 3537

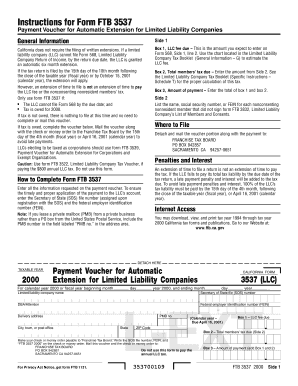

The Form 3537, also known as the California Form 3537, is a tax-related document used primarily by individuals and businesses in California. This form is utilized for reporting specific income and calculating the associated tax obligations. Understanding the purpose and requirements of Form 3537 is essential for ensuring compliance with state tax regulations. It is particularly relevant for taxpayers who need to report income not covered by regular payroll processes.

How to use the Form 3537

Using the Form 3537 involves several key steps. First, gather all necessary financial documents, including income statements and relevant tax records. Next, accurately fill out the form, ensuring that all information is complete and correct. Once completed, the form can be submitted either electronically or by mail, depending on your preference and the instructions provided by the California Franchise Tax Board. It is crucial to keep a copy of the submitted form for your records.

Steps to complete the Form 3537

Completing the Form 3537 requires careful attention to detail. Follow these steps for accurate completion:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide details about your income sources, ensuring all entries are accurate and reflect your financial situation.

- Calculate any deductions or credits you may qualify for, as these can significantly affect your tax liability.

- Review the form for any errors or omissions before finalizing it.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Form 3537

The legal use of Form 3537 is governed by California tax laws. To be considered valid, the form must be completed accurately and submitted within the specified timeframe. Additionally, the form must be signed by the taxpayer or an authorized representative. Electronic submissions are legally binding, provided they comply with the eSignature laws established by the state. Ensuring adherence to these legal requirements is vital for avoiding potential disputes or penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 3537 are crucial for compliance. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check for any updates or changes to deadlines that may occur due to legislative changes or other factors. Marking these dates on your calendar can help ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

Form 3537 can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online Submission: This method allows for quick and efficient filing through the California Franchise Tax Board's website.

- Mail: You can print the completed form and send it via postal mail to the designated address provided in the instructions.

- In-Person: Some taxpayers may choose to submit the form in person at local tax offices, although this may require an appointment.

Quick guide on how to complete form 3537 5622783

Complete Form 3537 effortlessly on any device

The management of documents online has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Form 3537 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Form 3537 with ease

- Obtain Form 3537 and click on Get Form to begin.

- Take advantage of the tools we provide to finish your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 3537 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3537 5622783

Create this form in 5 minutes!

How to create an eSignature for the form 3537 5622783

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA Form 3537 and how can airSlate SignNow help?

The CA Form 3537 is used for making estimated tax payments for personal income tax in California. airSlate SignNow simplifies the signing and submission process for the CA Form 3537 by providing a secure and user-friendly platform that enables quick electronic signatures.

-

How much does it cost to use airSlate SignNow for the CA Form 3537?

airSlate SignNow offers competitive pricing plans that cater to various needs, including individuals and businesses needing to sign the CA Form 3537. You can choose from different subscription plans that provide features specifically designed for document management and eSigning.

-

Is airSlate SignNow secure for submitting the CA Form 3537?

Yes, airSlate SignNow prioritizes security with industry-leading encryption protocols, ensuring that your CA Form 3537 and other sensitive documents are protected. Our platform complies with regulatory standards, providing peace of mind while completing your form electronically.

-

What features does airSlate SignNow offer for the CA Form 3537?

airSlate SignNow includes a range of features such as customizable templates, automated workflows, and real-time tracking that streamline the process of completing your CA Form 3537. These tools enhance efficiency and ensure that you never miss a deadline.

-

Can I integrate airSlate SignNow with other applications for handling the CA Form 3537?

Yes, airSlate SignNow supports integration with various popular applications like Google Drive, Salesforce, and Zapier. This flexibility helps you manage your CA Form 3537 across your existing workflows without the need for manual data entry.

-

How does eSigning the CA Form 3537 with airSlate SignNow work?

eSigning the CA Form 3537 with airSlate SignNow is a straightforward process. You upload your document, add the necessary fields for signatures, and send it to your signers for authentication; they can sign it electronically from any device.

-

What are the benefits of using airSlate SignNow for the CA Form 3537?

Using airSlate SignNow for the CA Form 3537 provides quick turnaround times, reduced paperwork, and enhanced accuracy. The electronic process minimizes the risk of errors commonly associated with paper forms, making tax submissions more efficient.

Get more for Form 3537

Find out other Form 3537

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure